Top 20 Corporate Tax Consultants in UAE

19-Jan-2026

Get Expert Corporate Tax Services in UAE Today!

Expert guidance on registration, filing, advisory, and strategic tax planning tailored for UAE businesses.

Corporate Tax Services in UAE

Corporate Tax services is a recent introduction in the UAE, making Corporate Tax Services essential for businesses to ensure compliance and avoid potential penalties imposed by the FTA. Reyson Badger is the #1 provider of professional Corporate Tax Services in the UAE . We offer a wide range of services, from Corporate Tax Registration to complete and reliable Compliance Management. Our team possesses the proficiency to customize our services to precisely match your specifications.

Reyson Badger offers the following Corporate Tax Services in UAE.

Corporate Tax Registration

Corporate Tax Registration is the first official process of complying with the Corporate Tax Law in UAE. The Registration Process is done through the EmaraTax Portal of the FTA. UAE Corporate Tax Registration is required for juridical persons operating in the UAE, foreign juridical persons managed and controlled in the UAE, Foreign Juridical Persons operating through permanent establishments in the country or having a taxable nexus in the UAE, and natural persons conducting business in the UAE.

Corporate Tax Registration Penalties & Relief Measures

Failure to register for UAE Corporate Tax will result in a penalty of AED 10,000.

If the violation is repeated within 24 months of the last violation, a penalty of AED 20,000 will be imposed.

2025 Penalty Waiver Initiative

Businesses can avoid/reclaim the AED 10,000 penalty if:

This is their first tax period

They submit either:

- Initial CT return OR

- Annual declaration

Submission occurs within 7 months of tax period closure

Example: A company with Dec 31, 2024 tax year-end must file by July 31, 2025.

Key Benefits

- Applies retroactively to penalties already paid (eligible for refund)

- Designed to ease compliance for new taxpayers

You can view the full details here: FTA Penalty Waiver Details .

Corporate Tax Registration Documents

Following are the major documents required for corporate tax services in Duba i .

- Copy of the Trade License

- Passport Copies of License Holders (Owners/Partners)

- Emirates ID of License Holders (Owners/Partners)

- Memorandum of Association (MoA) or (PoA)

- Concerned Person's Mobile Number and E-mail Address

- Address and P.O Details of the Company

- Financial Audit Report of the Business

Corporate Tax Registration Deadlines

The UAE Corporate Tax (CT) deadlines vary depending on the month of business license issuance. Here are the deadlines:

- January - February License Issuance : The deadline for CT registration was May 31, 2024.

- March - April License Issuance : The deadline for CT registration was June 30, 2024.

- May License Issuance : The deadline for CT registration was July 31, 2024.

- June License Issuance : The deadline for CT registration was August 31, 2024.

Also, consider the following scenarios:

- Entities without a license by March 1, 2024 : Must apply for CT registration within three months, which was May 31, 2024.

- Resident entities incorporated after March 1, 2024 : Must apply within three months from the date of incorporation.

- Non-resident entities with a permanent establishment : Must apply within six months of the existence of the permanent establishment.

- Resident individuals with business income exceeding AED 1, 000,000 are required to register for corporate tax by March 31, 2025, for the 2024 calendar year.

Corporate Tax Return Filing

Corporate tax return filing involves the meticulous preparation and timely submission of the corporate tax returns for a business to the Federal Tax Authority. It is important for the business to comply with Corporate Tax regulations. This means accurately reporting income, expenses, and other financial information to the FTA. It's important to file corporate taxes accurately to avoid penalties, stay legal, and protect the financial health of the business. It may require detailed paperwork and help from tax experts like Reyson Badger to understand the tax rules and regulations. Professional Corporate Tax filing Services in UAE can simplify this process and ensure full compliance with UAE tax laws.

Corporate Tax Filing Deadlines

The deadline for filing the first corporate tax return in the UAE depends on the company's financial year:

- Companies with a financial year starting June 1, 2024 and ending May 31, 2025 : The deadline date is 28 February 2026 .

- Companies with a calendar year starting January 1, 2025 and ending December 31, 2025 : The deadline date is 30 September 2026

- Companies with a calendar year starting April 1, 2025 and ending March 31, 2026 : The deadline date is 31 December 2026

For Corporate Tax return filings, the deadline is typically within nine months of the end of each tax period. However, the Federal Tax Authority (FTA) has extended the deadline to December 31, 2024, for certain entities with tax periods ending on or before February 29, 2024.

Corporate Tax Filing Penalties

It's important to note that penalties for late filing is AED 500 for each month for the first 12 months and 1,000 for each month from the 13th month onwards.

