In accordance with the recent amendments to the Corporate Tax Law in the United Arab Emirates (UAE), effective as of 2024, Reyson Badger reiterates its commitment to offering professional and specialized corporate tax registration services in UAE. Ensuring that our clients comply with the proper requirements and regulations of the UAE government remains at the heart of our primary objective. According to the latest update on February 28, 2024, starting from 1st March 2024, the Federal Tax Authority has imposed a fine of AED 10,000 on companies not registered for UAE Corporate Tax.

The MoF announced in January 2022 that they would bring in Corporate Tax on the business's net profit. Following that, the corporate tax came into effect on 1 June 2023 and 1 January 2024, depending on the financial year of the respective businesses. As soon as the Corporate Tax was announced, most of the auditors and Audit Firms in Dubai came up with Corporate Tax Registration Services in Dubai. The UAE Government has strictly followed the best rules and regulations that have been put out by OECD(Organisation for Economic Co-operation and Development).

Corporate Tax was implemented in the UAE to solidify the UAE's position as a hub for international trade and investment, as well as to facilitate the UAE's development to meet its long-term vision.

Juridical Persons in the UAE, foreign juridical persons managed and controlled in the UAE, Foreign Juridical Persons who operate through permanent establishments in the UAE or with a taxable nexus in the UAE, and natural persons engaged in a Business Activity must register for Corporate Tax in the UAE.

A natural person who has taxable income greater than AED 375,000 is subject to a 9% tax rate. A natural person whose taxable income is less than 375,000 would be exempt from paying any taxes.

Upon completing the corporate tax registration in Dubai, the registered person/entity will receive a Tax Registration Number once the Corporate Tax has been registered. Tax returns for a tax period should be filed within nine months of the effective end date of the period. As specified by the Minister, some cases excluded from corporate tax must be filed separately with the Federal Tax Authority.

Who Needs to Register for Corporate Tax in the UAE?

All taxable persons are required to register for UAE Corporate Tax and obtain a Corporate Tax Registration Number as per the UAE Corporate Tax law, even if their taxable income is below the threshold.

Any business incorporated in the UAE on the mainland or in a free zone has to register for corporate tax if it conducts business. Depending on the nature of the business, there are also opportunities for exemptions.

Entities with revenues falling into prescribed revenue thresholds must register for corporate tax.

Free zone entities with tax incentives, too, are to be registered and declare income to remain compliant.

Foreign bodies with a fixed presence, with branches or long-term contracts in the UAE, must register for corporate tax.

Bodies such as governmental agencies or qualifying public benefit organizations may be required to register to evidence their exemption status.

6. Individual Freelancers

Some freelancers or self-employed individuals with business earnings over the statutory threshold might also need to register.

Who is Exempt from Corporate Tax?

In the UAE, certain entities and individuals are exempt from Corporate Tax under specific conditions. However, even if an entity is exempt, it may still need to register with the Federal Tax Authority (FTA) and comply with certain administrative requirements. The following entities are generally exempt from Corporate Tax in the UAE:

These are the fundamental paperwork requirements for the registration procedure. However, there can be further requirements or actions necessary based on the company's specific structure or if you are a foreign company.

Click here to learn the essential documents for Corporate Tax Registration in UAE.

