Tax Residency Certificate (TRC) in the UAE is a formal document issued by the Federal Tax Authority (FTA) that confirms an individual's or business's tax residency status in the country. It serves as proof that the bearer of the certificate is a resident of the UAE for tax purposes. To qualify for a Double Taxation Agreement, individuals must present a TRC proving their residency in another nation and taxation status. Government bodies, businesses, and individuals are eligible to benefit from the UAE's double taxation avoidance agreements by using the TRC certificate.

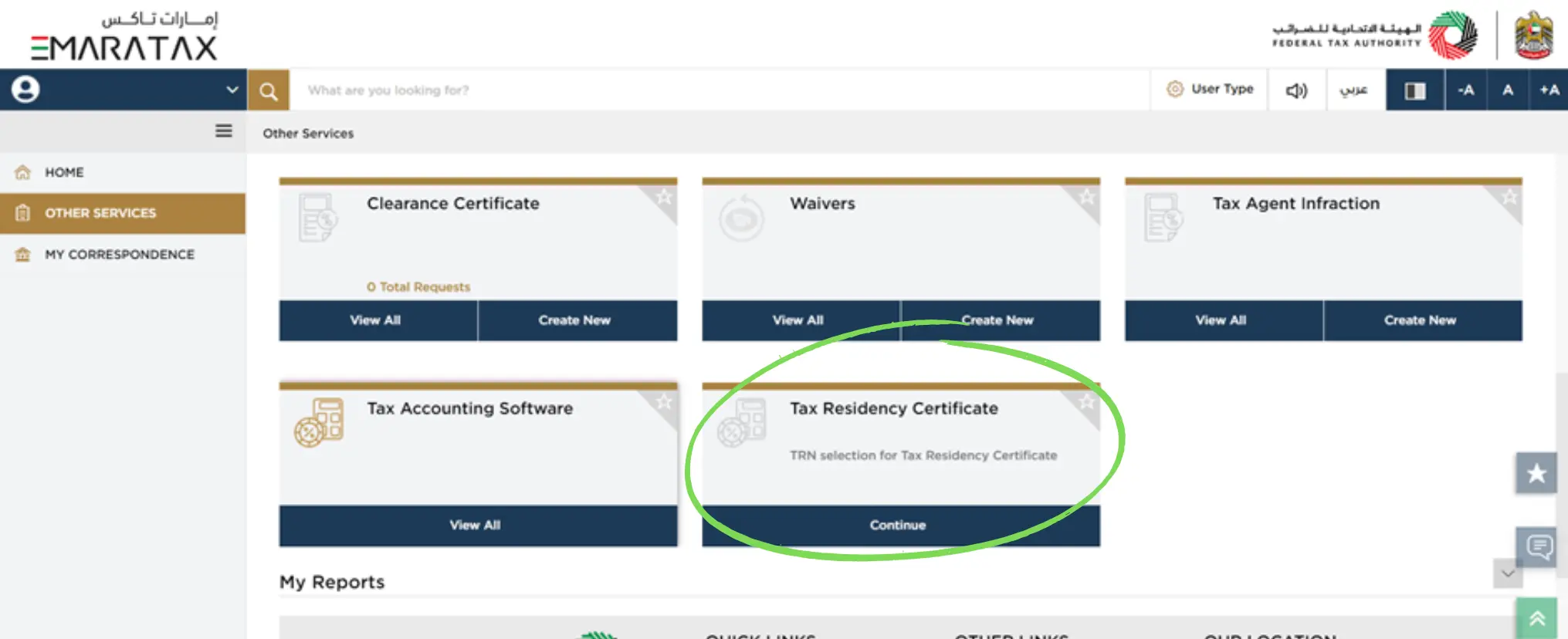

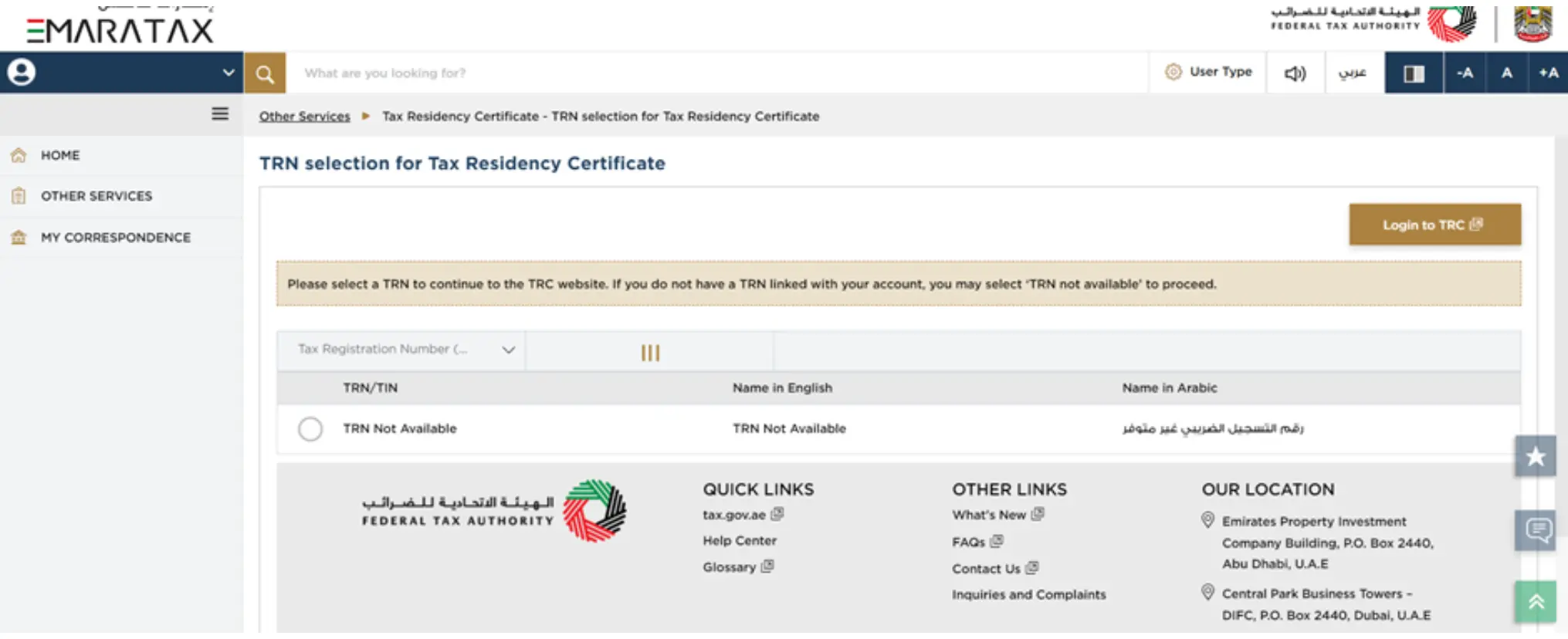

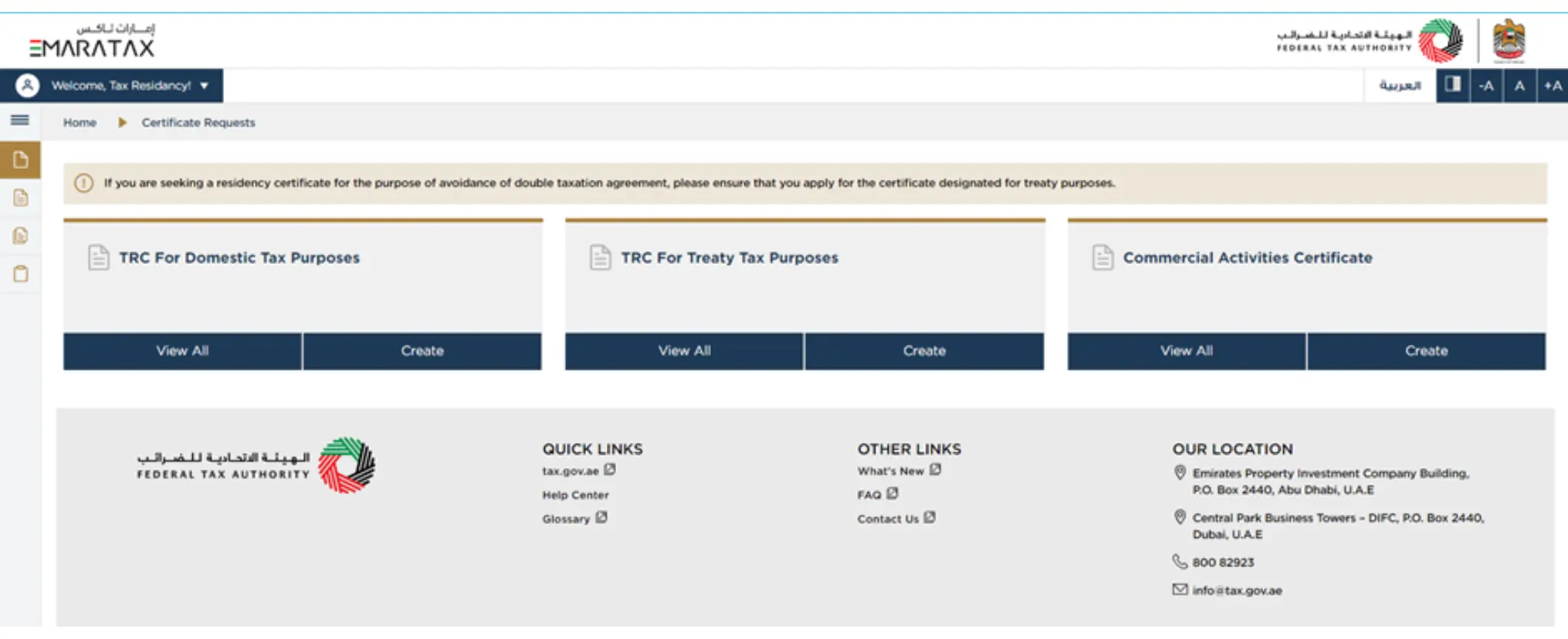

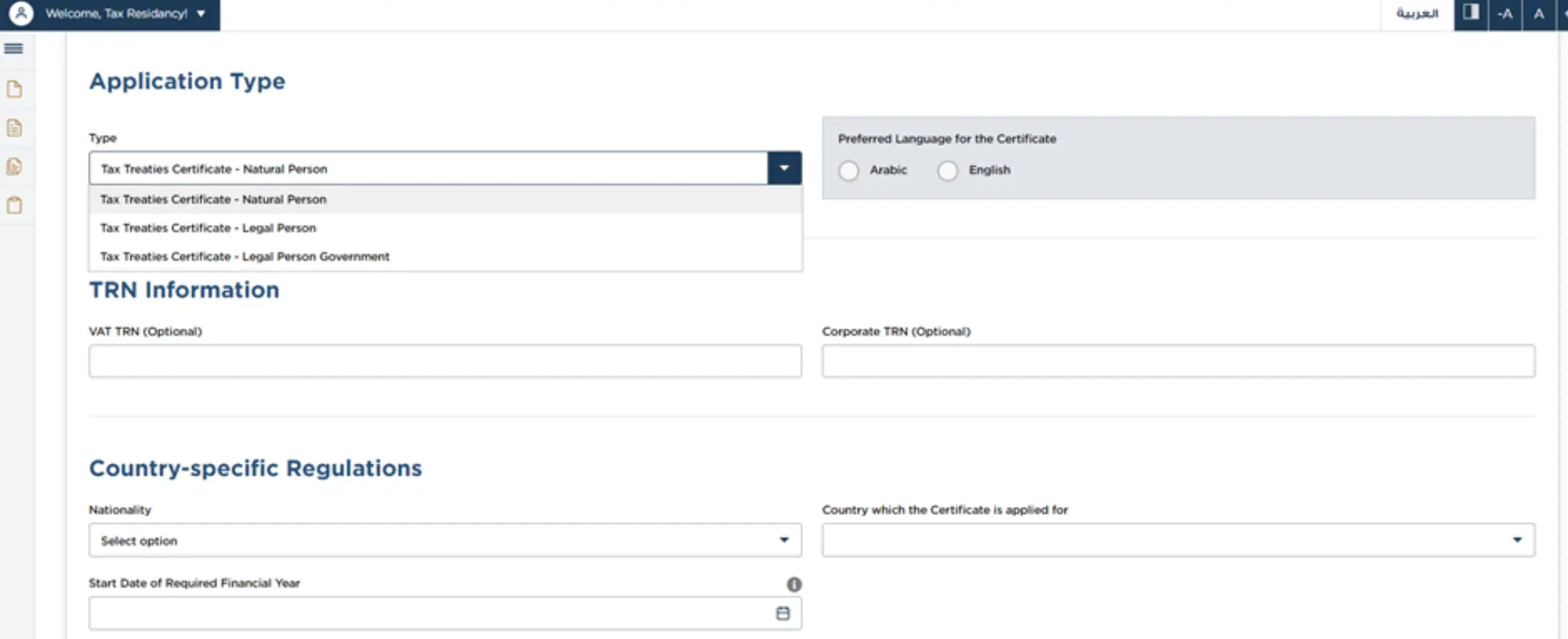

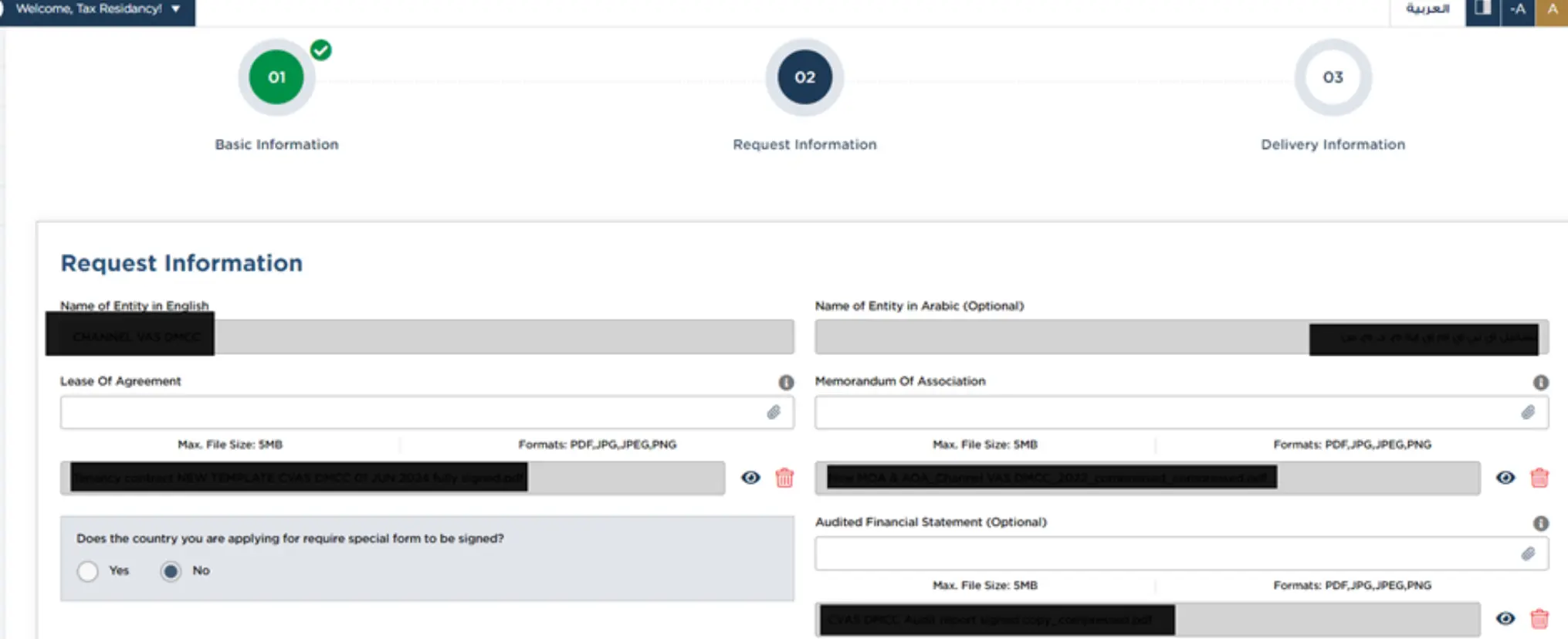

Tax Residency Certificate can be applied through the Federal Tax Authority’s web portal named EmaraTax Portal. Through this portal, we can apply for the Tax Residency Certificate and Commercial Activity Certificate.