These are the penalties for failing to file the Corporate Tax services in Dubai, UAE

| Violation | Penalty |

|---|---|

| Not maintaining the necessary documentation and other data as required by the Corporate Tax Law and Tax Procedures Law | 10,000 for every violation; 20,000 for multiple violations during a 24-month period |

| Failing to provide the Authority with requested tax-related data, records, and papers in Arabic | AED 5000 |

| Failing to file a deregistration application within the allotted time | 1,000 every month, with a maximum of 10,000 |

| Failure of Legal Representative to submit a Tax Return within the designated deadlines | 500 each month for the first 12 months, then 1,000 each month after that |

| Failure of the Registrant to file a tax return in the allotted period | 500 each month for the first 12 months, then 1,000 each month after that |

Corporate Tax Filing Documents

The specific documents needed for filing will vary depending on your business structure and operations. However, the documents include:

- Statements of financial position for determining taxable income

- Receipts for the claimed deductions

- Records serving as proof of asset depreciation for tax purposes

- Documentation related to transfer pricing transactions

- Details of transactions involving related parties

- Details about changes in financial reserves that affect the company's taxable income.

- Statements of financial position to calculate exempt income

- Documentation of exemption status

- Documents from a business loan indicating interest paid

- Records of any foreign taxes paid

Corporate Tax for Free Zones

UAE Corporate Tax is mandatory for all individuals within the Free Zones. The tax rate varies based on the type of income. For Free Zone entity, the applicable tax rate is either 0% or 9%. Here's a closer look at how these tax rates are determined for Free Zone individuals.

- 0% on Qualifying Income

- 9% on Taxable income , that is not qualifying (Non-Qualifying Income)

Qualifying Free Zone Person (QFZP)

This is a Free Zone company that meets specific criteria set by the UAE authorities and enjoys a 0% corporate tax rate on its Qualifying Income.

According to Article 18 of the law, if the Juridical Person satisfies the following 6 conditions, he becomes a Qualifying Free Zone Person:

- Maintain Adequate Substance in UAE

- Derives Qualifying Income

- Not elected to be subjected to the Corporate Tax

- Complied with Transfer Pricing Rules & Regulations

- Non Qualifying Revenue should not exceed the De Minimis Requirement

- Qualifying Free Zone Person need to prepare audited financial statements.

Qualifying Income

This refers to income earned by a QFZP (Qualifying Free Zone Person) from activities conducted entirely within the Free Zone which have a 0% Corporate Tax.

De Minimis Requirements

These are thresholds set to ensure QFZPs primarily operate within the Free Zone. There's a limit on non-qualifying income (usually the lower of 5% of total revenue or AED 5 million). If exceeded, the company loses its QFZP status and gets taxed at the standard 9% rate for a minimum of five years.

Qualifying Activities

These are business activities allowed within Free Zones and that qualify for the 0% tax rate.

Excluded Activities

Certain activities like banking, insurance, and real estate may be restricted or not qualify for the 0% tax rate within Free Zones.

There were three announcements made regarding the UAE Free Zone Corporate Tax . The first one was on 2022 - Federal Decree-Law No 47 of 22 (Corporate Tax Law) followed by another one named Federal Decree-Law No.63 of 2023 , and the recent update was published on May 2024. There were many documentations penned in the above-mentioned laws and one of the key elements was that every Free Zone individual must register for UAE Corporate Tax.

Non-Qualifying Income

Non-qualifying income is income that does not qualify for the special 0% corporate tax rate provided under the Free Zone Persons. Based on the Ministry of Finance, revenues derived from transactions conducted outside the said free zones or derived from activities that do not classify as "Qualifying Activities" under the related ministerial decisions are classified as Non-Qualifying Income.

- Revenue from activities that are excluded from the business like the sale of immovable property not used for business purposes

- Any transaction that an entity based in the Free Zone has with an entity that is not listed in the specified Qualifying Activities.

- Other streams of income that do not satisfy the regulatory conditions prescribed for tax preferences.

For Free Zone Persons, to retain eligibility for the 0% tax rate, there must be strict adherence to defined limits on Non-Qualifying Income. Notably, Non-Qualifying Income cannot exceed 5% of total revenue or AED 5 million, whichever is lower, in any accounting period. Where these thresholds are exceeded, may result in a loss of the preferential tax advantages and even imposition of the corporate standard tax rate.

Free zone Corporate tax benefits

The system of corporate tax in the UAE has several advantages for businesses, especially Free Zone businesses and small enterprises. With professional Corporate tax services in Dubai, companies can fully leverage these benefits, making the UAE an attractive destination for businesses both locally and internationally.

- Tax Exemptions for Free Zone Businesses: Free Zone establishments that are under specific criteria can be charged 0% tax on qualifying income.

- No Withholding Tax: Withholding tax on international transactions is not a concern for free zone businesses, making transactions easier.