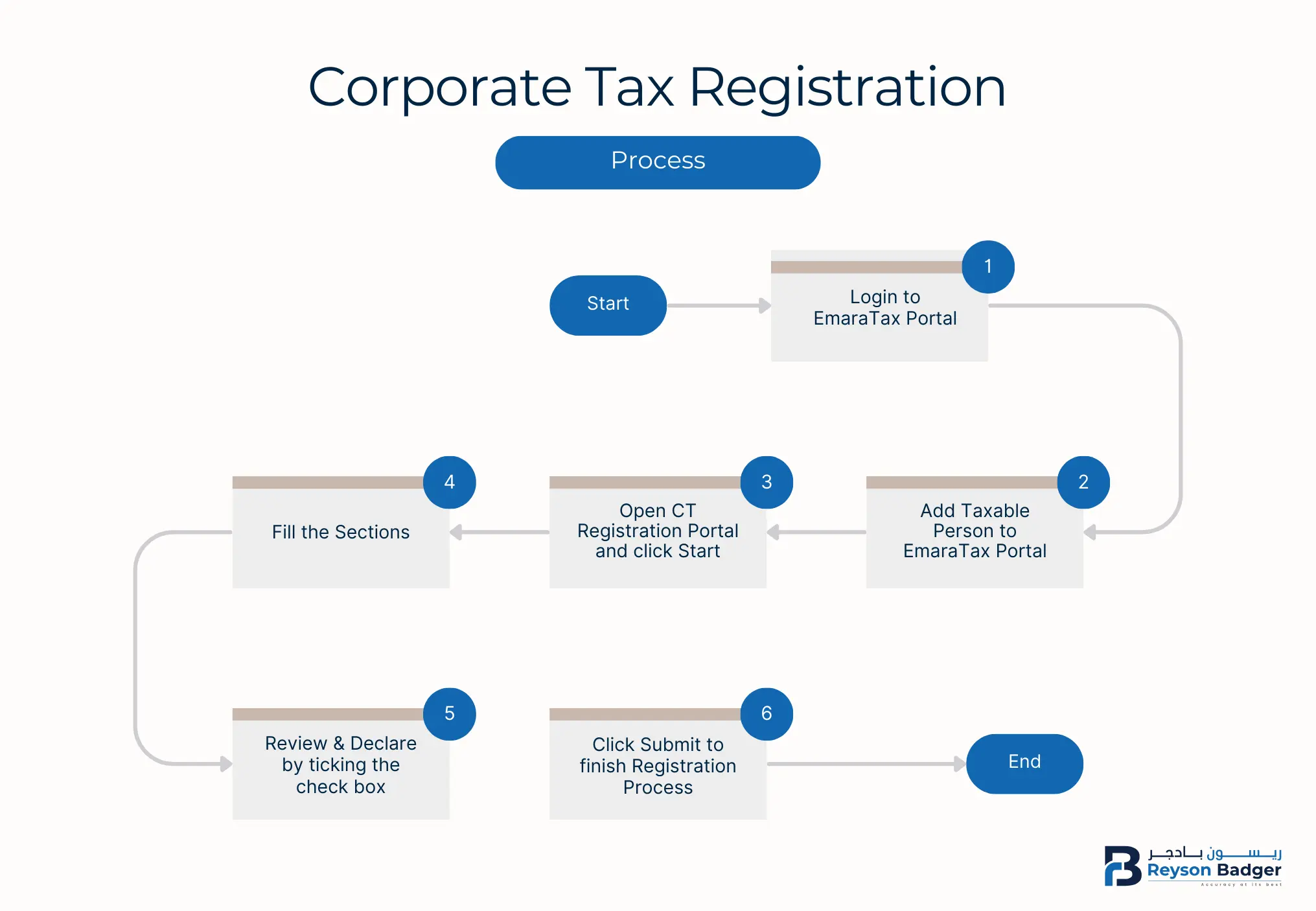

Corporate Tax is registered through the Emara Tax Portal of the FTA. EmaraTax is an easy-to-use online portal that can be used to register for taxes, make VAT payments, comply with regulations, file returns, and de-register. The user may create a new account or login with their existing account if they already have one. It is highly likely that you already have an account if you have already registered for VAT. It is also possible to access the portal via the UAE Pass if you do not have an FTA account.

Corporate tax registration services in Dubai can be conveniently completed through the Emara Tax Portal

The process of logging into the EmaraTax portal, registering information, and obtaining the Corporate Tax registration number is simple. It is very easy to register, and if you have any issues regarding the registration process, please do not hesitate to contact Reyson Badger. Let's discuss every step in detail:

Step 1: Log in to EmaraTax, the online tax portal operated by the Federal Tax Authority. You may use your login credentials or the UAE Pass to accomplish this. Alternatively, if you do not have an EmaraTax Account, you may create one by clicking Sign Up, or if you have forgotten your password, click Forget Password. If you prefer, you may log in via UAE Pass, which will take you to the UAE Pass Page and then to the Corporate Tax Dashboard.

