Businesses running in Sharjah need to check in for VAT if they meet certain standards based on their annual turnover. VAT registration is obligatory for agencies that meet positive income thresholds and also voluntary for small businesses. If you’re working for an enterprise in Sharjah VAT registration is a vital step to ensure compliance with UAE tax legal guidelines.

VAT registration is mandatory or voluntary depending on your business’s revenue. Registration for VAT ensures compliance with UAE tax laws, allows businesses to collect and remit VAT, and enables them to claim VAT on eligible purchases. Here are the two types of VAT registration services in Sharjah

Mandatory VAT Registration in Sharjah

Mandatory VAT registration is needed in Sharjah for businesses with annual sales exceeding AED 375,000. If your business falls into this category it should register with the Federal Tax Authority (FTA) to conform with UAE tax legal guidelines. This registration lets you accumulate VAT from your clients at 5% on most goods and services and you can also reclaim VAT paid in your business purchases. Failure to register when required can lead to penalties, so whilst your enterprise reaches turnover thresholds it is critical to make certain it is well registered.

Voluntary VAT Registration in Sharjah

Voluntary VAT registration in Sharjah is a choice for corporations with annual income between AED 187,500 and AED 375,000. If your business falls within this range, you could select to register for VAT although it’s no longer mandatory. By doing so, you may gather VAT from your clients and reclaim the VAT you’ve paid on your business charges. This can enhance your cash glide and reduce expenses. Additionally, being VAT-registered complements your enterprise’s credibility and permits you to attract larger customers or contracts that choose to paint with VAT-registered suppliers. Voluntary registration is a clever move if you anticipate a boom or need to set up a professional image in the market.

The main difference between these two types is that registration based on rules is mandatory, whereas mandatory voluntary registration allows companies to elect or claim certain benefits to deal with taxes.

Mandatory Registration:

Businesses with Annual Turnover Exceeding AED 375,000: If your enterprise’s taxable elements and imports exceed AED 375,000 in a year, you're required to check in for VAT with the Federal Tax Authority (FTA).

Voluntary Registration:

Businesses with Annual Turnover Between AED 187,500 and AED 375,000: If your taxable components and imports are between AED 187,500 and AED 375,000, you can opt for voluntary VAT registration. This allows you to reclaim VAT on business purchases and gather VAT from your clients.

Exemptions:

Businesses in Certain Sectors: Some sectors, which include healthcare, training, and residential actual property, can be exempt from VAT or have zero-rated supplies. Businesses that simplest deal in exempt materials do not need to register for VAT.

Foreign Businesses:

Foreign Companies Providing Goods or Services: If a foreign employer affords items or offerings inside the UAE and meets the turnover thresholds, it's also required to check in for VAT.

When identifying whether or no longer your industrial enterprise desires to register for VAT in Sharjah, you ought to calculate your annual taxable turnover. This calculation helps identify if your turnover exceeds the required registration threshold of AED 375,000 or falls within the voluntary registration range of AED 187,500 to AED 375,000. Here’s a manner to calculate your VAT turnover for registration:

Identify Taxable Supplies

Include All Relevant Income

Calculate Annual Turnover

To calculate your annual taxable turnover, follow these steps:

1. Sum Up Sales: Add up all your taxable sales for the past 12 months. This includes:

Formula: TOTAL TAXABLE TURNOVER = SALES OF GOODS + SALES OF SERVICES + INCOME FROM DEEMED SUPPLIES + VAT APPLICABLE IMPORTS

2. Assess Your Position:

3. Regular Monitoring

Annual Review: Regularly monitor your taxable turnover to ensure compliance. If your turnover approaches the registration threshold, be prepared to apply for VAT registration in Sharjah.

Example Calculation:

Total Taxable Turnover: 250,000 + 120,000 + 30,000 + 10,000 = AED 410,000

In this example, since the total taxable turnover is AED 410,000, the business must register for VAT.

1. Business Details:

2. VAT Registration Status:

3. VAT Registration Number:

4. Effective Date of Registration:

5. VAT Obligations:

Outline the obligations of the business under VAT regulations, which include:

6. VAT Exemption:

7. Signature and Stamp:

This structured VAT declaration letter is submitted to the Federal Tax Authority to ensure compliance and to declare VAT-related details accurately.