- Assistance for Small Businesses : Small businesses with a turnover of AED 3 million or less are eligible for tax breaks and simplified filing procedures.

- Transfer Pricing Compliance : Free zone businesses are required to abide by international transfer pricing rules with a view to preventing any exploitation of related businesses.

- Clear Tax Rate Structure: Companies earning up to AED 375,000 are exempted from taxes while those firms with profits greater than AED 375,000 are taxed at a nominal rate of 9%.

- Encouragement for Innovation: By ensuring that taxes are kept low, the tax system smoothly contributes to the process of innovation thus making the UAE a preferred destination to do business.

- Global Competitiveness: The tax system maintains the UAE competitive internationally hence encouraging both domestic and foreign investments.

- Simplified Compliance: The tax policies in UAE are quite simple and the government has cut laid down policies which makes it easier for any business to abide by them and work for more expansion.

The benefits of corporate tax in the UAE are aimed at promoting business growth, innovation, and a high level of competition. These facts are reasons why entrepreneurs and investors prefer to invest in this country.

Corporate Tax Audit

A corporate tax audit is a thorough examination of a company's financial records and tax returns conducted by tax authorities to ensure precise calculations and adherence to tax laws. Corporate tax auditors precisely verify the accuracy of all reported income, expenses, and deductions. Throughout the audit, tax authorities diligently scrutinize various documents, such as income statements, expense reports, balance sheets, and tax returns. They may even conduct interviews with employees to gather further information. To navigate this process confidently, many businesses turn to Corporate tax services in Dubai for expert support and audit readiness. As a result of the audit, the outcome could range from no changes being necessary to additional taxes being owed, or even a potential refund if there has been an overpayment. By maintaining precise and reliable records while also thoroughly understanding tax laws, companies can significantly streamline the audit process and ensure its smoothness and efficiency.

Corporate Tax Audits and Regular Tax Audits are similar in principle, requiring a thorough inspection of financial data to ensure compliance. However, Corporate Tax Audits especially focus on validating deductions, expenses, applicable regulations, and the correctness of the taxable and non-taxable revenue declared by businesses.

Corporate Tax Audit is a necessary requirement in the process of filing Corporate Tax Returns. To ensure compliance, it is mandatory to have your financial statements audited by an approved auditor in Dubai . These audited statements must then be submitted to the Federal Tax Authority in order to complete your returns filing.

Corporate Tax Accounting

Corporate Tax Accounting is crucial for ensuring tax compliance and maintaining accurate financial records related to corporate tax. It involves calculating taxable income, assessing tax liabilities, and monitoring deductions and credits. Effective tax accounting not only helps minimize tax bills and avoid penalties, but also ensures accurate reporting to tax authorities. It is essential to have a deep understanding of tax legislation, stay updated on tax law changes, and maintain detailed records.

Timely accounting your financial statements can help you file your Corporate Tax Filing easy. Keep accurate record of your financial records with the best accounting services in Dubai .

Corporate Tax Services in UAE

Reyson Badger's Corporate Tax Service helps your business register for corporate tax, comply with tax regulations, file tax returns, conduct corporate tax audits and receive comprehensive tax support.

- Our Corporate Tax Consultants review your business activities, financial records, and other pertinent information to accurately assess your tax liabilities irrespective of mainland and free zone companies

- Our consultants provide advice on tax-saving strategies to minimize your tax liability.

- We can help you register for corporate tax with the assistance of our professionals.

- Our consultants prepare audited financial reports and file corporate tax returns, ensuring accuracy and compliance.

- Our accounting experts will help you oversee your financial records to ensure smooth corporate tax filing.

- Our consultants ensure the timely and accurate payment of your taxes.

- In the event of a tax audit, our consultants will advocate for your business and offer guidance for a smooth process.

- Our Corporate Tax Consultants provide ongoing support and advice to ensure your business remains compliant with tax regulations.

Corporate Tax in UAE

Corporate Tax is a direct tax on the net income or profit of corporations and other entities from their business activities. It is governed by Federal Decree-Law No. 60 of 2023 , which amends parts of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses. All businesses with financial years starting on or after June 1, 2023, are now subject to UAE Corporate Tax. Ongoing compliance is required for all subsequent years.

The Corporate Tax aims to strengthen the UAE's position as a top worldwide business and investment destination. It also supports the country’s development and transformation to meet key strategic objectives. To ensure smooth adaptation, many businesses are turning to Corporate tax services in UAE for expert guidance. Additionally, the UAE intends to reaffirm its commitment to international norms for tax transparency and the prevention of harmful tax practices.