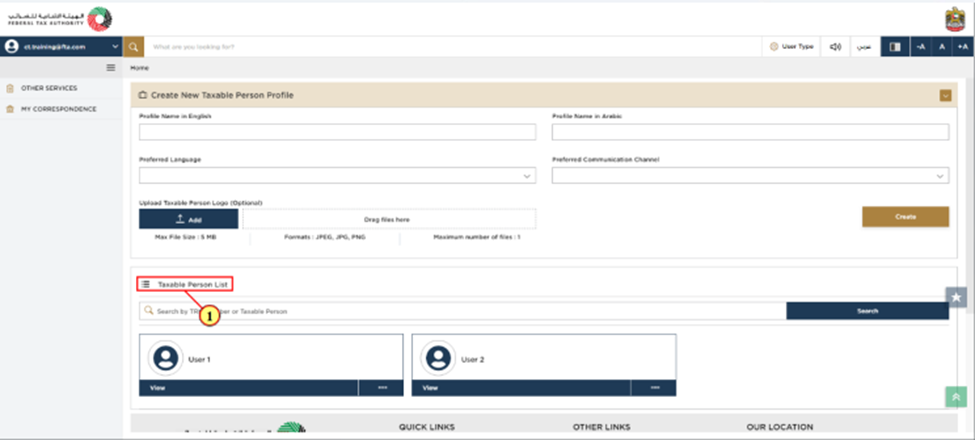

Step 2: It is important to verify whether any taxable persons are linked to your EmaraTax profile. If there is no taxable person associated with your account, you will need to add one. To create a new taxable person, please enter the required details and click Create. Once you have created one, the taxable person can be viewed on the list.

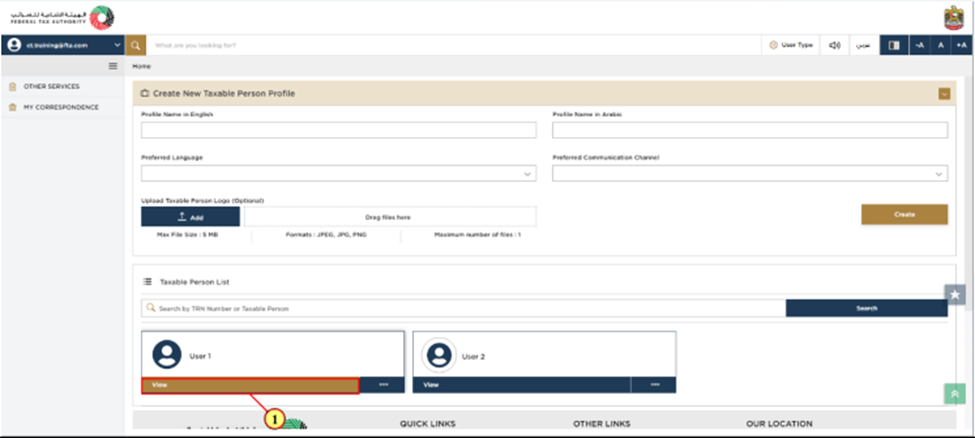

Step 3: Check the taxable person, and click view to open the Corporate Tax Dashboard.

