VAT Impact on Company Profit in UAE: Key Factors Businesses Must Understand

19-Jan-2026

VAT Consultant in Dubai

Expert VAT consultancy in Dubai helping

businesses ensure UAE VAT compliance through

accurate registration, filing, and advisory support

VAT Services in Dubai, UAE

The Value Added Tax (VAT) is a consumption tax levied at each stage of the production or distribution of goods and services. Dubai, as well as the United Arab Emirates (UAE), launched it on January 1, 2018. In recent years, VAT has become an integral part of the UAE's fiscal framework, providing a key source of revenue for infrastructure development and public services. A business or individual must understand the VAT and its implications in order to comply with the law. To simplify your compliance process, it is recommended that you seek the assistance of expert VAT Services in Dubai. Reyson Badger is a Top VAT service provider in the UAE, providing specific VAT services like VAT registration, VAT deregistration, VAT return filing, VAT accounting, and more

Value Added Tax for UAE Businesses

UAE introduced VAT on 1 January 2018 at a standard rate of 5% for most goods and services; however, certain supplies are zero-rated or exempt under UAE VAT law. With this new source of revenue, the transition to a more sustainable system of consumption will make it possible to provide high-quality public services. It also aims to reduce the government's dependence on hydrocarbons such as oil for funding. Value Added Tax Consultants in Dubai help with value-added tax registration, deregistration, accounting, return filing, advisory services, and other related processes by providing a variety of VAT services across the Emirates. The implementation of VAT has resulted in major changes to the Emirate's tax structure. Using right VAT services may assist a firm in reducing the risk of incurring excessive taxes. They can also keep accurate VAT records and be up to date on VAT filing requirements. VAT Service Companies in UAE

VAT: What is it?

Value-added tax, or VAT, is a tax imposed at every point of sale on the purchase or use of goods and services. The end user will ultimately be the ones bearing the costs. Organisations that support the government are required to collect and report on taxes. Businesses in both the UAE mainland and in designated free zones, if they meet the mandatory or voluntary registration thresholds, may be required to register for VAT; special rules apply for designated zones under UAE VAT law. VAT services help businesses handle compliance more efficiently.