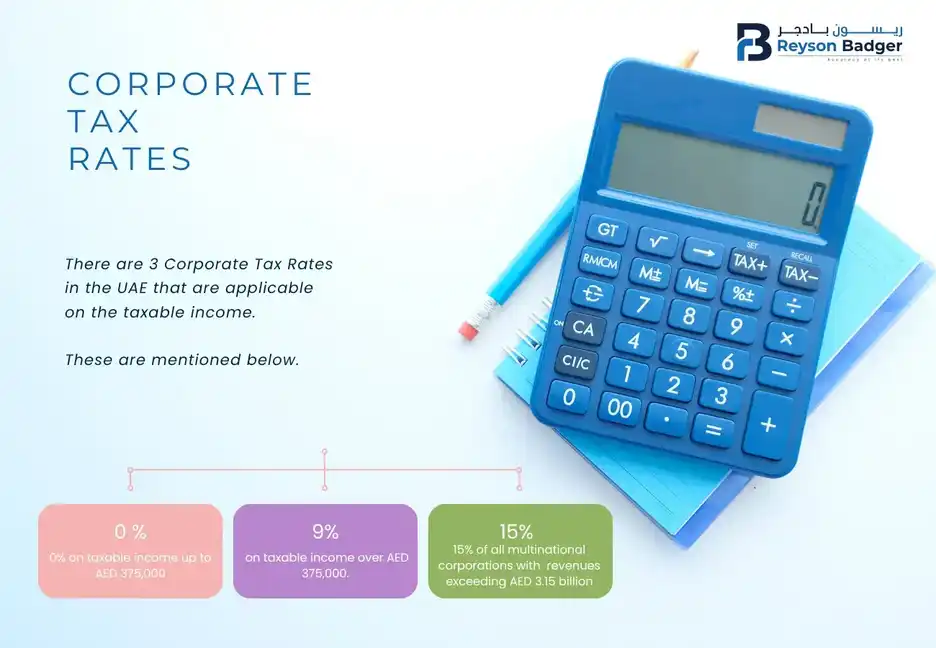

UAE Corporate Tax Rates

Corporate Tax will be imposed on businesses' taxable income at these rates:

- 0% on taxable income up to AED 375,000.

- 9% on taxable income over AED 375,000.

- 15% of all multinational corporations with worldwide revenues exceeding AED 3.15 billion, as per OECD Base Erosion and Profit-Sharing laws under Pillar 2 of the BEPS 2.0 framework.

Benefits of UAE Corporate Tax

- Corporate Tax helps governments generate additional revenue while promoting transparency in business operations.

- The implementation of corporate tax helps maintain control over the economy while also promoting its growth.

- Corporate Tax promotes equitable distribution of taxes among all businesses

- Corporate Tax is indeed more stable when compared to other taxes. It is also easier to manage since there is only one entity involved.

- Corporate Tax provides social security and helps protect against financial difficulties and debt.

- Corporate Tax is an important source of government revenue in the UAE, which helps fund essential public services.

Special Provisions and Relief in UAE Corporate Tax

In the UAE, the advanced systems of business taxation contain legal provisions and reliefs based on specific areas of investment designed to provide support to corporations to increase investment and growth.

- Small Business Relief : Small businesses that earn up to AED 3 million can file their taxes more easily and may even be exempted from corporate tax. With this move, this initiative is set to reduce the regulatory requirements that early-stage adopted startups as well as SMEs have to contend with, thus freeing them up to more on business development instead of worrying about compliance costs.

- Tax incentives for free zones : The companies operating in qualifying free zones can qualify for tax incentives; such incentives include a 0% corporate tax rate on qualifying income. This increases the UAE's attractiveness as a destination for investment, especially for international businesses looking to extend their business into this region.

- Double Taxation Agreements (DTAs): The UAE has entered into multiple double taxation treaties with most countries of the world so that the profits of a firm should not be taxed twice in two separate jurisdictions. It strives to facilitate international trade and investment while lessening the tax burden on different businesses from varying countries. To navigate these treaties effectively, many companies rely on expert Corporate Tax services in UAE for guidance and compliance. The UAE has entered into multiple double-taxation agreements with most countries of the world so that the earnings of a company need not be taxed twice in two different jurisdictions. It tries to enable international trade and investment while reducing the tax burden on various businesses across different countries

- Transfer Pricing Guidelines : The UAE follows international transfer pricing guidelines that govern cross-border transactions across related entities and ensure that cross-border transactions between related entities are fairly taxed. Business entities must have documentation and maintain arm's length principles to prevent tax authorities from adjusting their records.

These provisions do not only contribute to the general easing of the tax burden placed on business entities, but they also maintain the UAE's competitiveness in the global economy thereby making it attractive for more business to set up their operations in the country.

UAE Corporate Tax Scope

Corporate Tax (CT) will applicable to:

- All businesses and individuals operating under a commercial license in the UAE.

