UAE Tax Residency Certificate for Companies

The UAE Tax Residency Certificate for Companies is a crucial document to confirm the status of tax residency for the business organizations and to provide them with the opportunity to take advantage of double taxation agreements.

Eligibility Criteria - Tax Residency Certificate for Companies

- A Tax Residency Certificate (TRC) can only be issued to a legal entity that has been in existence for a minimum of one year.

- Financial accounts must be: 1) Prepared or audited by a accredited audit company. 2) attached to the TRC application together with other necessary documents.

- The audit report must be verified and stamped by the auditing company.

- The audited financial report attached to the application must include the year that the certificate is being requested for.

- The audit report must cover the previous year if the certificate is being obtained for the current year.

Benefits of Tax Residency Certificate for Companies in UAE

- Helps to avoid double taxation in two different countries

- Strengthens the connected company's transparency and trustworthiness.

- Helps you avoid paying more in taxes, allowing you to save money on important assets.(Also allow to claim extra-taxes)

Required Documents

The Applicant is a Legal Entity

- Trade License

- Memorandum of Association.

- Proof of Authorization from Memorandum of Association or a Power of Attorney

- Copy of the Audited Financial Report, which is duly signed and stamped by the auditing company. This copy shall be certified by an independent auditor. The financial audit report should cover the same start date of the financial year requested in the application or the previous year.

- Certified Lease agreement / tenancy contract for the office.

- A bank statement issued by a local bank covering 6 months within the financial year related to the request

Applicant is a Legal Person – Government Entity

- A copy of the Decree or Government Decision or Trade license.

