VAT Registration in Saudi Arabia is an important step for businesses to follow the tax rules correctly. Value Added Tax (VAT) is a type of tax that Saudi Arabia started using in 2018. It's a bit like a sales tax you might have seen in other places. This tax applies to most things you buy, like when you go shopping for clothes, food, or even when you pay for services like getting your car fixed or going to the hair salon.

If you're someone who has a business or is thinking of starting one, VAT is something you need to know about. Registering for VAT means telling the government that you're now part of the system that collects this tax. This is important because there is a legal requirement for this. Not registering can lead to problems later on.

Many people have concerns about how it works, when they need to register, and what they need to do to stay on the right side of the law. This guide aims to help answer those questions regarding VAT registration in Saudi Arabia easier for everyone.

There are two main types of VAT registration services Mandatory and Voluntary. Mandatory means you must do it by law, while voluntary means you can choose to do it if you want to. Whether it's mandatory or voluntary for you depends on how much your business makes in sales. If your sales reach a certain amount, you have to register.

There are also some things that VAT doesn't apply to. These are called exemptions. For example, some basic food items, medical services, and certain financial services might not have VAT added to their prices. If you are curious to know more about it let's get into details.

In Saudi Arabia, certain businesses are needed to register for VAT. The General Authority of Zakat and Tax (GAZT), the governing body for tax matters, outlines the criteria for mandatory registration. Here's a breakdown:

Threshold-Based Registration: This means that if your business crosses a certain limit of taxable supplies within a specific period, you must register for VAT. The current threshold is SAR 375,000 (approximately $100,000 USD) for the total value of taxable supplies in the past 12 months or what you expect to make in the next 12 months. Once you cross this threshold, you have 30 days from the end of that month to register for VAT.

Mandatory Registration for Specific Sectors: There are also specific businesses that must register for VAT regardless of whether they meet the threshold or not. These include:

It's important to keep track of your taxable supplies and understand whether you fall under the mandatory registration criteria. If you do, it's your responsibility to register for VAT within the specified timeframe. Not doing so can lead to penalties imposed by GAZT.

Failing to register for VAT when mandatory can lead to penalties imposed by GAZT. These penalties can be significant, so it's important to ensure you comply with the regulations.

Not every business in Saudi Arabia has to register for VAT, there's an option called voluntary registration that can be helpful in some situations. Here's why you might think about choosing voluntary registration:

Recovering Input Tax: If your business spends a lot on purchases that have VAT included (called input tax), VAT Registration in KSA lets you get that VAT money back from the tax authority (GAZT). This can improve how much money you have available.

Competing Better: In some industries, being registered for VAT can make your business look more trustworthy and competitive.

It's important to know that choosing voluntary registration means you also have to follow all the rules for VAT. This includes things like regularly reporting your sales and purchases to the tax authority and paying any VAT you owe. Before deciding on voluntary registration, think about both the good things and the challenges it might bring to your business.

In Saudi Arabia, most businesses that sell goods and services have to pay Value Added Tax (VAT). However, certain things don't have VAT added to their prices. Here are some examples:

These exemptions are there to make sure that things like food, education, and some financial services stay affordable for people.

These documents are required for VAT registration in Saudi Arabia:

It's important to ensure you have all the necessary documents before starting the VAT registration process.

Here is a detailed explanation of the VAT registration process in Saudi Arabia:

First, visit the ZATCA website at zatca.gov.sa. This is the official website for the General Authority of Zakat and Tax (GAZT) in Saudi Arabia.

On the ZATCA website, look for the "General Services" tab. This tab is usually located in the main menu or navigation bar of the website.

Once you're on the General Services page, find and click on the "Registration for VAT" tab. This tab will take you to the VAT registration section of the website.