- Free Zone Businesses (The UAE CT regime will continue to honor the current CT incentives for free zone businesses that adhere to all regulatory requirements and solely operate within the UAE's free zones).

- Foreign entities and individuals only if they conduct trade or business in the UAE on an ongoing or regular basis.

- Banking operations.

- Businesses engaged in real estate management, construction, development, agency, and brokerage activities.

Government Entities and Regulatory Framework

The legal requirements governing corporate tax in the UAE are a set of coordinated relations between major government bodies and components, which effectively regulate the implementation, management, and compliance with the tax legislation. These entities include:

Ministry of Finance: The MoF has major responsibility for creating new policies and putting into practice the corporate tax system in the UAE. It also confirms that these policies conform with the global trends, for example, OECD standards while preserving its economic profile. The ministry offers political leadership, framework, constructive instructions, and legislative backing to help various companies develop and integrate proper tax awareness.

Federal Tax Authority : The FTA manages the day-to-day administration of taxes. Some of the functions of tax administration include tax registration, collection, enforcement, and auditing. Through the FTA, digital systems and services are provided, for instance, the EmaraTax system to enable businesses to make and process taxes within the country easily.

Federal Decree-Law No. 47 of 2022: Federal Decree-Law No. 47 of 2022 lays down Corporate Tax in UAE for the financial year that begins on or after June 1, 2023. It applies to any commercial entity and organizations gaining taxable income in the UAE, though some exceptions are given to compound entities such as government entities, investment funds, and public benefit organizations.

Under this law, taxable income is taxed as follows:

- 0% income tax for income up to AED 375,000, which is more supportive of small enterprises and startups.

- 9% tax for more than AED 375,000 income.

The law is administered through the Federal Tax Authority (FTA) which supervises tax registration, submission as well as collection. Companies have to adhere to legal requirements; make their accounts balanced, and submit their accounts and taxes on an annual basis. Amendments, such as Decree Law 60, made in the year 2023, are often meant to elaborate on the earlier provisions to facilitate better compliance or to bring them by the international tax rules.

- Free Zone Authorities: These authorities make sure that only those companies within the free zone areas meet the exact standards and conditions of the tax incentives provided to the free zones. Although there is a certain amount of exemptions for the free zones, there are certain qualifying conditions that need to be fulfilled in order to maintain the 0% tax rate on corporate income.

The regulatory framework of corporate tax in the UAE should weigh up on transparency, competitiveness, and ease of doing business for any corporation to grow economically while meeting international tax standards such as the Base Erosion and Profit Shifting (BEPS) framework

Key Steps for Complying with UAE Corporate Tax Laws

Companies registered in the UAE should therefore ensure that their corporate tax regulations are aligned to avoid penalties, remain in good standing, and benefit from any tax relief or incentives. The following are the specifics regarding compliance and procedural requirements:

- Corporate Tax Registration : All business owners must register with the FTA for corporate tax within a statutory timeframe. Failure to comply before the deadline will cost a business a penalty amounting to AED 10,000 in 2024. In any case, apply for your registration as early as possible to prevent infringement.

- Filing Corporate Tax Returns : Upon registration, firms are expected to submit their tax return each year, indicating profits and taxation liabilities. The time for filing tax returns depends on the financial year.

- Maintaining accurate records: Businesses should keep detailed financial books and other supporting documents so that financials are transparent and can be taxed accordingly. This avoids issues at the time of tax audit

- Transfer Pricing Compliance: Companies operating transactions involving more than one border have to adhere to international transfer pricing guidelines. This means that companies need to abide by arm's length principles while engaging in intercompany transactions.

- Penalties for Non-Compliance : In the UAE, penalties will be imposed for late registration, late filing of returns, or any other form of non-compliance. Businesses that fail to comply with the corporate tax law will face huge fines.

- Corporate Tax Audits: The FTA may undertake audits for corporate tax compliance. Businesses will be required to present themselves during the audit and maintain proper records.

- Tax Deregistration : In some instances, companies deregister from corporation tax. This happens, for example when a company stops its operations or its tax status changes

- Best Practices for Compliance : To be compliant, businesses must constantly review financial records, adhere to deadlines, and consult professional services if need be. It will not help to keep up with any changes in tax regulations, but it can save on mistakes that cost money.

Exemptions and Taxable Elements

The UAE Corporate Tax system separates income and entities into two groups - that are exempt from taxation and those that are subject to Corporate Tax. This separation helps businesses in the UAE follow tax rules correctly.

Exempt Income & Entities

Certain income categories and specific entities are exempt from UAE Corporate Tax. This exemption simplifies the tax filing process for these entities and supports specific economic activities within the UAE.