- Request letter issued by the person – the Government entity

Application Process - Tax Residency Certificate for Legal Persons in UAE

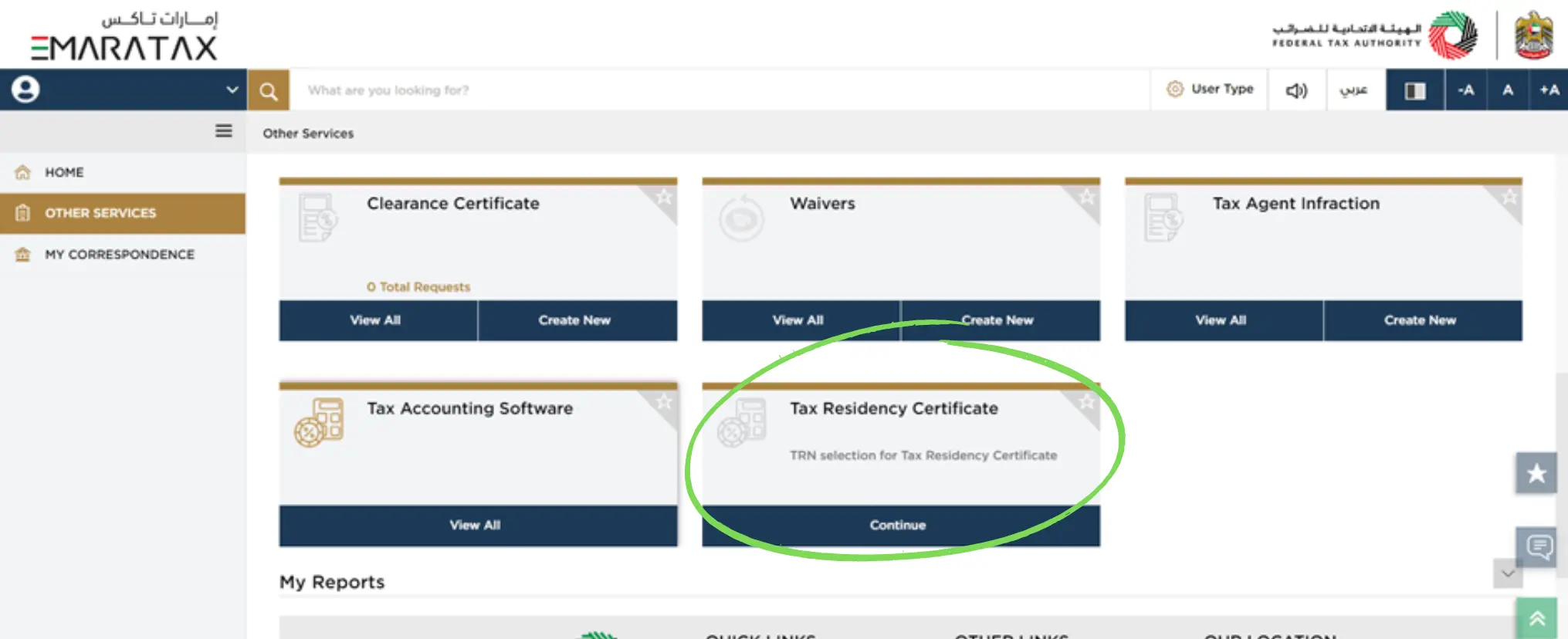

- To apply for the Tax Residency Certificate, visit the FTA's EMARATAX portal.

- You have three options for using EMARATAX: use your existing account, make a new one, or link an old account from a previous TRC portal.

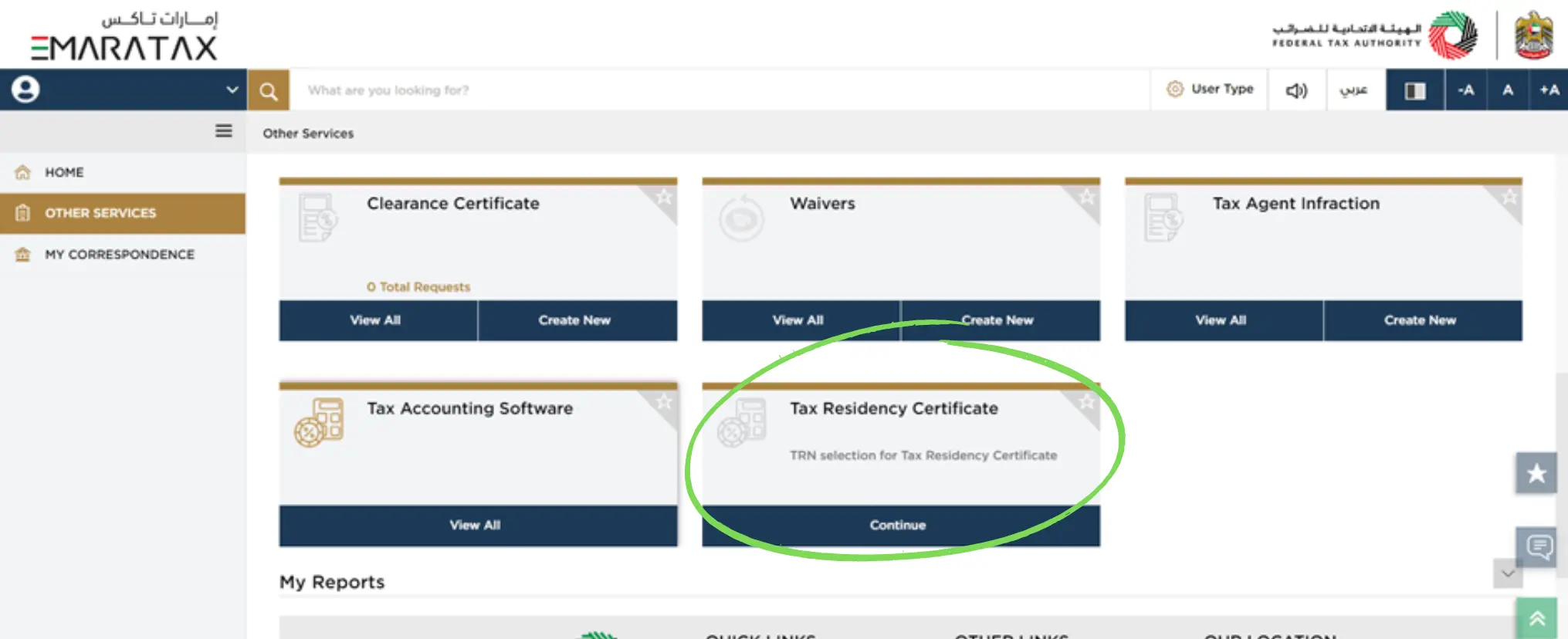

- Once you are logged in, choose "Other Services".