Double Taxation happens when similar taxes are imposed in two different countries on the same taxpayer and same taxable entity. This affects the goods, services, and technology transfer across the countries.

A double Taxation treaty has been implemented to avoid the double-taxation b/w countries with significant cross-border investments. The first Double Taxation Agreement was signed between UAE and France, the recent double Taxation Agreement was signed between UAE and Qatar. Currently, the UAE has signed 146 agreements between different countries to avoid double taxation. The Tax Residency Certificate is issued to take advantage of the Double Taxation Avoidance on income.

Double Taxation Avoidance Agreements, DTAA, are treaties Founded between two or more countries to prevent the same income being taxed at the same time to an individual and his business. These DTAs are significant because they encourage cross-border trade and investment in a highly civilized manner by clearly allowing the ways of taxing income earned by a resident of another country in one country. Without DTAAs, a tax-payer would be subjected to a real challenge of paying tax on the same income in the country where it is earned and the country of residence that would significantly reduce his or her overall earnings.

DTAAs assist in deciding which country would be empowered to tax specific types of income such as dividends, royalties, interest, capital gains, and business profits. This is done by making available mechanisms like tax credits, exemptions, and reduced tax rates that prevent double taxation. They benefit individuals but also result in higher economic cooperation between two countries, ensuring international business is more feasible.

Here's the list of 146 Countries UAE has signed Double Taxation Agreement.

Managing Double Taxation: TRC provides individuals and businesses with the opportunity to take advantage of Double Taxation Avoidance Agreements (DTAAs) the UAE has negotiated with different countries. As a result, the same income does not have to be taxed twice in two separate jurisdictions.

Strengthened Credibility: It is believed that having a tax residency certificate enhances an individual's or business' credibility in the eyes of foreign tax authorities, as it confirms that the individual or business is a tax resident in the UAE.

Reduced Withholding Taxes: In accordance with the relevant DTAA provisions, holders of TRCs can enjoy reduced withholding taxes on dividends, interest, royalties, and other income types.

Effectiveness of Tax Planning: People and companies may be able to structure and plan their tax obligations more effectively and lower the number of tax returns by utilizing a TRC.

Global Market Access: DTAAs give companies more competitive access to international markets, which lowers tax obligations and boosts profitability.

Law Adherence: Possessing a TRC guarantees adherence to global tax laws and assists you in avoiding legal issues related to tax residency and double taxation.