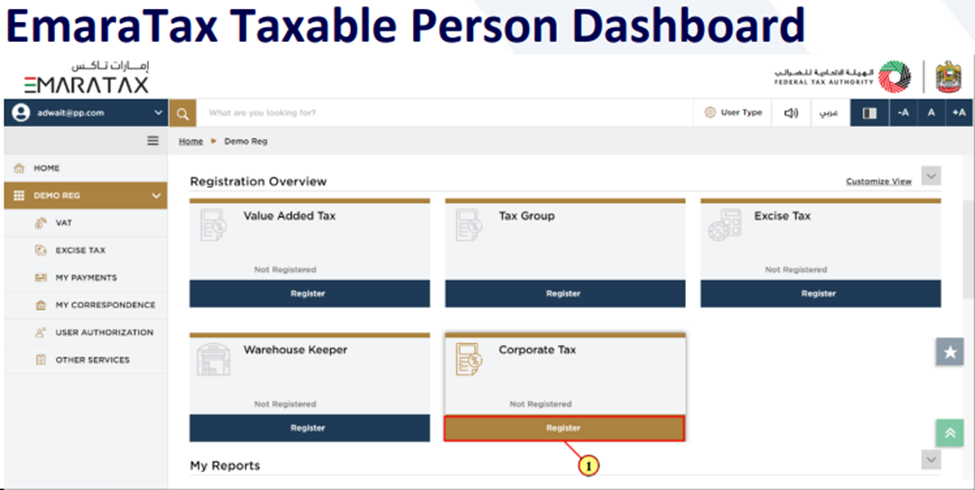

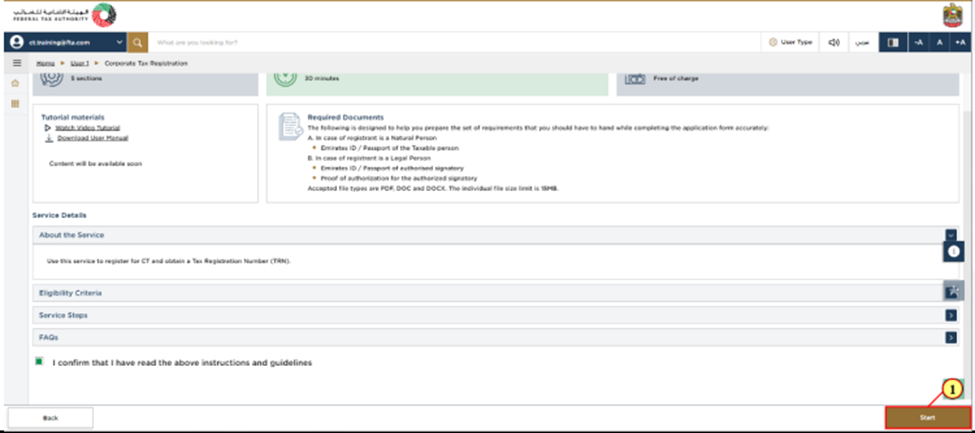

Step 4: The Corporate Tax Registration in UAE Dashboard is now visible to you. To begin the Corporate Tax Registration process, click Register on the Corporate Tax tile. As soon as you click Register, you will see the instructions and guidelines for the Corporate Tax Registration process. Please read the instructions carefully and tick the check box.

Step 5: Click Start to begin the Corporate Tax Registration Process.

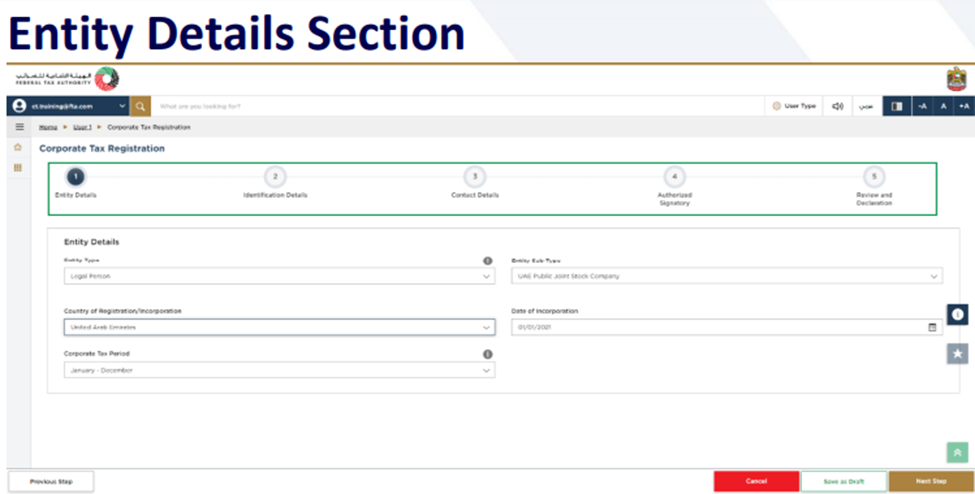

There are five sections in the registration application. As can be seen in the image below, it represents a progress column. The section that you are currently in would be indicated in blue. By the time you reach the next section, the completed section would be represented in green. The mandatory fields of the present section must be completed in order to move from one section to another (except for the optional fields). In order to avoid rejection of your application, please ensure that all documents you submit cross-verify the information you entered in the application.

Step 6: You may select your firm's entity type under the Entity Details Section. It is important to note that all input fields vary depending on the entity you choose.

Note: By clicking "Save as Draft", you can save the information you entered and return later to complete the Corporate Tax Registration Process. Alternatively, you may click "Cancel" to cancel the registration process.