When applying for VAT registration in Sharjah, businesses must provide the Federal Tax Authority (FTA) with the necessary documents. These documents are essential to prove the legitimacy, financial standing, and eligibility of the business for VAT purposes. Below is the list of documents required for VAT registration specifically in Sharjah:

1. Trade License

2. Emirates ID and Passport Copy

3. Financial Statements

4. Bank Account Details

5. VAT Registration Form

6. Proof of Business Activities

7. Customs Registration Number (if applicable)

8. Self-Prepared Calculation Sheet (for Taxable Supplies)

9. Revenue Forecast

10. Monthly Turnover Declaration

11. Supporting Financial Documents

For Taxable Expenses:

12. Expense Budget Report

Additional Documents (if applicable):

13. Articles of Association/Partnership Agreement

14. Certificate of Incorporation

15. Ownership Information

16. Power of Attorney

17. Charity or Association Documents (if applicable)

Supporting Forms for Application:

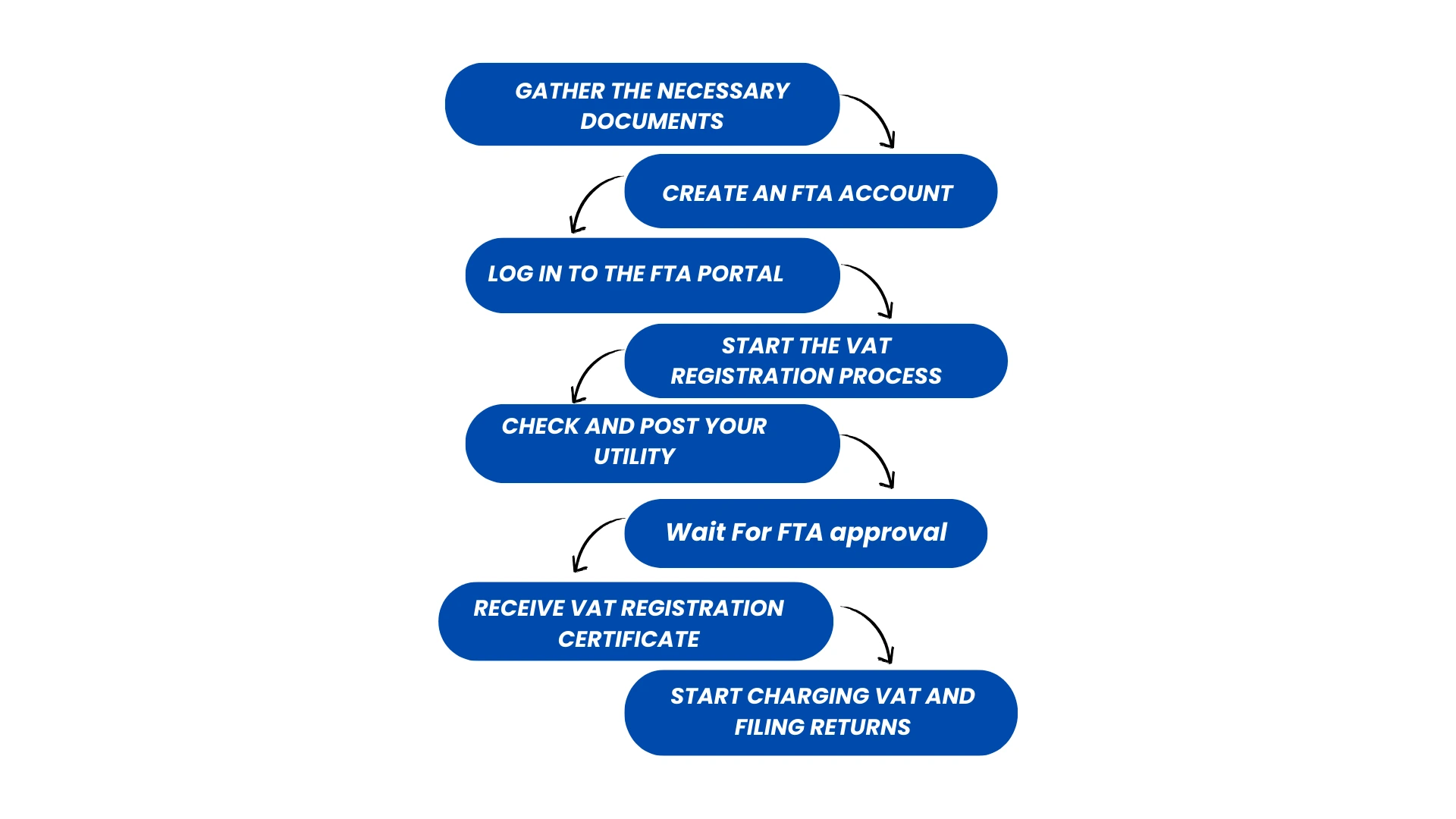

VAT registration in Sharjah, UAE, is a crucial step for businesses that meet the eligibility standards under the Federal Tax Authority (FTA). The method is easy and can be carried out online. Below is a step-by-step manual to help you complete your VAT registration in Sharjah.