Income categories not subjected to UAE Corporate Tax

Examples:

- Dividends received from qualifying subsidiaries

- Capital gains on disposal of assets

- Public grants * Reinvested export income (conditions apply)

Exempt Entities

Entities not required to pay UAE Corporate Tax

Examples:

- UAE federal and local governments

- Public charitable institutions

- Pension funds

- Natural resources companies subject to Emirate-level taxes

Taxable Income & Entities:

All other business income and most business entities operating in the UAE fall under the taxable category. Knowing what counts as taxable income and which entities must pay corporate tax is important for businesses to correctly figure out how much tax they need to pay.

Taxable Income

Income subject to UAE Corporate Tax after accounting for allowable deductions

- Net profit from core business activities

- Rental income from property

- Interest income

- Royalties

- Gains on disposal of depreciable assets

Taxable Entities

Entities required to pay corporate tax on their taxable income.

- Mainland businesses (excluding exempt entities)

- Free Zone companies (unless they qualify as a Qualifying Free Zone Person)

- Branch offices of foreign companies

UAE Corporate Tax - Tax Groups

According to Article 40 of the Corporate Tax Law , a Tax Group consists of two or more taxable persons who are classified as a single taxable person in the UAE. Corporate Tax Group is different from VAT Tax Group.

UAE group entities can form a tax group if certain conditions are met.

- The parent company must be a UAE tax resident and must directly or indirectly hold at least 95% of the share capital, voting rights, and profits and net assets.

- All entities in the group must have the same financial year and use the same accounting standards.

- Also, neither the parent company nor the subsidiary can be an exempt person or a QFZP.

- When a tax group is formed, the parent company will handle the administration, such as submitting a single tax return and settling the tax liability for the entire tax group.

Transfer Pricing Regulations

Corporate Tax Transfer Pricing is the process of setting prices for transactions between related entities within a multinational corporation. This practice ensures that goods, services, and intellectual property are exchanged at market rates, adhering to the arm's length principle. Proper transfer pricing is essential for accurately allocating profits across different tax jurisdictions, preventing tax evasion, and ensuring fair taxation. Regulations and documentation requirements help maintain transparency and compliance with both international and local tax laws.

Corporate Tax Deductions and Expenditures

Expenses that are entirely and solely incurred for business purposes in the UAE and are not capital in nature are usually tax deductible. UAE Corporate Tax limits the deductibility of specific expenses. The intention is to guarantee that the relief can exclusively be claimed for expenses related to the generation of taxable income and to counteract potential instances of misuse or exaggerated deductions.

General Interest Deduction Limitation Rule:

- 30% EBITDA Cap: Companies are allowed to write off up to 30% of their EBITDA (earnings before interest, taxes, depreciation, and amortization).

- Excess Interest: If interest exceeds earning, before calculating the EBITDA limit, extra interest expenses might be deducted from total earnings.

- Exempt Income: Exempt forms of income are not subject to this provision.

- Net Interest Expenditure: Computed as the difference between interest expenses and interest earned, including interest that has been carried over from prior periods.

- Threshold: Net interest expenditure is not considered exempt if it falls below a specific threshold.

- Carry Forward: Net interest expenses that are disallowed may be carried forward and written down over the course of the following ten tax years.

- Exempt Entities: These rules do not apply to insurance companies, banks, or certain other specific businesses.

Specific Interest Deduction Limitation Rule:

Related Party Loans

- Dividends/Profit Distribution: Interest paid on loans used to distribute earnings to a related entity or pay dividends is not deductible.

- Share Capital Transactions: Interest paid on loans to affiliated parties for share capital reduction or return is not deductible.

- Business Ownership Acquisition: Interest paid on loans taken out from family members for acquiring business ownership stakes is not deductible. (Exceptions: These interest deductions might be allowed if the loan wasn't taken out to take advantage of tax breaks or if the lender pays a substantial corporate tax.)