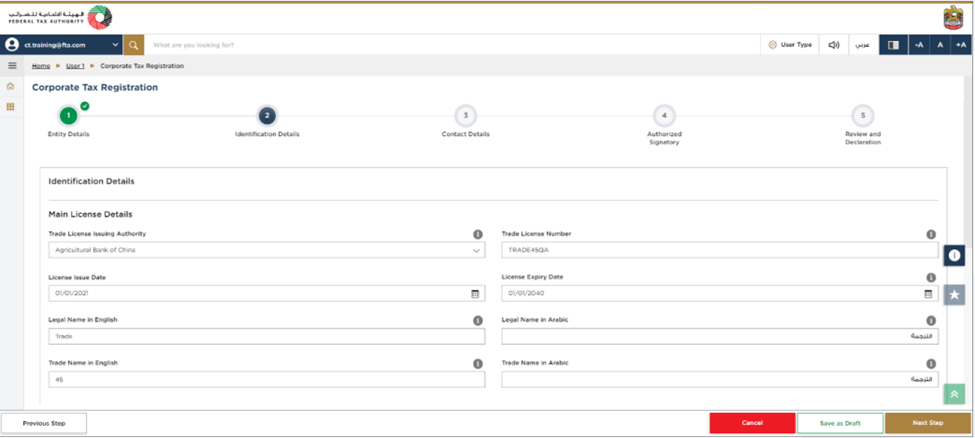

Step 7: As soon as you have completed all the required fields on the "Entity Section", click "Next Step" to proceed to the "Identification Details" section. In the Identification Section, you are required to enter the details of the "Trade License" according to the selected entity.

Trade License is not applicable for the following Entity Subtypes.

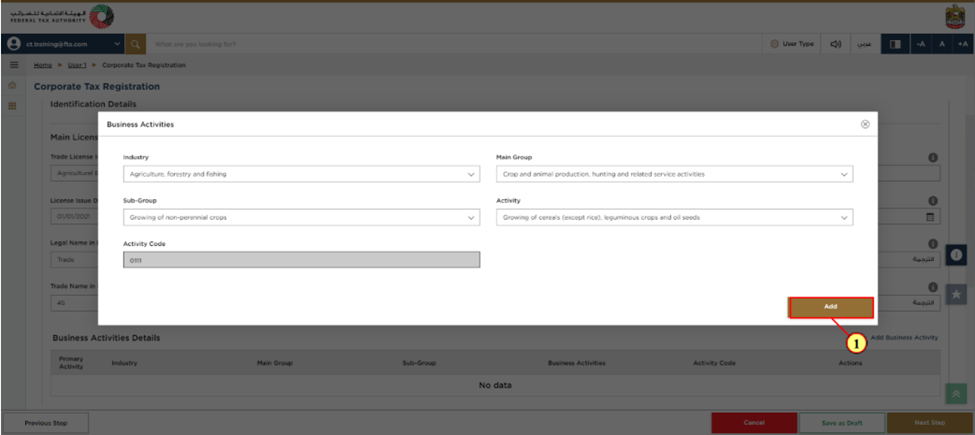

Step 8: Add all the business activities involved within the Trade License by clicking "Business Activity".

Step 9: Click "Add" after entering all of the required "Business Activity" information. There will be an Activity Code displayed on the screen.