Implication of VAT

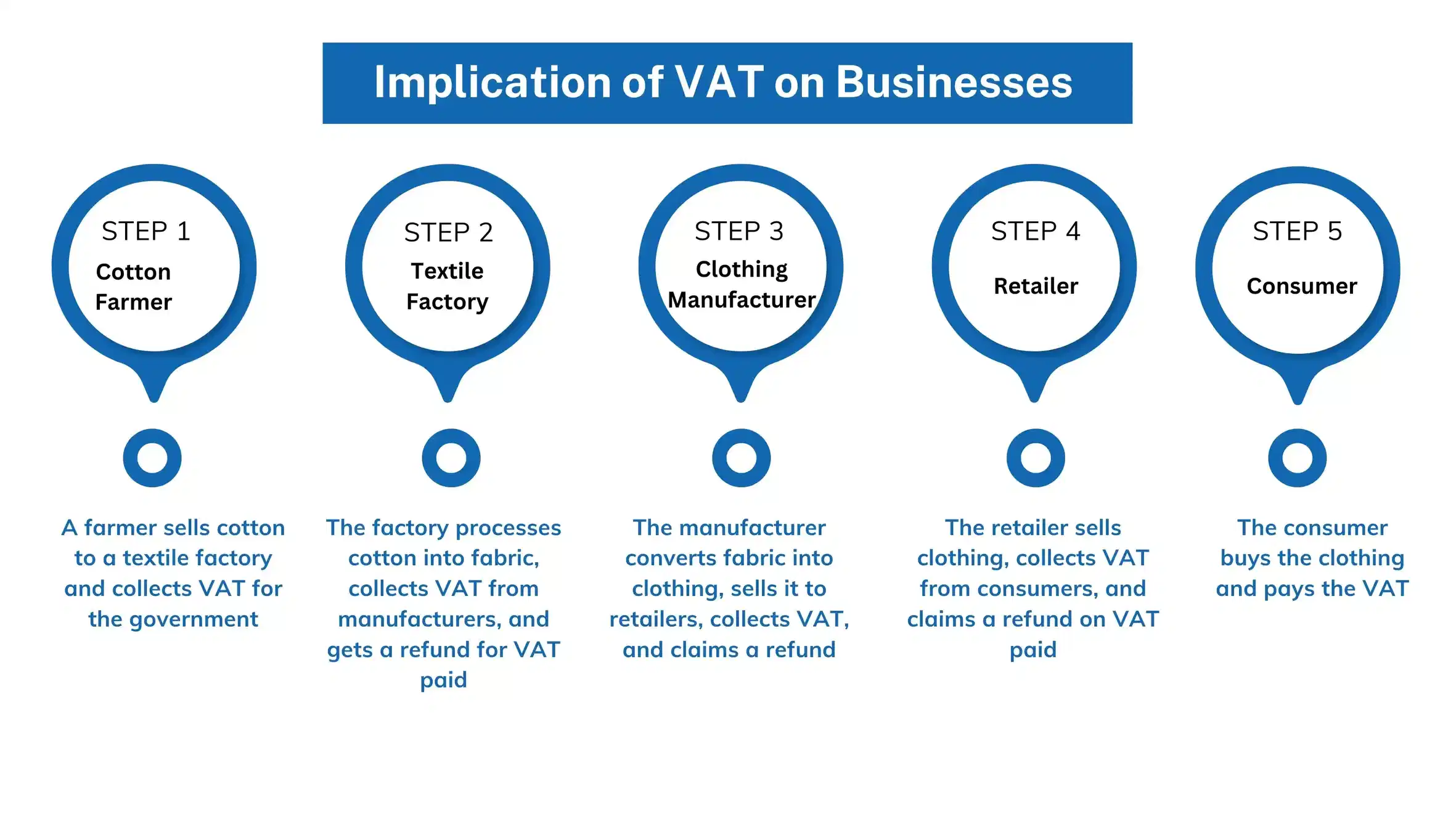

The above image illustrates the implications of VAT on businesses through a five-step supply chain process. Here's the description for each step:

- Step 1: Cotton Farmer

A farmer grows cotton and sells it to a textile factory. The farmer collects VAT from the factory on behalf of the government. - Step 2: Textile Factory

The factory processes the cotton into fabric and sells it to clothing manufacturers. The factory collects VAT from the manufacturers and receives a refund on the VAT paid to the farmer. - Step 3: Clothing Manufacturer

The manufacturer turns the fabric into clothing and sells it to retailers. The manufacturer collects VAT from the retailers and receives a refund on the VAT paid to the textile factory. - Step 4: Retailer

The retailer sells the clothing to consumers, collects VAT from the consumers, and receives a refund on the VAT paid to the manufacturer. - Step 5: Consumer

The consumer buys the clothing and pays the VAT included in the price.

This flow demonstrates how VAT is collected at each stage of the supply chain, with businesses acting as intermediaries to collect and remit VAT to the government, while receiving refunds on the VAT they paid in earlier stages. The final burden of VAT is borne by the consumer.

UAE VAT Services Significance

Maintaining accurate financial records is one of the first actions every firm must do in order to comply with the recent legislation. To file VAT returns on schedule and without errors, all invoices, outflows, and so on must be well documented. The only way to properly improve your VAT processes is to work with a trustworthy and competent VAT consultant. A skilled VAT specialist improves your company's operational efficiency, VAT compliance, and performance.

How can VAT Services in Dubai Help your Business?

- Maintaining Compliance : Compliance with UAE tax laws is one of the primary functions of VAT services in Dubai. You can avoid costly penalties and fines by staying on top of regulations and changes. Compliance also helps to improve your company's reputation and trustworthiness.