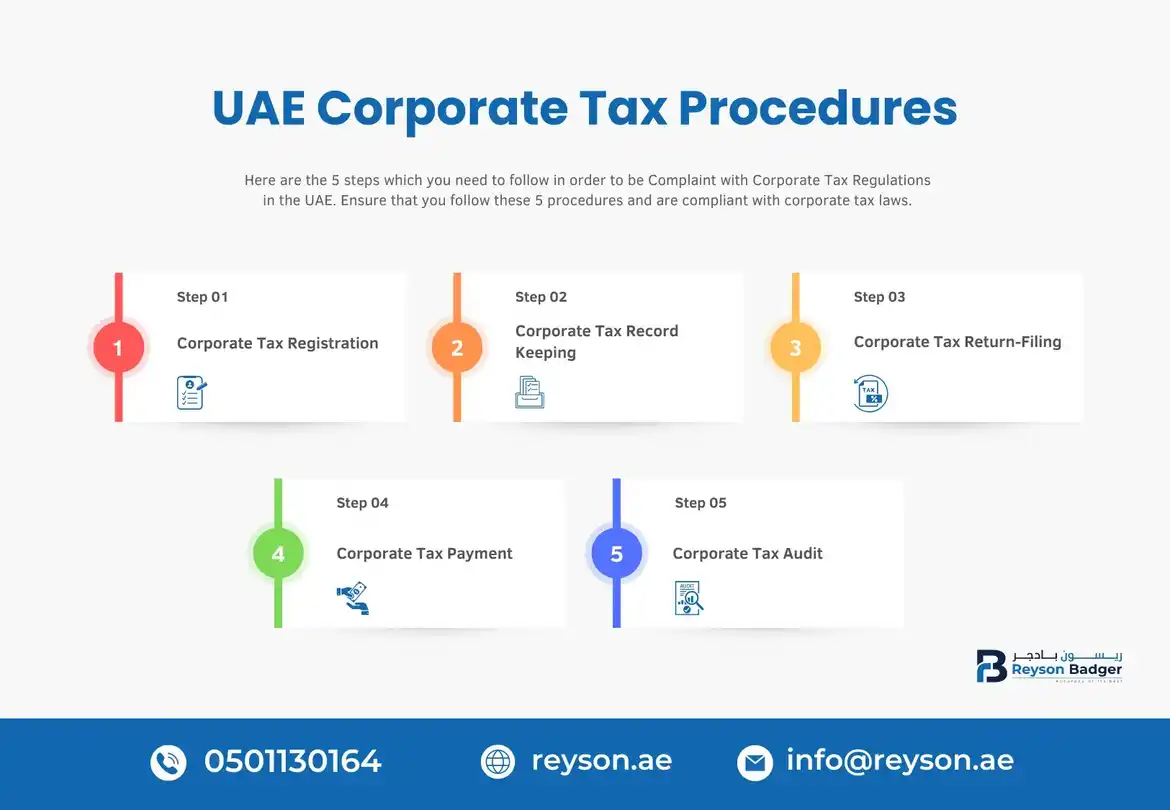

UAE Corporate Tax Procedures

Several procedures must be followed for businesses to comply with the UAE Corporate Tax regime. Here's a breakdown of the key steps.

Registration

- Every business in the UAE must register for the UAE Corporate Tax with the Federal Tax Authority (FTA). (Exemptions are there for some businesses falling under specific categories.)

- The registration process involves submitting necessary documents and obtaining a Tax Registration Number (TRN).

Record-Keeping

- To file Corporate Tax Returns, businesses must maintain accurate and clear financial records.

- For tax calculation purposes, these records should contain documentation of all income and expense transactions.

Return Filing

- Businesses must file their corporate tax returns electronically with the FTA by the stipulated due date (typically nine months following the end of the financial year).

- It is important that the tax return accurately reflects taxable income, deductions, and the tax liability calculated.

Tax Payment

Any corporate tax payable based on the filed return must be settled within the prescribed time frame (usually within the same timeframe as return filing).

Potential Audits

- The FTA may select companies for audits to verify compliance with tax regulations.

- Businesses should be prepared to present necessary documentation and address any auditor inquiries during the audit process.

Corporate Tax Losses

A tax loss occurs when a business's expenses or allowable deductions surpass its revenue in a given tax year, leading to a net loss as per the Corporate Tax Law. This loss can be used to offset future taxable income, referred to as carry-forward tax losses.

Corporate Tax Calculation

Calculating corporate tax in the UAE involves several key steps and considerations. Here’s an overview of the process:

Determine Taxable Income

Start by calculating the company's taxable income for the financial year. This involves subtracting allowable deductions and expenses from the total revenue earned during the period.

Applying Deductions

The UAE corporate tax system allows for various deductions that can reduce your taxable income. These include

- Business expenses (rent, salaries, utilities)

- Depreciation on assets

- Interest on business loans

Apply Tax Rate

The UAE applies a tiered corporate tax rate structure:

- A 0% tax rate is applied to taxable income up to AED 375,000.

- A 9% tax rate applies to taxable income exceeding AED 375,000.

- Multinational corporations subject to OECD BEPS 2.0 regulations face a 15% tax rate on global revenues exceeding AED 3.15 billion.

Calculate Tax Liability

Multiply the applicable tax rate by the taxable income to determine the corporate tax liability.

Taxable Income (above AED 375,000) x 9% = Corporate Tax

Consider Tax Credits and Incentives

Evaluate any available tax credits or incentives that may reduce the overall tax liability. These could include incentives for specific industries or activities.

Prepare and Submit Tax Returns

Complete corporate tax returns accurately and on time, detailing the calculated tax liability. Submit these returns through the EmaraTax platform or as per regulatory requirements.