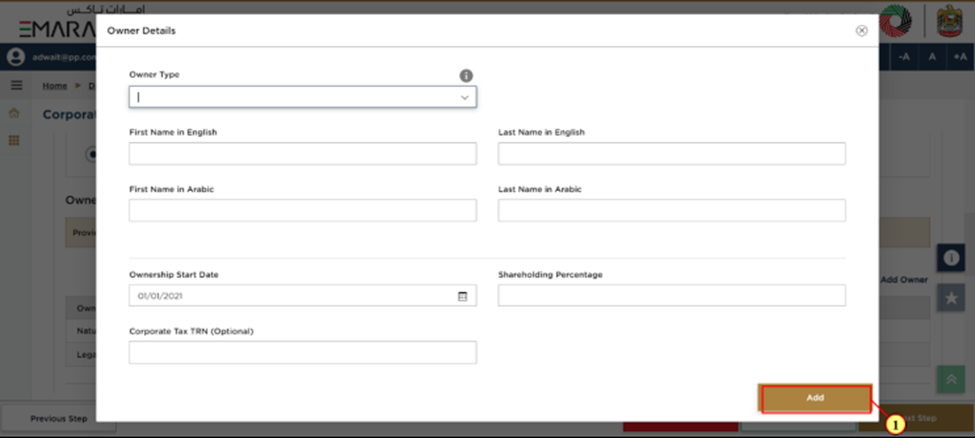

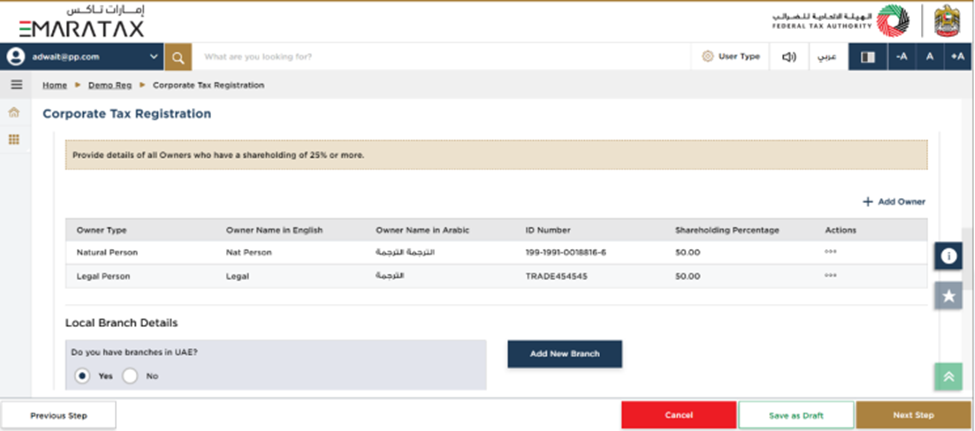

Step 10: You can enter all the owners associated with the Trade License by clicking on "Add Owners". Enter the required information about the owner and click "Add". (The owner may be a natural person or a legal person).

Step 11: Click "Yes" if you have "one or more" branches in the UAE. Enter the "Trade License Details", the "Business Activities", and the "List of Owners" for each branch.

Note: It is intended that the registration will be made in the name of the "Head Office" meeting the selected criteria. In spite of the fact that the branches are located in more than one Emirate, only one Corporate Tax Registration is required.

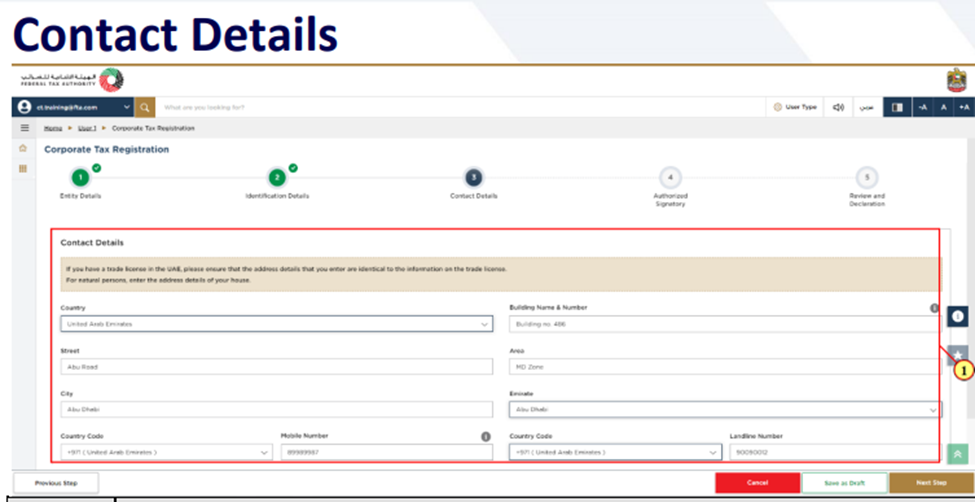

Step 12: After entering the necessary details click on “Next Step” and move-on to the Contact-Details Section.

Step 13: Enter the details of the registered address of the business.

Note: Do not include the address of another business or individual (such as your accountant's address). In the case of multiple addresses, include the address where your day-to-day activities are performed.