Step 1: Gather the necessary documents

Before you start your registration, make sure you have all the necessary files ready, including:

Step 2: create an FTA account

To apply for VAT registration you need to create an account on the Federal Tax Authority (FTA) portal:

Step 3: Log in to the FTA Portal

Once your account is created, log in to the FTA e-services portal using your credentials.

Step 4: Start the VAT registration process

Step 5: Check and post your utility

Step 6: Wait for FTA approval

Once you've submitted your application, the FTA will evaluate your VAT registration request. This manner can take several days, depending on the way you complete your utility.

Step 7: Receive VAT Registration Certificate

Once your VAT registration is accepted, the FTA will issue you a VAT Registration Certificate. The certificate will include:

Step 8: Start Charging VAT and Filing Returns

Once registered, you should follow UAE VAT legal guidelines, including:

Non-residents can register for VAT in Sharjah under specific conditions. Below is a detailed explanation of the process and requirements for VAT registration for non-residents in Sharjah:

Non-residents are required to register for VAT in Sharjah if they meet the following criteria:

Tax Agent:

Tax Identification Number (TIN):

VAT Registration Application:

Appointment of Tax Agent:

TIN Application:

VAT Registration Application:

Verification and Approval Process

After VAT registration, non-resident businesses must observe all VAT laws in Sharjah, including

To remain compliant after VAT registration, non-resident businesses have to:

Charge VAT: Apply VAT at the ideal price (5% or 0% for responsibility-loose items) on all taxable goods and services.

To problem a VAT-compliant invoice: Ensure VAT invoices include:

1. File VAT returns on time: File VAT returns via the FTA portal before the required deadline.

2. Pay VAT dues promptly: Pay VAT dues on time to avoid penalties.

3. Maintain VAT records: keep detailed records of all VAT transactions inclusive of invoices, receipts, and payments.

4. Display the TRN: Include the TRN with all invoices, receipts, and different business files.

5. Update the accounting machine: Ensure that the business’s accounting software is VAT compliant.

6. Train employees: Educate employees about VAT rules and make sure they observe accurate VAT procedures.

7. Follow FTA regulations: Keep updated with FTA guidelines and make sure you comply with all VAT-associated guidelines.

Non-residents conducting taxable business activities in Sharjah are required to register for VAT, appoint a tax agent, and comply with the ongoing VAT obligations. Following the proper registration steps and ensuring VAT compliance is critical for non-resident businesses operating in Sharjah.

VAT Group Registration is a process that allows multiple businesses in Sharjah to register as a single entity for VAT purposes. This simplifies VAT compliance and reduces administrative burdens for related businesses operating within the UAE.

Conditions for VAT Group Registration

To sign up as a VAT group in Sharjah, the following criteria must be met:

1. Related Businesses: The businesses ought to be linked, such as:

2. Residency: All businesses in the VAT group must be residents of the UAE.

3. Turnover Requirement: The combined annual turnover of the businesses meets or exceeds AED 375,000.

VAT Group Registration Process in Sharjah

The steps to register as a VAT group include:

1. Identify Group Members: Determine which businesses might be part of the VAT group and clarify their relationships.

2. Appoint a Representative: One business, known as the representative member, is chosen to deal with all VAT-related matters on behalf of the group.

3. Submit VAT Group Registration Application: The representative member submits the VAT group registration application via the EmaraTax platform.

4. Required Documents:

5. FTA Approval: The Federal Tax Authority (FTA) reviews the application, and once approved, the businesses are registered as VAT groups.

Note that VAT group registration is a challenge to FTA approval, and extra documentation or information may be required. Consulting a tax expert or the FTA for further guidance is recommended.