- Efficient VAT Registration : Businesses whose taxable supplies and imports exceed AED 375,000 per annum are mandatorily required to register for VAT, and those whose supplies/imports or taxable expenses exceed AED 187,500 may register voluntarily. It is possible to obtain assistance in navigating the VAT registration process from expert VAT services in Dubai. As a result, you are assured that your application will be completed accurately and timely submitted to the Federal Tax Authority (FTA). By doing so, you will be able to save time and reduce the possibility of errors.

- Simplifying VAT Filing : There can be a great deal of complexity involved in filing VAT returns, particularly for larger businesses. By working with VAT Consultants in Dubai, you can streamline this process so that your business can submit accurate and timely returns. You will receive assistance in maintaining organised records and ensuring that all eligible input tax credits are claimed.

- Manage VAT payments : VAT Consultants in Dubai can help you manage VAT payments efficiently. The VAT liability of your business is calculated, and the correct amount is paid. By managing VAT payments properly, cash flow can be improved, and overpayments can be reduced.

- Support for VAT Audits : VAT Services can provide valuable assistance in the event of a VAT audit by the FTA. Professional assistance of this kind is extremely valuable, as it minimizes disruptions and potential financial consequences.

- Cost Management : It may be possible to reduce operational costs by outsourcing your VAT-related tasks to experts, particularly for small and medium-sized businesses that may lack the financial resources to maintain an internal tax department. You can focus on your core business activities while VAT consultants in Dubai offer cost-effective solutions.

“Stay Compliant with FTA Requirements with Expert VAT Services in Dubai . ”