There are two types of Tax Residency Certificates:

If the Applicant is a Natural Person

Source of Income:

If the Applicant is a Legal Person

If the Applicant is a Legal Person - Government Entity

In accordance with Cabinet resolution number (27) for 2023

"If the Applicant is a Natural Person who has spent more than 183 days in the UAE"

If the Applicant is a Natural person who has spent less than 183 days but at least 90 days in the UAE

If the Applicant is a Natural Person who has spent less than 90 days in the UAE or falls under other situations

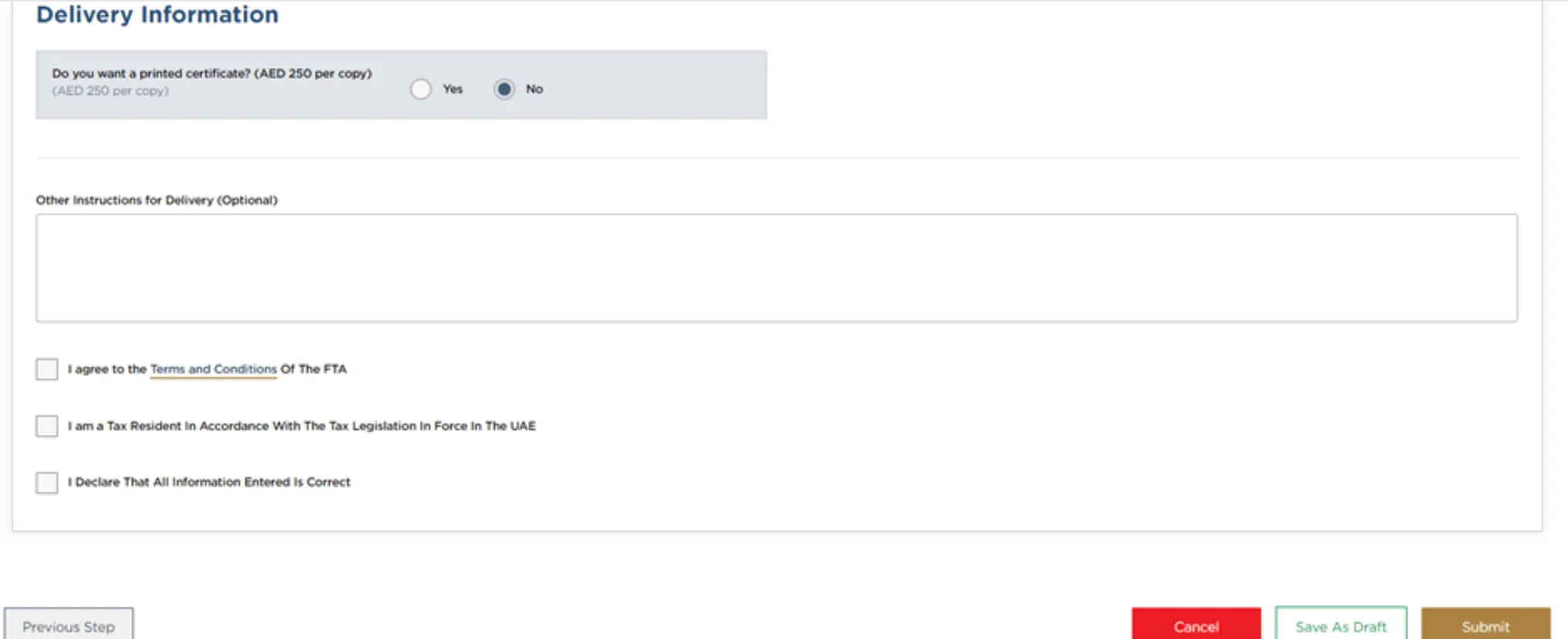

It is important that you double-check all of the details as you will not be able to make any changes in the future.