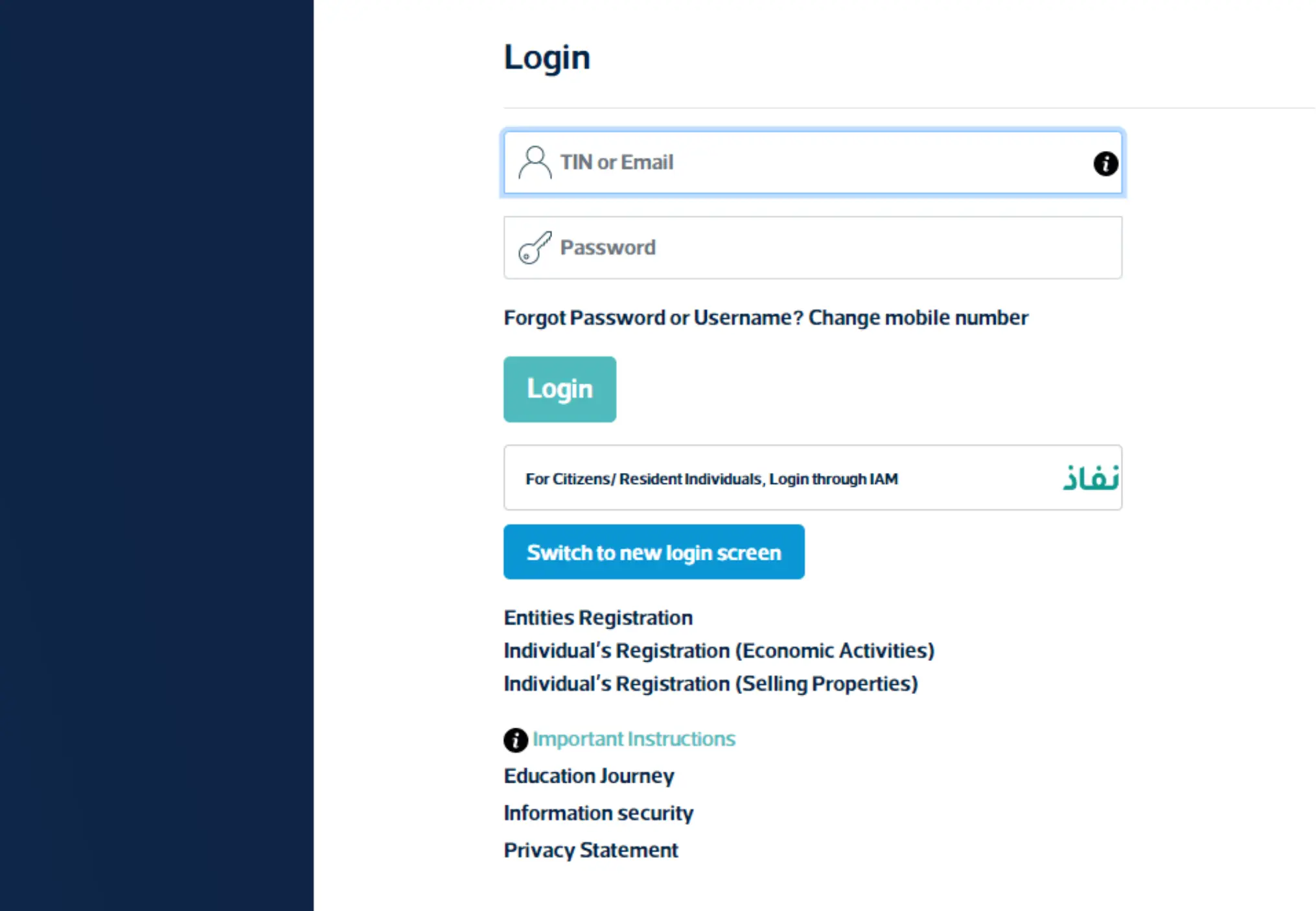

Login to the ZATCA Portal using your ZATCA TIN/E-Mail and Password. If you are a Citizen/a Resident you can login through the IAM Portal

After clicking on the "Registration for VAT" tab, you'll be directed to a registration form. Fill out this form completely and accurately. The form will ask for details such as your business name, contact information, tax identification number, and other relevant details.

Once you've filled out the registration form, review it carefully to ensure all information is correct. After verification, submit the form through the online submission portal provided on the website. Be sure to follow any additional instructions or guidelines provided during the submission process.

After submitting the registration form, you'll receive a confirmation or notification from the GAZT. This notification may be sent via email or through the online portal. It will confirm that your registration request has been received and is being processed.

Once your VAT registration is approved, you will receive a VAT certificate. This certificate serves as official proof that your business is registered for VAT in Saudi Arabia.

It's important to note that the VAT registration process may vary slightly depending on updates or changes made by the GAZT. Therefore, it's recommended to refer to the official ZATCA website for the most current and accurate information regarding VAT Registration in Saudi Arabia.

At Reyson Badger, we're here to make dealing with VAT registration in Saudi Arabia easier for you. Our team of tax experts can help you with several important things related to VAT. We will figure out if you need to sign up for VAT Registration in KSA. This depends on how much your business sells and what kind of business you have. we will explain the difference between needing to register and choosing to register. If you do need to register, we will guide you through the whole process. we will help you gather the right documents, fill out the forms, and send everything to the tax authorities on time. Once you're registered, we will take care of preparing and submitting your VAT returns accurately and on time. we will make sure you follow all the rules and regulations related to VAT to avoid any penalties or problems. No matter if you have a small business or a big one, we're here to answer all your questions and provide the assistance you need with VAT registration in Saudi Arabia.

VAT registration is done electronically through the GAZT portal. You'll need to obtain a Tax Identification Number (TIN) before registering. The GAZT website provides detailed instructions on the registration process.

Documents typically required include your business license, financial statements, and proof of address. The specific requirements may vary depending on your business type.

The frequency of VAT return filing depends on your taxable supplies. Businesses with a total value of taxable supplies exceeding SAR 40 million ($10.67 million USD) in a calendar year must file VAT returns monthly. Others can file quarterly.

Non-compliance with VAT regulations can attract penalties, including fines and potential business license suspension.