VAT Refund Services in UAE

The value-added tax was introduced in the United Arab Emirates (UAE) in January 2018, when it was implemented. Many businesses and individuals in the United Arab Emirates are now required to comply with VAT regulations, in which they pay VAT on goods and services. However, many may not know that they would be eligible for a refund of VAT, which enables them to recover a significant portion of their VAT expenses. VAT refund services in UAE are an essential tool for businesses and individuals to guide them through the complex process of VAT refunds, ensuring they obtain the refunds they are legally entitled to.

What is VAT Refund in UAE?

VAT refund in the United Arab Emirates is a means by which people or an enterprise can recover Value Added Tax (VAT) payable on goods and services. These measures are aimed at retrieving tax from tourists, business ventures outside the UAE borders, and particular types of individuals which helps boost tourism and supports the country's reputation in terms of shopping.

What are the Eligibility Criteria for VAT Refund in UAE

Eligibility for claiming VAT refund is different and depends on the category of the claimant:

- Tourists: The visitor should be minimum 18 years old; the goods must be taken from the retailers participating in 'Tax Refund for Tourists Scheme'; the goods should be taken out from the UAE; and the goods should not have been consumed inside the country.

- Businesses: Businesses registered outside the UAE can claim a refund of VAT paid during their activities in the UAE. The claimant must prove payment and fulfill certain documentary requirements.

- Citizens of the UAE Building New Homes: Citizens can recover VAT on the cost of building their own homes.

What are the Types of VAT Refunds Available in the UAE?

- Tourist Refund: Tourists can claim back VAT paid on eligible purchases during their stay in the UAE. For this, they need to present tax invoices and tax-free tags at the validation points before leaving the country.

- Business Refund: Businesses registered outside the UAE are eligible to claim VAT on expenses incurred for business purposes while conducting business in the UAE. This includes goods and services purchased for business purposes.

- New Residences Built by Emirati Citizens: They are entitled to VAT refunds on construction costs based on specific guidelines issued by the Federal Tax Authority.

- Special Schemes: Refund schemes may also be applicable for foreign governments, international bodies, and diplomatic missions under their respective agreements with the UAE government.

What are the Benefits of VAT Refund Services in UAE?

- VAT Paid on Business Expenses Returned: The most prominent advantage for businesses in the UAE by using the VAT refund services is that such services allow companies to receive back VAT paid on applicable expenses. Recovering those VAT amounts substantially reduces cost operations, so companies would be able to reinvest those funds in business activity, thus increasing overall profitability.

- Higher Cash Flows and Lower Costs: By recovering VAT, companies are going to increase their cash flows. This is highly essential for startups and small-sized enterprises as they can get into cash constraints at a time. The process of recovery helps in removing financial burden that arises in terms of VAT payment, hence improving the management of company budget and decreasing the costs in operations.

- Compliance with UAE VAT Laws and Regulations: The use of VAT refund services ensures that the companies do not breach the laws of UAE VAT. A company avoids the penalties and legal issues related to the breach of the laws through the proper procedures of VAT refund claims. It brings transparency and accountability within the company.

- Improved Financial Control and Planning: It further ensures better financial planning and management, as businesses will better anticipate their cash flows to understand when they would expect their VAT refunds and consequently take better decisions for their investments and expansions and all sorts of financial commitments.

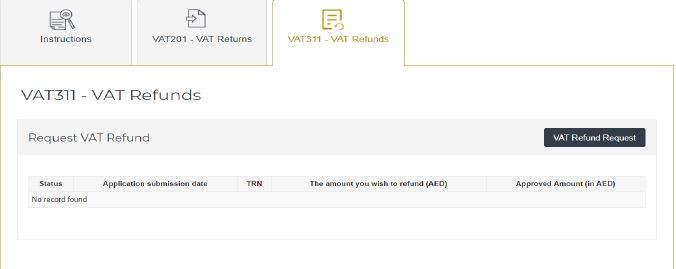

To submit a VAT refund claim in the UAE, follow these simple steps for a seamless process:

- Login to FTA e-Services Portal: Access the FTA portal with your username and password. Navigate to the 'VAT Refunds' section under the 'VAT' tab. Click the 'VAT Refund Request' button.

- Complete the Refund Form: Fill in all mandatory fields (marked with an asterisk). Ensure your information is accurate, including pre-filled details retrieved from your profile.

- Attach Required Documents: Upload a stamped bank account validation letter issued by your bank, containing the account holder's name (matching FTA registration), bank details, and IBAN.

- Submit the Form: Click 'Submit' after reviewing the form thoroughly. Ensure all information and attachments are accurate.

- Approval & Refund Process: The FTA processes the application within 20 business days and notifies you of the result. Upon approval, the refund is credited within 5 business days.