A VAT Registration Certificate is issued by the FTA in Sharjah, confirming a business’s registration for VAT. This certificate, also referred to as a VAT Registration Letter, contains the following details:

The VAT Registration Letter is typically issued within 10 running days after the FTA approves the VAT registration application. It is used for diverse purposes, which include:

Businesses must safeguard their VAT Registration Certificate as it serves as evidence of VAT registration and is required for VAT-related transactions.

In Sharjah, the following terms are used interchangeably and refer to the same thing:

The TRN is a unique 15-digit range assigned to a business through the FTA after successful VAT registration. This number is essential for VAT-related activities and must appear on VAT invoices, returns, and other documents.

The TRN layout within the UAE is:

123456789012345

Where:

Businesses must show their TRN on all VAT-related files, such as invoices, receipts, and credit notes, to validate their VAT registration and follow UAE VAT guidelines.

This process ensures that businesses in Sharjah are compliant with VAT rules and simplifies VAT administration for related entities through group registration.

The time required to process a VAT registration application in Sharjah, UAE, can vary depending on several factors. These include the accuracy and completeness of the application, the workload of the Federal Tax Authority (FTA), and whether additional information is required. Here's an outline of the VAT registration process and estimated timeframes:

1. Submission: You submit the VAT registration form along with all required files to the FTA, either directly or through a tax agent.

2. Review by FTA:

3. Approval:

Generally, the method can take anywhere between 10 to 20 working days, depending on how well the application is ready and if any follow-up is needed.

Once a business exceeds the mandatory registration threshold of AED 375,000 in taxable supplies or imports, it must register for VAT within 30 days of exceeding the threshold. FThere will be severe penalties if you don't register by this deadline.

Some products and services in Sharjah are VAT-free, including:

1. Healthcare Services: Hospital fees, physician fees, and medical treatments.

2. Education Services: Tuition expenses, schools, universities, and associated services.

3. Residential Real Estate: Except for commercial real estate, residential property sales and leases.

4. Local Passenger Transport: Taxi services, bus fares, and metro expenses.

5. Certain Food Items: Basic food staples like rice, bread, milk, and meat (excluding luxury or processed foods).

6. Healthcare Goods: Medicines, clinical systems, and related products.

7. Charitable Activities: Donations and charity work offerings.

8. Religious Services: Services supplied by mosques, churches, and temples (excluding items like religious books).

9. Government Services: Parking and municipal fees are included in public services.

10. Financial Services: certain financial services (not including insurance and reinsurance), bank interest, and loans.

These VAT exemptions make it easier for companies to adhere to VAT regulations while assisting important industries by lowering the tax burden on necessities in Sharjah.

Not registering for VAT in Sharjah when you are required to can lead to several serious consequences, both financial and legal. Here are the potential penalties and issues businesses may face:

Monetary Fines

Failure to register for VAT on time can result in financial penalties. The length of the delay and the seriousness of the non-compliance determine how much these fines are. The fines may increase with the length of time a business waits to register.

Legal Repercussions

Businesses that fail to register for VAT when necessary may face legal action from Sharjah's Federal Tax Authority (FTA). This could include formal warnings, and in severe cases, legal proceedings, especially if the business continues operating without fulfilling its VAT obligations.

Business Restrictions

Non-registration can restrict your ability to conduct certain business activities. For instance, a business that is not registered for VAT may be unable to:

Tax Liability

Even if a business fails to register for VAT, it is still liable to pay taxes on taxable substances. Businesses who postpone VAT registration are still required to pay VAT. Additional penalties and interest on past-due taxes should result from this.

Damage to Reputation

A company's reputation may suffer if VAT regulations are not followed. Partners, suppliers, and customers could be reluctant to collaborate with a company that is not following the law's tax rules, which could result in missed opportunities.

Voluntary Disclosure:

Mandatory Disclosure:

Additional Penalties for Non-Compliance in Sharjah

The FTA can impose further penalties for issues such as:

Choosing Reyson Badger in your VAT registration services in Sharjah means you have the advantage of professional guidance to meet the unique requirements of VAT compliance within the UAE. Our role is important in ensuring that your VAT registration in Sharjah process is smooth, accurate, and fully compliant with nearby guidelines.

Here's why Reyson Badger is the excellent desire for your VAT registration services in Sharjah:

VAT registration in Sharjah requires accurate form submission and compliance with strict rules. Failing to check in or comply can bring about consequences. Reyson Badger guarantees that your business is completely compliant, saving you time, attempt, and potential economic chance. You can rely on our knowledge to help you navigate the process smoothly and avoid frequent registration errors.