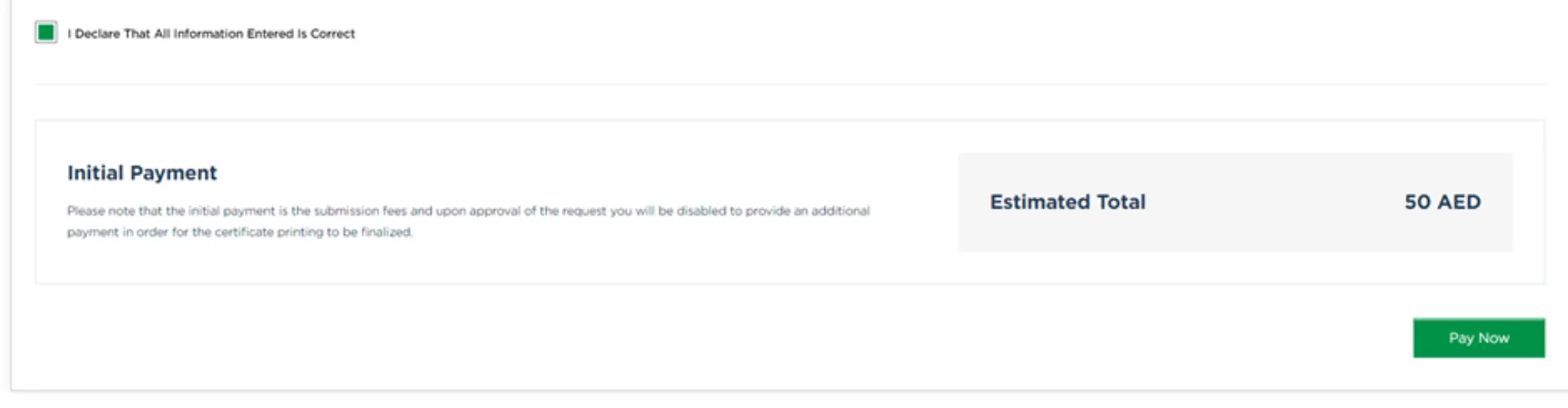

| Note: AED 250 will be added to the cost of the hard copy certificate. |

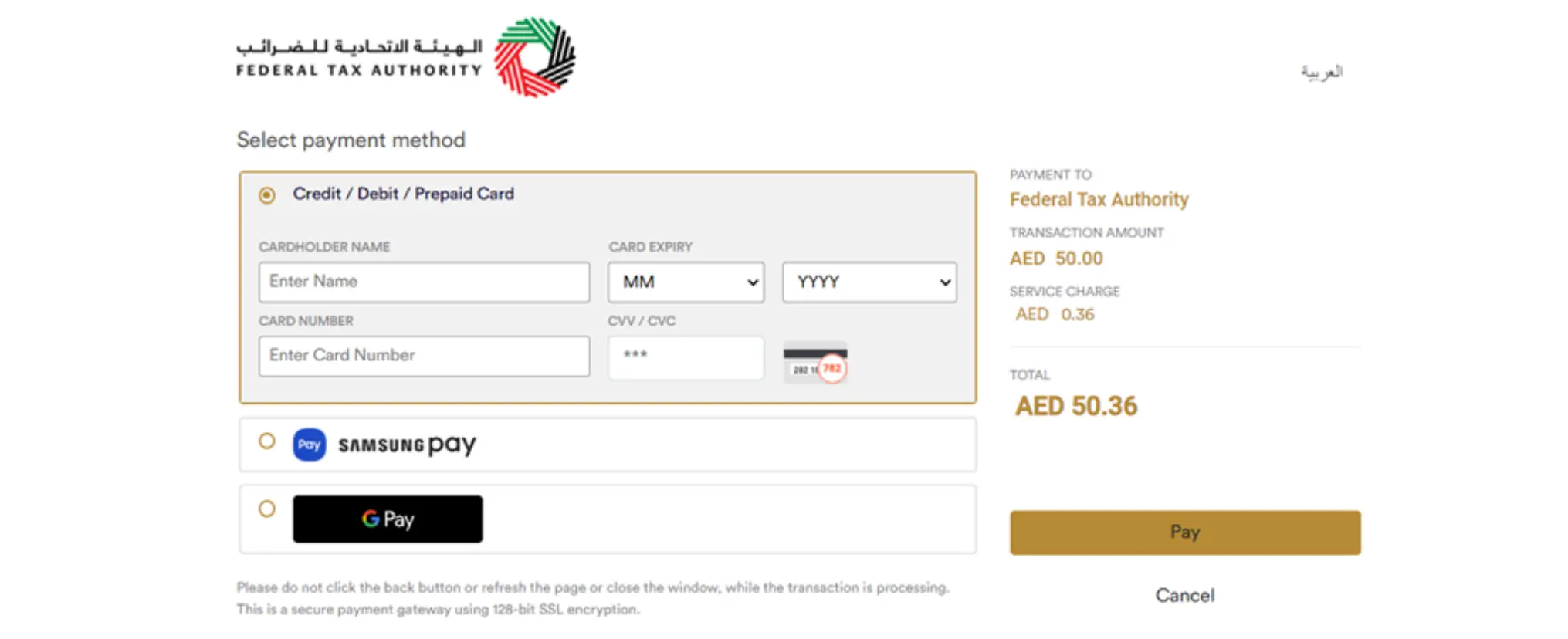

The payment gateway is the final step in the TRC Certificate download process. To download the certificate, you must first make a payment. You can use a credit or debit card, Google Pay, or Samsung Pay to make the payment.

The Tax Residency Certificate will only be valid for transactions that occur during a specific financial year. When the financial year is up, you may need to apply again or renew your TRC to maintain your tax resident status in the UAE.

It can take anywhere from a few weeks to a few months to receive a Tax Residency Certificate (TRC) after applying. The timing depends on how quickly the Federal Tax Authority processes your application. It also depends on whether they require further information or documents from you, as well as their current workload with other applications.

Certain countries in the UAE have agreed with the Double Taxation Agreement with UAE to avoid multiple taxation of taxes. In those countries with double taxation, individuals/businesses can show their Tax Residency Certificate to avoid multiple taxation. Here's a list of countries that have a Double Taxation Agreement with the UAE.