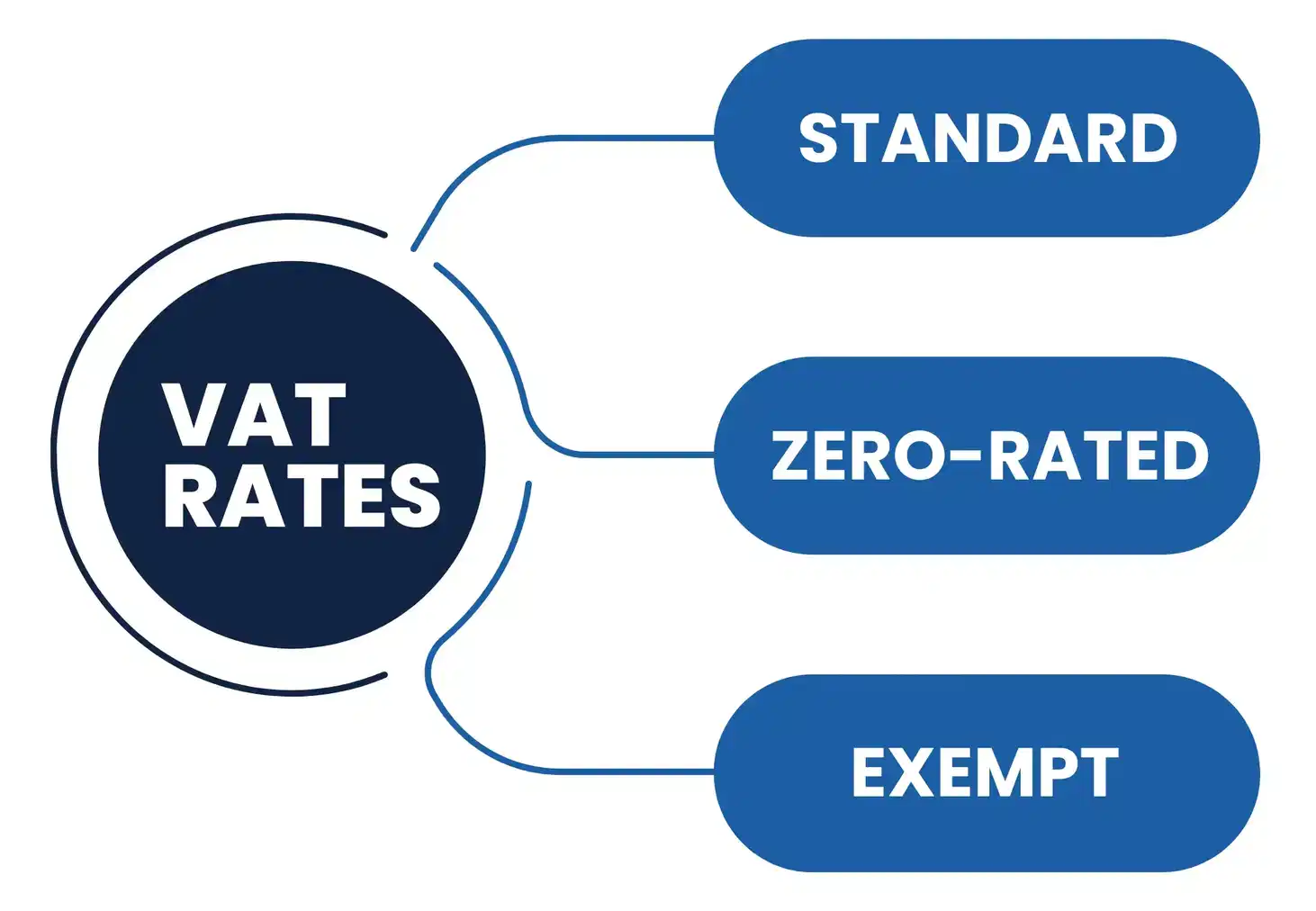

VAT Rates in Dubai

Businesses and individuals must understand the VAT rates in the UAE to comply with tax regulations.

Rate Type | VAT Rate |

|---|---|

Standard VAT Rate | 5% |

Zero-Rated | 0% |

Exempt | Nil |

Standard VAT Rate

VAT is charged at a standard rate of 5% in the UAE. Taxes are imposed at this rate on the majority of goods and services provided in the country. When you purchase taxable goods or services, you will generally see a 5% VAT included in the total price.

Zero-Rated Supplies

Zero-rated supplies have 0% VAT. VAT paid by businesses on zero-rated supplies can still be claimed as input tax credits. The following supplies are included, but are not limited to:

- Medical supplies and medications

- Basic food items such as bread, rice, fruit, and vegetables

- Exports of goods and services outside the Gulf Cooperation Council

Exempt Supplies

Certain goods and services are exempt from VAT in the UAE. Contrary to zero-rated supplies, exempt supplies are not eligible for input tax credits for VAT paid on expenses related to them. Following is a list of exempt supplies:

- Financial services (e.g., interest on loans, Islamic finance products)

- Public transportation (e.g., buses, taxis)

- Residential properties (subject to specific conditions).

To know more about Standard, Exempt and Zero-Rated supplies, check out here.

VAT Penalties

The Federal Tax Authority has amended VAT penalties to ensure that VAT compliance is maintained in the UAE. Consequently, more businesses will register for VAT, leading to a stronger economy in the UAE. It's always better to file the VAT on time. Here are some tips on filing the VAT Penalties on time for your business.

The new fine structure is as follows:

- In the case of late VAT Registrations, the FTA has proposed a fine of AED 10,000.

- In the case of late VAT Deregistration, the FTA has proposed a fine of AED 1000, and a month later, there would be a maximum penalty of AED 10,000.

- In the event that a VAT return is filed late for the first time, the FTA has assessed a fine of AED 1000, and if the return filing is delayed again within 24 months, the fine increases to AED 2,000.

- FTA has imposed a penalty of 2% of the unpaid tax for Late VAT payment, followed by 4% after one month from the date of the due payment, and so on.

- If the Tax Submission Return is incorrect, the FTA has stipulated a penalty of AED 1,000 for the first time, and AED 2000 for repeated errors.

- VAT Refund Claims: Businesses can increase cash flow and cut expenses by reclaiming paid taxes through VAT refund claims.