- You have to choose the Tax Registration Number for which you are requesting for a TRC. If there is no TRN, select "No TRN" as the last option. The selected TRN will allow the user to automatically fill up the data in the TRC portal based on that TRN.

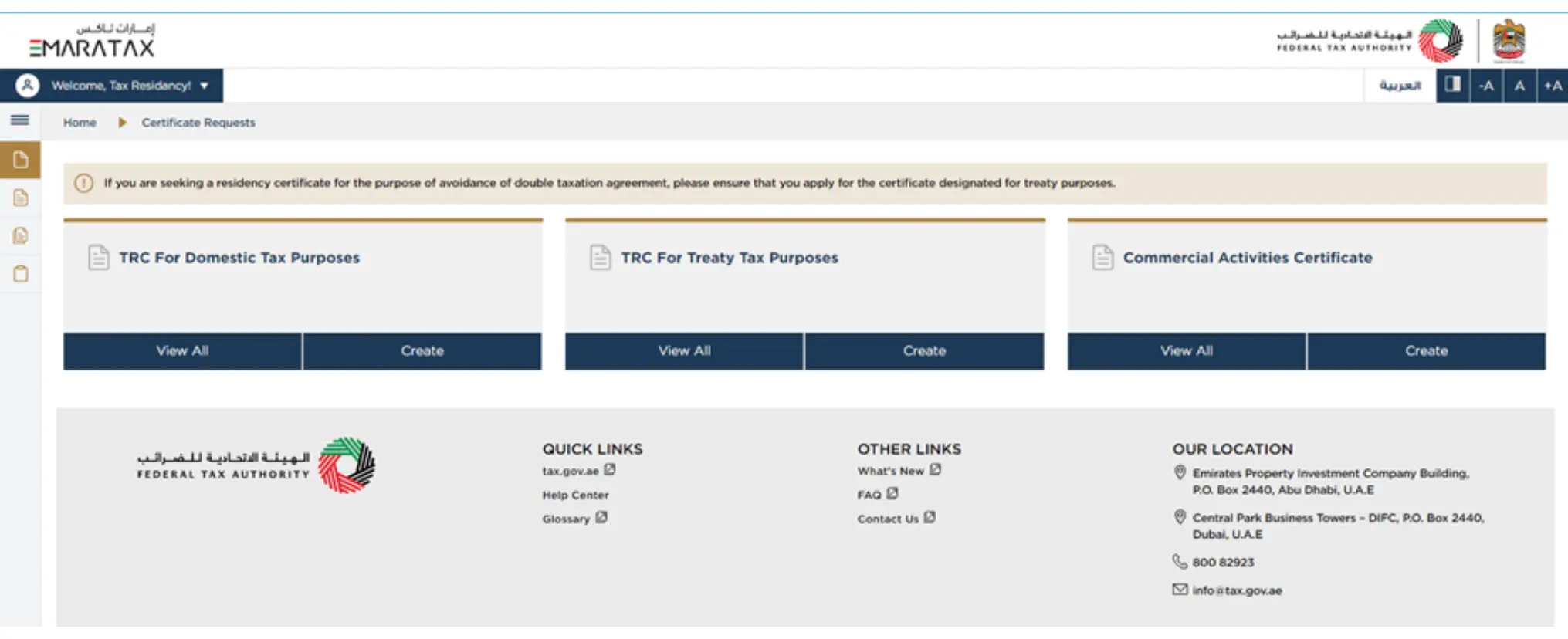

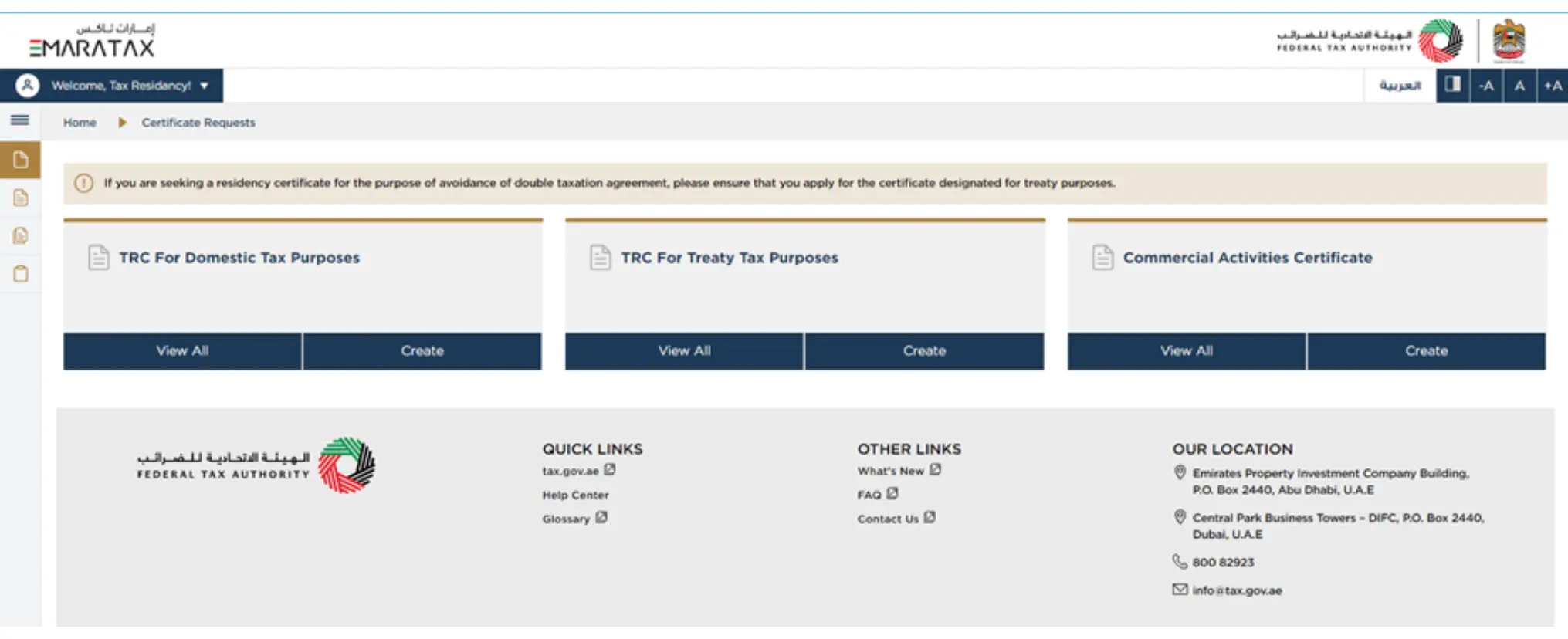

- Depending on whether the TRC is required for tax treaty or domestic purposes, select the appropriate option.

- Once you have completed the creation process, you will need to pay the submission fees and submit your application.

- Once the certificate has been approved by the FTA, the certificate processing fee is paid.

- In the case of a special tax form, the FTA's attestation is required. (Intended for tax residency certificates for treaty purposes only).

- Alternatively, electronic special forms can be uploaded with the application in the Tax Residency Certificate Portal.

A signed copy will be returned via the application.

- With return service by mail.

- With return service by courier

- It is the applicant's responsibility to pay the fees associated with sending and returning documents.

- A tax payer must complete this form, which corresponds to the application in the system with respect to the certificate's financial year.

Validity, Renewal and Cost of TRC for Companies

TRC Validity

As of the date of issuance, Tax Residency Certificates for Legal Persons remain valid for one year from the date they were issued.

Cost for Tax Residency Certificate

- Submission Fee - AED 50

- All Commercial Activity and Tax Registered Entities - AED 500

- Non-Tax-Registered Companies - AED 1000

TRC Renewal Process

Renewing a Tax Residency Certificate is not possible in the UAE. The TRC should always be reapplied for each new financial year.

To obtain further assistance regarding the Tax Residency Certificate, get in touch with Tax Professionals at Reyson Badger. We will assist you in arranging the necessary documents, verifying your eligibility, and completing the TRC process as quickly and efficiently as possible.

Tax Residency Certificate for Companies in UAE