The Tax Residency Certificate (TRC) is extremely significant for individuals and enterprises dealing with taxes in many nations. It assists you in determining where you need to pay taxes, ensuring that you do not pay taxes twice on the same money. This accreditation also assists you in properly adhering to tax laws. Having a TRC expert, such as Reyson Badger, makes tax preparation easy.

Understanding your residency status under UAE's taxation agreements ensures compliance and maximizes tax benefits. The procedure of obtaining a TRC, as well as the length of time it takes, demonstrate its importance in tax management and economic growth. Working with Tax Residency Certificate (TRC) specialists in the UAE improves tax management, enhances international business, and boosts global economic success.

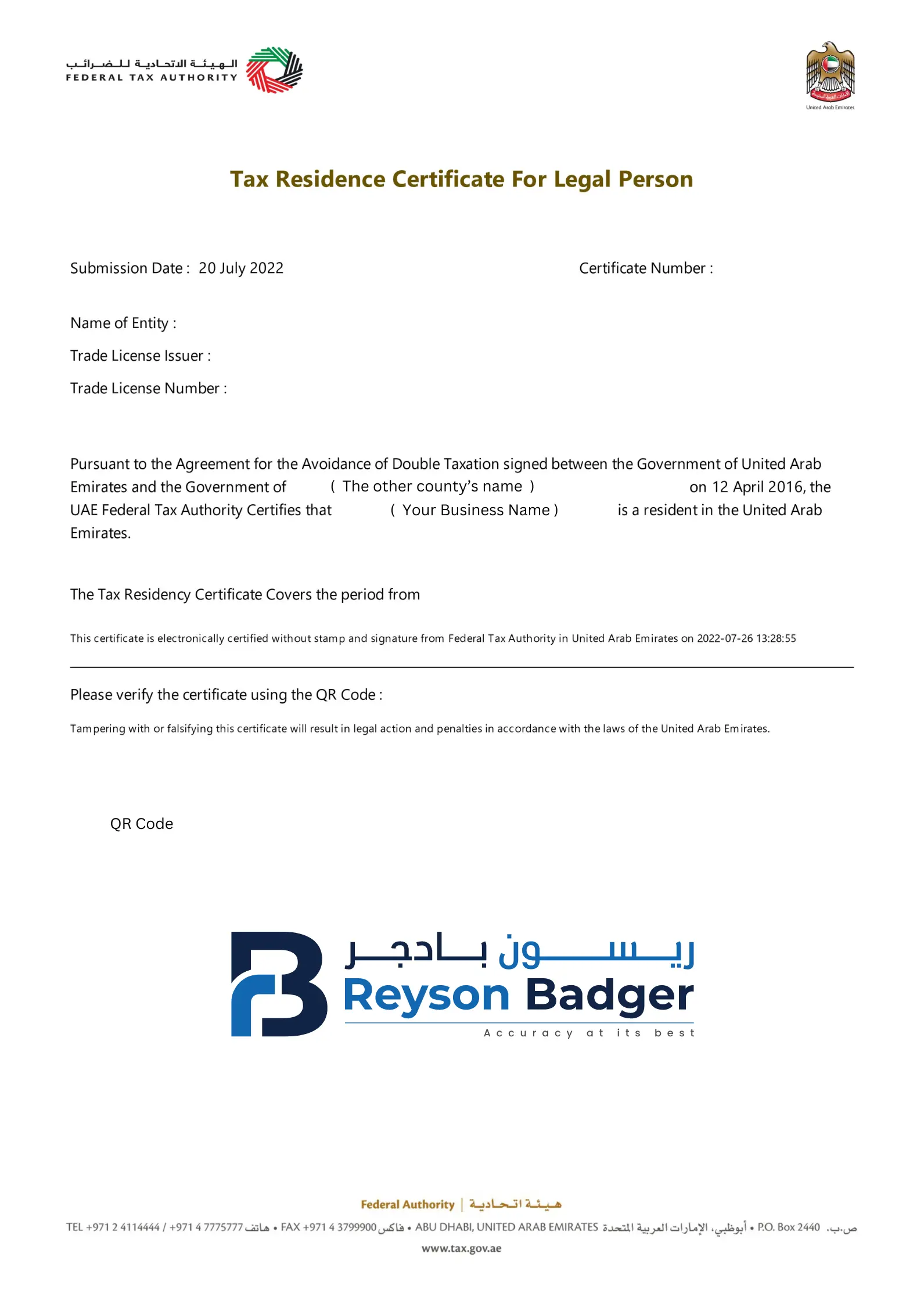

Here is a Tax Residency Certificate for a Legal Person in the UAE

The Tax Residency Certificate for Legal persons consists of the following details:

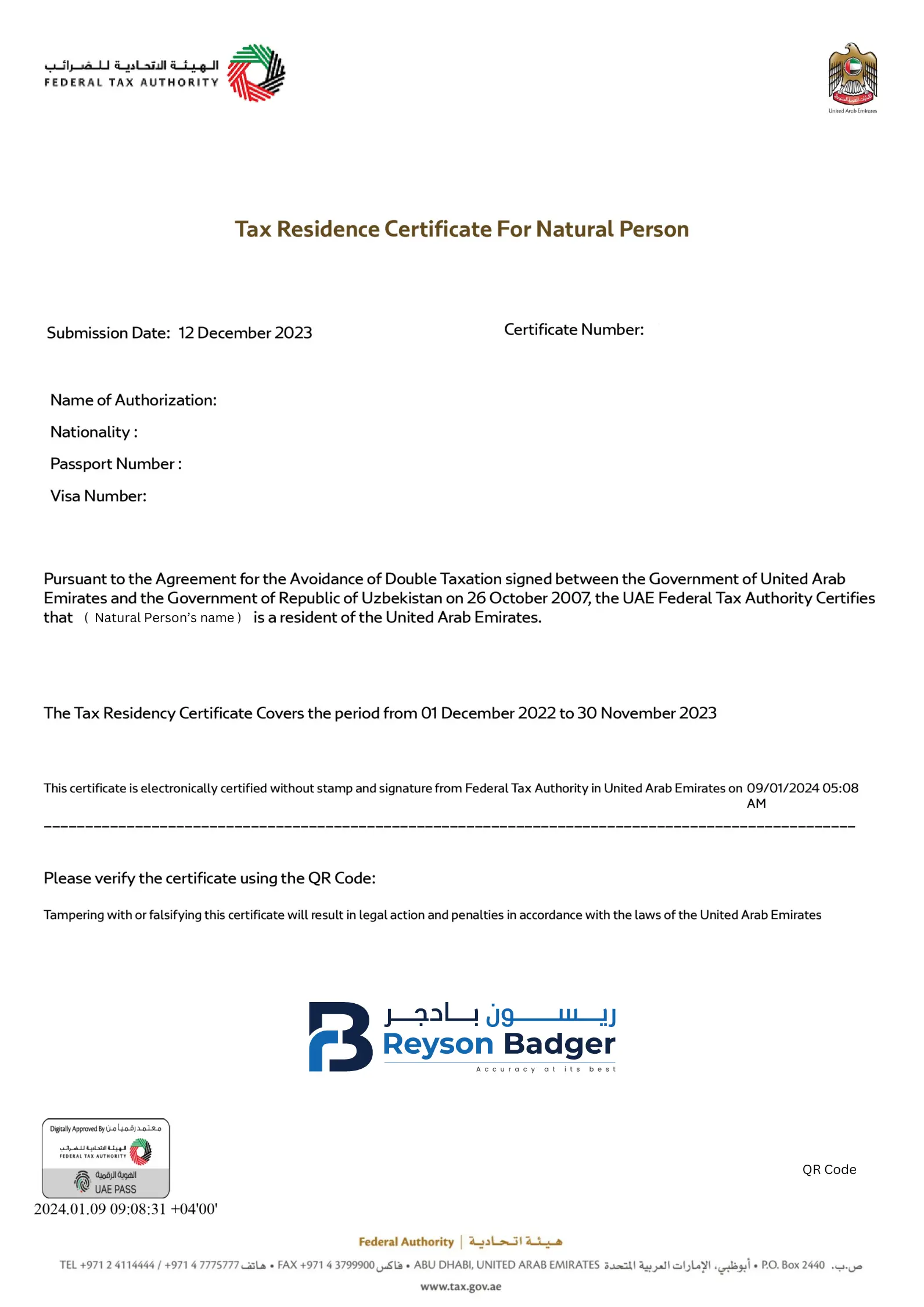

Here is a Tax Residency Certificate for a Natural Person in the UAE

The Tax Residency Certificate for Natural Persons consists of the following details:

Here are the other VAT Services Reyson Badger provides

| VAT Registration | VAT Reclaim |

| Excise Tax Registration | VAT De-Registration |

| VAT Return Filing | VAT Refund Services |

| Excise Tax Advisory | ESR Notification & Reporting |

A certificate issued on request that allows applicants to take advantage of the Double Taxation Agreement.

The Tax Residency Certificate is issued by the Federal Tax Authority (FTA) in the UAE.

No, the UAE does not issue a Tax Residency Certificate to non-residents.

The processing time varies, but it typically takes a few weeks to a few months.

You will receive a notification explaining the reason for rejection and can reapply with revised documents.

Yes, but you may have to apply for separate TRCs for personal and business purposes. The Tax Residency Certificate for Treaty Purposes and Domestic Purposes is mentioned above.

The FTA must be notified and your information must be updated through the FTA's EmaraTax Portal.

Tax Residency Certificate's are country-specific and cannot be transferred.

TRC's are only issued to individuals who are 18 years of age or older.

Follow the cancellation procedure and notify the FTA through the EmaraTax Portal.

Yes, but you must provide proof of income and meet the eligibility requirements.

TRCs are available to all UAE residents who meet the eligibility criteria, regardless of their nationality.