- VAT Input Tax Credit: Companies can recover taxes paid on purchases through VAT input tax credit, if the appropriate documentation is maintained.

- Zero-Rated VAT: Zero-rated VAT allows for tax credits without invoicing customers for exports and certain deliveries. Examples include basic needs like healthcare; businesses may then not be able to claim input tax credits.

- VAT Exemptions: Cross-border transactions often use the reverse charge mechanism, which helps in compliance with international transactions.

- Reverse Charge Mechanism: Effective VAT savings strategies include proper planning, use of exemptions, and optimizing refund claims to minimize liabilities.

Here is the Latest Amendment of the UAE VAT Decree Law.

VAT Services

VAT Registration

VAT Registration in Dubai is a crucial step for businesses post the introduction of Value Added Tax (VAT) in 2018. As part of this process, businesses are granted the authority to charge VAT on their goods and services in accordance with UAE tax regulations. Businesses must register for VAT if their taxable supplies and imports exceed AED 375,000 in 12 months. Those with turnover over AED 187,500 can register voluntarily to reclaim input tax. An application for registration is submitted online to the Federal Tax Authority (FTA) and awaits approval, which typically takes between two and three weeks. Reyson Badger's VAT services ensure smooth regulation, reducing businesses' burden and building credibility in Dubai's competitive market.

“Businesses can register for VAT through the FTA Portal.”

VAT Return Filing

Value Added Tax (VAT) Return Filing Services make it easier for businesses to comply with tax laws by streamlining the filing procedure. These services aid in the precise computation of VAT obligations, the retrieval of input tax credits, and the timely submission of returns. VAT returns must be submitted within 28 days of the end of the tax period with expert guidance. Most businesses pay taxes quarterly; however, those with an annual revenue of AED 150 million or more must pay them monthly. Expert handling of VAT ensures compliance, minimizes errors, and allows businesses to focus on core activities. From data collection to submission, Reyson Badger provides clients with all-inclusive assistance with managing VAT legislation, maintaining compliance, and maximizing tax outcomes with our experience. Partnering with our VAT services helps businesses reduce admin tasks and focus on maximizing profits in competitive markets.

VAT Reclaims Services

Businesses can maximize their tax efficiency by recovering Value Added Tax (VAT) paid on qualified expenses with the help of VAT Services in Dubai. These services carefully go over corporate transactions to find out where VAT was paid on expenses and purchases. Our skilled experts provide VAT services that UAE businesses trust, ensuring compliance, maximizing VAT recovery, reducing tax liability, and improving cash flow and financial performance. Reyson Badger delivers customized VAT services in the UAE, guiding clients through the full reclaim process. They handle paperwork and liaise with tax authorities, easing admin tasks and speeding up VAT recovery. Businesses can take advantage of potential tax savings, improve their financial position, and maintain their competitiveness in Dubai by partnering with our VAT reclaim services.

VAT Refund Services

VAT refund services play an important role in helping businesses reclaim VAT incurred on eligible purchases, expenses, or investments. These VAT services in the UAE are crucial for VAT-registered entities that pay VAT on inputs but are not required to charge VAT on their sales.

VAT refund specialists guide businesses through the process of filing a claim for refund to the tax authorities, ensuring that all necessary documents are well-arranged and that the claim is made in accordance with legal provisions. Businesses can recover VAT paid out, improve cash flow and reduce operational costs by using VAT refund services.

VAT Advisory

VAT Advisory provides expert guidance to help businesses simplify tax rules and stay compliant. VAT advisors create customized solutions to businesses in key areas that include VAT registration, filing of returns, tax planning, managing transactions that involve VAT, dispute resolution, managing audits, and interpretation of tax laws as applied in cross-border transactions or industry-specific challenges.

With VAT advisory services, businesses are presented with the opportunity to minimize tax liabilities, avoid penalties, and achieve proper VAT management towards conformity with the latest legal and regulatory standards.