Payment of Taxes

Ensure timely payment of the calculated tax liability to the Federal Tax Authority (FTA) within the stipulated deadlines to avoid penalties and interest charges.

Compliance and Reporting

Maintain compliance with UAE tax laws and regulations, including record-keeping requirements and responding to any tax audits or inquiries from the FTA.

Corporate Tax Experts in UAE

Reyson Badger offers expert corporate tax services with a team of highly qualified professionals. Our team is well-versed in UAE tax laws, ensuring compliance and providing effective corporate tax solutions. We have a strong track record of successfully handling complex tax issues, earning the trust of our clients. Our personalized consultations and tailored tax advice cater to each client's specific needs and business goals. Additionally, our multilingual support helps clients from diverse backgrounds understand and manage their tax obligations.

We stay updated on tax regulations to advise clients on compliance and tax incentives. Our client-focused approach prioritizes smooth and hassle-free tax services. We provide expert advice and personalized solutions for businesses to achieve the best tax outcomes and free them to focus on growth.

Corporate Tax Advisory Services in UAE

At Reyson Badger, we recognize that every business has unique tax challenges and operational goals. That’s why our corporate tax advisory services are customized to meet the specific needs of each client, ensuring compliance with UAE tax regulations while optimizing tax efficiency. For more details, visit our blog on corporate tax advisory services.

Our experienced corporate tax consultants in UAE assist clients with key services, including Corporate Tax Registration, Filing Tax Returns, and providing up-to-date guidance on the latest regulations from the Federal Tax Authority (FTA). We help businesses navigate the complexities of the tax landscape and avoid potential fines and penalties.

Learn more in detail here: Corporate Tax Advisory Services

With a reputation for delivering exceptional service and strategic tax solutions, Reyson Badger is the preferred choice for Corporate Tax Services in the UAE. Contact us today for expert advice or visit our office for comprehensive support.

Latest Blogs

UAE to Become Global Capital of Entrepreneurship – What it Means for Company Formation?

UAE's vision to be global entrepreneurship hub fosters innovation, attracts investors, and creates vast opportunities for seamless company formation.

READ MORE →

Who Are the Taxable Persons for Corporate Tax in the UAE?

Taxable persons for UAE Corporate Tax include mainland companies, free zone entities, and individuals conducting licensed business activities.

READ MORE →

Net Worth Certificate for UAE Visas: Investor, Family, Student & Golden Visa Requirements

READ MORE →

The Complete Guide to Ultimate Beneficial Owner Verification in the UAE

A complete guide to Ultimate Beneficial Owner rules in the UAE, UBO verification steps, compliance requirements, and how expert support can help businesses avoid penalties.

READ MORE →

Accrual Accounting vs Cash Basis Accounting: Which Is Right for Your Business?

Accounting Companies in Dubai ensures that your accounting method aligns with UAE regulations and business goals.

READ MORE →

Understanding Article 3: A Guide to Calculating Excise Tax and VAT in the UAE

This blog provides a clear guide to understanding Article 3 and how it affects the calculation of excise tax and VAT in the UAE. It explains the applicable tax rules, computation methods, and compliance considerations businesses must follow to ensure accurate tax reporting and regulatory adherence.

READ MORE →

How to Get a Net Worth Certificate in Abu Dhabi & Sharjah from a Licensed Auditor?

Learn how to obtain a Net Worth Certificate in Abu Dhabi and Sharjah, including required documents, processing time, costs, and why certification by a licensed UAE auditor is essential for visas, bank loans, and business purposes.

READ MORE →

UAE Audit Requirements 2026 – A Complete Compliance Guide

A clear overview of UAE audit requirements in 2026, covering compliance obligations, regulatory updates, and key reporting standards for businesses.

READ MORE →

The Sugar Shift: A Business Guide to the UAE’s New 2026 Tiered Excise Tax

The UAE’s new 2026 tiered excise tax introduces a structured approach to taxing sugar-sweetened beverages based on sugar content. This guide explains how the updated excise framework affects manufacturers, importers, and distributors, outlining compliance requirements, financial implications, and practical steps businesses must take to stay prepared.

READ MORE →

Financial Strength Certificate vs Net Worth Certificate - What You Need to Know

Understand the key differences between a Financial Strength Certificate and a Net Worth Certificate in the UAE. Learn which document authorities require and how professionally prepared certification from Reyson Badger can help ensure faster, compliant approvals.

READ MORE → The Federal Tax Authority (FTA) has announced that businesses must complete Corporate Tax registration within 90 days from the Date of Incorporation / MOA.

The Federal Tax Authority (FTA) has announced that businesses must complete Corporate Tax registration within 90 days from the Date of Incorporation / MOA.