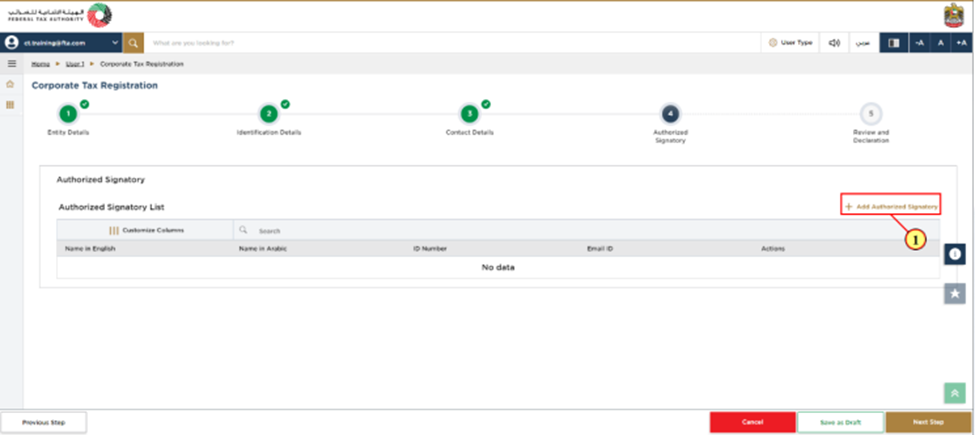

Step 14: Click on "Next Step" once you have entered all the required details to proceed to the "Authorized Signatory" section.

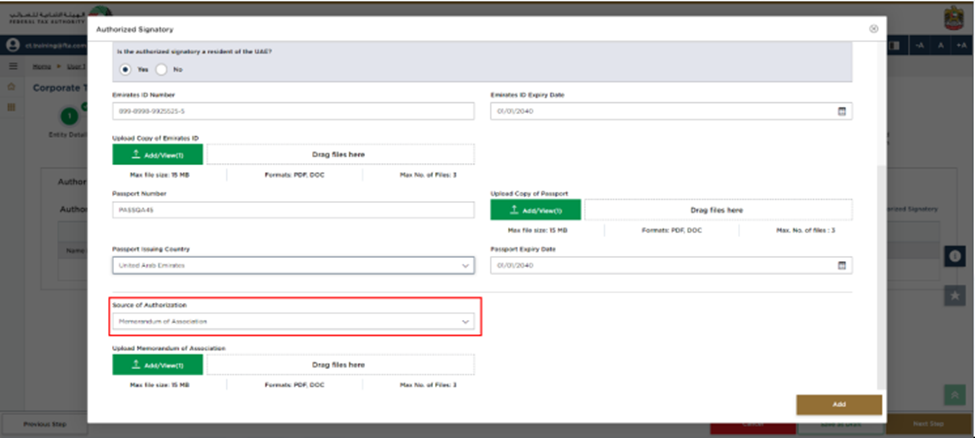

Step 15: By clicking "Add Authorized Signatory", you can enter the details of the authorized signatory. If necessary, you may add one or more authorized signatories.

If a legal person is involved, a "Power of Attorney" or a “Memorandum of Association” may be required as a source of authorization.

Step 16: Once the authorized details have been entered, select "Add".

Step 17: To proceed to the "Review and Declaration" section, select "Next Step" after filling out the necessary information. In this section, you will review and declare all the information that you entered throughout the application.

Step 18: Once the application has been reviewed, tick the checkbox to declare it

Step 19: To proceed with the Corporate Tax Registration Application, select "Submit".

Once your application has been registered, the Federal Tax Authority (FTA) issues a Tax Registration Number (TRN). Please note this reference number in case you need to communicate with the FTA in the future.

Following the submission of an application, FTA will approve, reject, or request resubmission of all necessary information and subsequently inform the applicant.

Learn the steps for UAE corporate tax registration in this guide

UAE Resident Legal Persons (Companies and Juridical Entities)

Non-Resident Legal Persons

Natural Persons (Individuals Conducting Business Activities)

The United Arab Emirates' Federal Tax Authority (FTA) has set the corporate tax registration last date as March 31, 2025, for natural persons conducting business activities within the UAE to register for Corporate Tax.

In February 2024, the Ministry of Finance (MoF) issued Cabinet Decision No. 10 of 2024, which published an adjustment to the Violations and Penalties concerning the terms of Cabinet Decision No. 75 of 2023 on the administrative penalties for violations of the application of Federal Decree-Law No. 47 of 2022. According to Cabinet Decision No. 10 of 2024, the Corporate Tax Registration Penalties will take effect on March 1, 2024.