- Verify Your Balance: Check your transaction history in the 'My Payment' section to confirm the refunded amount.

Pro Tips:

- Ensure your bank details are up-to-date in your FTA profile.

- Expect delays if your bank lacks a UAE correspondent bank, as international transfers may take longer and incur fees.

This streamlined guide will help you confidently navigate VAT refund claims in the UAE

Fields in UAE VAT Refund Form

The fields mentioned below are all part of the VAT Refund Form (Form VAT311) used by businesses registered for VAT in the UAE to claim refunds for excess input tax. Here's a detailed explanation of each field:

- Tax Registration Number (TRN): This number is like your company's special ID given by the Federal Tax Authority (FTA) when you register for VAT. Make sure it's correct for your business.

- Total Amount of Excess Refundable Tax (in AED): This shows how much VAT you've paid on things you bought, which is more than what you got from selling your goods/services (input tax more than output tax). The FTA calculates this based on your previous VAT returns, minus any penalties you owe (except for late registration).

- The Amount You Wish to Have Refunded (in AED): Here, you write down the exact amount you want back from the excess VAT you paid (mentioned in point 2). Remember, you can't ask for more than what's shown in point 2.

- Remaining Amount of Eligible Excess Refundable Tax (in AED): After you ask for a refund (mentioned in point 3), this shows how much excess VAT you still have left that you can ask for in the future. It's like a balance you can claim later.

- Late Registration Penalty Amount (in AED): If you registered for VAT after the deadline and got a penalty, this field shows how much you owe. If you paid it already, it will show "Zero (AED)."

- Authorized Signature and Declaration: This part has spaces for

- The name of the person in your company who's allowed to sign the form (in English & Arabic).

- A place for that person to physically sign the form.

- A statement saying you agree to give more documents if the FTA asks to check your refund claim.

VAT Refund Application: How to Track its Status?

| Status |

Explanation |

| Pending |

Once the details are submitted, the form transitions to this status while awaiting processing by the Federal Tax Authority (FTA). |

| In Progress |

The FTA has begun reviewing the refund application. |

| Resubmit |

The FTA requires additional information or documentation. Details of the required action are sent to the authorized signatory's email. The tax registrant must respond within five (5) working days with the necessary updates. |

| Reviewed |

The refund application has been reviewed, and the FTA has initiated payment of the VAT refund to the taxable person's bank account. |

| Approved |

After successful receipt of the VAT refund amount by the taxable person’s bank account, the status changes to "Approved." |

| Rejected |

If the refund application is denied, the status changes to "Reject," indicating the application did not meet the FTA’s requirements. |

- Validation Letter of Bank Account: Name of account holder, bank details (SWIFT/BIC, IBAN).

- Supporting Evidence: Proof of payment for excess credit claims or transfers from another TRN.

- Tax Invoices: The top five tax bills from standard-rated purchases and other relevant invoices.

- VAT Refund Form: It is a downloadable form at EmaraTax.

Timeline and Expected Processing Time for VAT Refund

- First Review: FTA will first review an application submitted within 20 business days.

- Notification of Decision: Applicants are given a response regarding acceptance or rejection within this time.

- Refund Processing: After approval, refund is processed and credited usually within the next 5 business days.

What are the Common Mistakes in VAT refund applications?

- Mistakes in filling out the application can lead to delays or rejections. Common errors include incorrect amounts, missing information, or failing to follow instructions.

- Submission of incomplete applications or missing necessary documentation may delay the refund process. This could lead to return requests for corrections or other supporting information.

- Processing times may vary, and extraordinary delays can emerge considering that there is a great volume of submitted applications or other reviews needed by the FTA.

Why Need a Professional VAT Refund Services in UAE?

- The professional VAT refund services are familiar with UAE VAT laws and regulations in great detail and assure full compliance and accuracy.

- VAT Refund process to be completed effectively in timely and efficient manners

- Professional VAT refund services reduce the risk of error and penalties while ensuring that your activities comply with the rules and regulations of UAE VAT.

- Professional VAT refund services ensure that you obtain the maximum VAT refund amount so that your cash flow and profitability will be maximized.

VAT Refund Consultants in UAE

VAT refund services are very important for the UAE, as it allows businesses and individuals to gain the maximum refund possible for which they are entitled. Individuals and businesses can make less risk of error and penalty through professional VAT refund services such as Reyson Badger, in turn maximizing cash flow and profitability. With the change in laws and regulations surrounding VAT in the UAE, businesses and other individuals should make sure they always comply and look for reputed VAT refund services. With that being said, those looking to use VAT refund service in the UAE must exercise thorough research on a provider, scrutinize all their relevant experience, or reputation, before finally making such a very important selection.