VAT Compliance Services

VAT Compliance Services allow businesses to be in compliance with all legal and regulatory requirements of Value Added Tax. The services include VAT registration, accurate return filing, record keeping, and timely VAT payments. Experts in VAT compliance ensure their clients are updated on changing tax laws and help them identify specific industry challenges.

By availing these services, enterprises ensure a lower probability of errors, penalties, or audits, combined with an optimization process in their tax compliance. VAT compliance services have strategic importance regarding the smooth flow of operations and build confidence in the regulatory authorities.

VAT Training

VAT training enables individuals and businesses to understand and manage Value-Added Tax processes effectively. Training programs deal with essential topics like VAT regulations, registration, filing returns, calculating VAT on sales and purchases, and handling VAT compliance. Designed for business owners, finance teams, and tax professionals, VAT training gives practical insights on how to handle VAT audits, solve disputes, and keep updated with tax law changes. Participation in VAT training will therefore enhance in-house expertise, reduce errors, and ensure smooth and compliant VAT operations.

VAT Consulting Service

VAT consulting expert advice that will help their clients understand how to comply with and how to optimize value-added tax obligations. Consultants will educate on registration, which requires all the procedures involved in charging, collection, or remittance of VAT money to the tax authorities' returns and exemptions, how to receive VAT refunds, help in the reduction of penalties, and risks involved with the tax authorities regarding VAT.

VAT consultants can also advise businesses on the tax implications of their business transactions, cross-border trade, and the latest tax regulations to ensure the businesses operate efficiently and within local tax laws.

Excise Tax Registration

Excise Tax Registration Services helps businesses subject to excise tax regulations ensure compliance with the UAE's tax laws. These services facilitate the registration process, guiding businesses through the requirements and documentation needed for excise tax registration. Expert professionals understand the complexities of excise tax laws, aiding businesses to understand their obligations and avoid penalties for non-compliance. By obtaining formal recognition from the government, businesses gain the authority to impose excise taxes on specific goods and fulfill their tax obligations. Reyson Badger simplifies VAT registration and ensures the timely submission of all required documents. With our expertise, businesses can navigate excise tax regulations efficiently, minimize administrative burdens, and maintain compliance in the competitive Dubai market. Partnering with excise tax registration services empowers businesses to operate smoothly within the regulatory framework, fostering growth and success.

VAT De-Registration Services

The process of terminating a business's VAT registration with the Federal Tax Authority in the United Arab Emirates is known as VAT Deregistration. Companies must follow proper procedures to avoid fines, even when ceasing operations or meeting legal conditions. Those closing down need a government-issued liquidation letter, and VAT deregistration can be done via the FTA website. While guaranteeing adherence to legal standards. Reyson Badger offers professional VAT deregistration services, as well as assistance in assessing your needs and guiding you through the complex process. Focusing on VAT control and compliance, we provide a full range of VAT services to help companies manage.

VAT Accounting Services

Businesses need VAT accounting services in Dubai to help them understand the complexities of Value Added Tax (VAT) laws. Reyson Badger provides comprehensive VAT accounting solutions that are specifically designed to meet the demands of companies that operate in the growing economy of Dubai. Our experienced accounting services make sure that all VAT requirements established by the Federal Tax Authority (FTA) are followed, that timely VAT returns are filed, and that proper VAT records are kept. We offer assistance at every level, from VAT registration to continuing accounting support, assisting companies in streamlining their VAT procedures and lowering the possibility of fines or non-compliance. Reyson Badger makes sure businesses retain financial transparency and compliance while optimising prospects for VAT recovery and minimising tax liabilities. It does this by focusing on efficiency, transparency, and sticking on to best practices.

VAT Audit Services

Businesses are guaranteed to adhere to Value Added Tax requirements by the Federal Tax Authority (FTA) with the help of VAT Audit Services in Dubai. The services include detailed checks of financial records and VAT documents to confirm accuracy and detect any errors. Professional auditors evaluate VAT law compliance, pointing to inaccuracies or possible fraud. An efficient audit procedure depends on keeping well-organized data and collaborating with FTA auditors. Reyson Badger’s VAT auditors in Dubai provide expert guidance during audits, helping businesses stay compliant. This reduces the risk of FTA fines and gives companies peace of mind regarding tax regulations.

Tax Residency Certificate

Services for Tax Residency Certificates are available in Dubai and are crucial for helping firms navigate the intricacies of international trade and tax laws. Reyson Badger helps individuals and businesses obtain Tax Residency Certificates to ease double taxation issues. These certificates support tax compliance and grant access to tax benefits and incentives. The Ministry of Finance of the United Arab Emirates issues these certifications, which make it easier for firms to comply with agreements aimed at avoiding double taxation and improving their financial efficiency. Reyson Badger ensures UAE tax compliance by handling all required documents. This benefits eligible individuals and businesses. We prioritize accuracy and efficiency, which speeds up the application process and ensures that Tax Residency Certificates are issued on schedule. Companies that partner with Reyson Badger can feel secure in the knowledge that their tax affairs are being managed by seasoned professionals dedicated to their success.

VAT Services for industries

VAT Services for Industries provides specialized support to businesses in various industries, ensuring that they are compliant with VAT regulations, which include registration, filing, and tax planning. Such services help manage VAT obligations within industries, reduce risks, and make tax processes more efficient. Value Added Tax (VAT) varies across different sectors, requiring businesses to have sector-specific compliance support. E-commerce businesses must manage VAT on online sales and issue correct invoices. Retail businesses are responsible for applying VAT on sales and handling customer refunds properly. Manufacturers manage VAT on raw materials, production costs, and finished goods. Healthcare may have VAT exemptions, but some medical services and supplies are still taxable. Real estate and import/export firms handle VAT on property deals and international transactions. Financial services have unique VAT rules, as many services are exempt, but businesses still need to manage VAT on other activities. VAT is charged on construction, development, and even real estate sales. Startups in Dubai must register for VAT if their annual turnover exceeds the threshold, ensuring they stay compliant from the beginning.

VAT Laws and Regulations

VAT Laws and Regulations outline guiding principles and standards that ought to be achieved by businesses about the collection and remittance of VAT imposed on enterprises, based on the conditions under which local tax authorities place.

VAT filing deadlines, registration threshold, and compliance are the prime aspects of proper tax practice. Filing of reports is required for businesses at specific times, for example, monthly or quarterly to avoid penalties. The VAT registration threshold is the point at which a business must register for VAT based on its taxable turnover. In the UAE, the mandatory threshold has been set at AED 375,000. The UAE Federal Tax Authority (FTA) is the main body administering VAT and ensuring businesses do not violate the regulations.

VAT compliance audits are conducted to verify accurate tax reporting and to find any discrepancies. Meanwhile, VAT deregistration is vital for businesses that no longer qualify for registration, thus ensuring proper closure with the tax authority.

Complete VAT Services Across Saudi Arabia and the UAE

VAT services in Saudi Arabia and the UAE cities of Jeddah, Riyadh, Dammam, Sharjah, and Abu Dhabi are essential for businesses looking to navigate the complexities of VAT compliance. In Saudi Arabia, businesses must comply with the country’s VAT regulations, ensuring proper registration, filing, and reporting. VAT services involve assisting companies in understanding the complexity of VAT in various sectors such as retail, manufacturing, healthcare, and real estate.

Similarly, the local VAT laws must be complied with in Sharjah, Abu Dhabi, and Dubai, managing registrations and VAT returns and getting exemptions and VAT refunds correct in the UAE. Whatever country you operate from, Saudi Arabia or the UAE, VAT services help in minimizing risks, optimizing tax processes, and complying with regulations in each country.

Reyson Badger - Your one stop VAT Consultant in Dubai

VAT compliance in the UAE requires meticulous record-keeping and timely submissions, but is manageable with attention to detail. Professional guidance and a VAT Health Check can simplify the process and avoid penalties. Overall, VAT legislation may be straightforward for some businesses, but challenging for others. Engaging a professional VAT Consultant like Reyson Badger with expertise in UAE VAT laws and VAT Services can be beneficial, especially for businesses with complex operations.

Other Services Reyson Badger Provides are:

FAQs

1. Why should I hire UAE VAT consultants for my business?

UAE VAT consultants help businesses understand Federal Tax Authority VAT rules, ensure accurate filings, and avoid penalties. They also provide VAT compliance review services to identify gaps and improve processes.

2. What are the key Federal Tax Authority VAT rules businesses must follow?

The Federal Tax Authority VAT rules require proper VAT registration (if eligible), timely filing of returns, accurate invoicing, and proper VAT record keeping UAE businesses must maintain for at least five years.

3. What do VAT accounting services typically include?

VAT accounting services cover VAT return preparation and filing, reconciliation of input and output VAT, advisory on VAT for Free Zone businesses, and ongoing VAT record keeping UAE companies need to stay compliant.

FAQs

Latest Blogs

UAE to Become Global Capital of Entrepreneurship – What it Means for Company Formation?

UAE's vision to be global entrepreneurship hub fosters innovation, attracts investors, and creates vast opportunities for seamless company formation.

READ MORE →

Who Are the Taxable Persons for Corporate Tax in the UAE?

Taxable persons for UAE Corporate Tax include mainland companies, free zone entities, and individuals conducting licensed business activities.

READ MORE →

Net Worth Certificate for UAE Visas: Investor, Family, Student & Golden Visa Requirements

READ MORE →

The Complete Guide to Ultimate Beneficial Owner Verification in the UAE

A complete guide to Ultimate Beneficial Owner rules in the UAE, UBO verification steps, compliance requirements, and how expert support can help businesses avoid penalties.

READ MORE →

Accrual Accounting vs Cash Basis Accounting: Which Is Right for Your Business?

Accounting Companies in Dubai ensures that your accounting method aligns with UAE regulations and business goals.

READ MORE →

Understanding Article 3: A Guide to Calculating Excise Tax and VAT in the UAE

This blog provides a clear guide to understanding Article 3 and how it affects the calculation of excise tax and VAT in the UAE. It explains the applicable tax rules, computation methods, and compliance considerations businesses must follow to ensure accurate tax reporting and regulatory adherence.

READ MORE →

How to Get a Net Worth Certificate in Abu Dhabi & Sharjah from a Licensed Auditor?

Learn how to obtain a Net Worth Certificate in Abu Dhabi and Sharjah, including required documents, processing time, costs, and why certification by a licensed UAE auditor is essential for visas, bank loans, and business purposes.

READ MORE →

UAE Audit Requirements 2026 – A Complete Compliance Guide

A clear overview of UAE audit requirements in 2026, covering compliance obligations, regulatory updates, and key reporting standards for businesses.

READ MORE →

The Sugar Shift: A Business Guide to the UAE’s New 2026 Tiered Excise Tax

The UAE’s new 2026 tiered excise tax introduces a structured approach to taxing sugar-sweetened beverages based on sugar content. This guide explains how the updated excise framework affects manufacturers, importers, and distributors, outlining compliance requirements, financial implications, and practical steps businesses must take to stay prepared.

READ MORE →

Financial Strength Certificate vs Net Worth Certificate - What You Need to Know

Understand the key differences between a Financial Strength Certificate and a Net Worth Certificate in the UAE. Learn which document authorities require and how professionally prepared certification from Reyson Badger can help ensure faster, compliant approvals.

READ MORE → The Federal Tax Authority (FTA) has announced that businesses must complete Corporate Tax registration within 90 days from the Date of Incorporation / MOA.

The Federal Tax Authority (FTA) has announced that businesses must complete Corporate Tax registration within 90 days from the Date of Incorporation / MOA.