Businesses that do to comply with the Corporate Tax Registration in the UAE will face an AED 10,000 penalty from March 1, 2024. For businesses with tax periods in January or February, registration must be completed by May 31, 2024. This would be the first tax period undergoing the registration process, and subsequently will be followed by other dates.

Learn more about the penalties for not completing corporate tax registration in the UAE

Expert Corporate Tax Registration Services in UAE

Get expert guidance and support from Reyson Badger. Our team of seasoned professionals will help you navigate the complexities of Corporate Tax registration, ensuring you avoid penalties and focus on growing your business. Don't miss the deadline! Register for Corporate Tax today and secure your business's future. Get in touch with us to learn more about our Corporate Tax registration services, and let us handle the complexities for you. Register now and ensure compliance with confidence!

How many days does it take for registration after applying?

Registration typically takes 5-10 working days after applying, but may vary depending on the Federal Tax Authority's (FTA) processing time.

How can I correct the name of the company in the corporate tax registration certificate if I had entered the name of the company incorrectly?

Contact the FTA directly to request a correction. You'll need to provide documentation supporting the correct company name.

How to register corporate tax for Group TRN?

Registering for a Group TRN requires a single application covering all group members. Consult the FTA website or a tax advisor for detailed instructions.

What if my company is an online business and not VAT registered?

Follow the same registration process, but ensure you provide the required documents and information for online businesses

How to get a Certificate of Incorporation?

Obtain the Certificate of Incorporation from the relevant UAE authority where your company was incorporated (e.g., Department of Economic Development).

Is the Certificate of Incorporation and MOA the same?

No, they are not the same. The Certificate of Incorporation confirms the company's existence, while the MOA outlines the company's structure and operations.

If we don't have a Certificate of Incorporation, can we put the date mentioned on MOA as the incorporation date?

No, use the first trade license issuance date as the incorporation date if you don't have a Certificate of Incorporation.

At the beginning, should it be the person's name or the company name?

If you have not yet created an account on Emara tax, it means you are not registered on the Emara tax portal. Once you have entered the portal, you will begin by providing your personal information. Subsequently, in both cases - when creating a taxable person or during the registration process - you will be prompted to enter the company details.

What are the Steps After Receiving the Welcome Guide for Corporate Tax Registration?

I have a professional license for a sole establishment with 100% ownership in Dubai mainland, created on March 4, 2024. I haven't registered for corporate tax yet. Do I need to register?

Yes, it is recommended to register for corporate tax as soon as possible, even if you're not actively operating or don't have a physical office location.

Why do I need to register if I'm not operating?

The UAE's Corporate Tax law requires all businesses, including inactive ones, to register and file tax returns. Failure to register may incur penalties and fines.

What if I don't have an office location?

Having an office location is not a requirement for corporate tax registration. Even if you do not have a physical presence, you can register and comply with tax requirements.

What are the consequences of not registering?

Non-registration may lead to:

How to choose a corporate tax period in the UAE?

To choose a corporate tax period in the UAE, follow these steps:

1. Understand the UAE's corporate tax law: Familiarize yourself with the UAE's corporate tax regulations and requirements.

2. Determine your company's financial year-end: Choose a financial year-end date that aligns with your company's business cycle and industry practices.

3. Consider the following options:

4. Align with group company or parent company: If applicable, align your financial year-end with theirs for simplified reporting and compliance.

5. Consult with a tax professional: Seek advice from a tax expert to ensure your chosen tax period complies with UAE regulations and suits your company's specific needs.

6. Notify the Federal Tax Authority (FTA): Once chosen, notify the FTA and ensure you meet all necessary reporting and filing requirements.

What are the benefits of choosing a calendar year as the corporate tax period?

Choosing a calendar year (January 1 to December 31) simplifies tax compliance and aligns with international financial reporting standards.

Can I change my corporate tax period later?

Yes, but you must notify the FTA and obtain approval. It's recommended to consult a tax professional before making any changes.

Are there any exemptions from corporate tax in the UAE?

Yes, certain entities are exempt from corporate tax in the UAE. These include government entities, government-controlled entities, extractive businesses (oil and gas companies), and non-extractive natural resource businesses, provided they meet specific conditions. You can learn more about it here.

Can businesses claim deductions under the UAE corporate tax system?

Yes, businesses can claim deductions for certain expenses, including:

Here are the other Corporate Tax Services in UAE Reyson Badger Offers: