Corporate Tax services is a recent introduction in the UAE, making Corporate Tax Services essential for businesses to ensure compliance and avoid potential penalties imposed by the FTA. Reyson Badger is the #1 provider of professional Corporate Tax Services in the UAE. We offer an extensive range of services, covering everything from Corporate Tax Registration to foolproof Compliance Management. Our team possesses the proficiency to customize our services to precisely match your specifications.

Reyson Badger offers the following Corporate Tax Services in UAE.

Corporate Tax Registration is the first official process of complying with the Corporate Tax Law in UAE. The Registration Process is done through the EmaraTax Portal of the FTA. UAE Corporate Tax Registration is required for juridical persons operating in the UAE, foreign juridical persons managed and controlled in the UAE, Foreign Juridical Persons operating through permanent establishments in the country or having a taxable nexus in the UAE, and natural persons conducting business in the UAE.

Failure to register for UAE Corporate Tax will result in a penalty of AED 10,000.

If the violation is repeated within 24 months of the last violation, a penalty of AED 20,000 will be imposed.

Following are the major documents required for corporate tax services in Dubai.

The UAE Corporate Tax (CT) deadlines vary depending on the month of business license issuance. Here are the deadlines:

Also, consider the following scenarios:

Corporate tax return filing involves the meticulous preparation and timely submission of the corporate tax returns for a business to the Federal Tax Authority. It is important for the business to comply with Corporate Tax regulations. This means accurately reporting income, expenses, and other financial information to the FTA. It's important to file corporate taxes accurately to avoid penalties, stay legal, and protect the financial health of the business. It may require detailed paperwork and help from tax experts like Reyson Badger to understand the tax rules and regulations.

The deadline for filing the first corporate tax return in the UAE depends on the company's financial year:

For Corporate Tax return filings, the deadline is typically within nine months of the end of each tax period. However, the Federal Tax Authority (FTA) has extended the deadline to December 31, 2024, for certain entities with tax periods ending on or before February 29, 2024.

It's important to note that penalties for late filing is AED 500 for each month for the first 12 months and 1,000 for each month from the 13th month onwards.

These are the penalties for failing to file the Corporate Tax services in Dubai, UAE

| Violation | Penalty |

| Not maintaining the necessary documentation and other data as required by the Corporate Tax Law and Tax Procedures Law. | 10,000 for every violation; 20,000 for multiple violations during a 24-month period. |

| Failing to provide the Authority with requested tax-related data, records, and papers in Arabic. | AED 5000 |

| Failing to file a deregistration application within the allotted time | 1,000 every month, with a maximum of 10,000 |

| Failure of Legal Representative to submit a Tax Return within the designated deadlines. | 500 each month for the first 12 months, then 1,000 each month after that. |

| Failure of the Registrant to file a tax return in the allotted period. | 500 each month for the first 12 months, then 1,000 each month after that. |

The specific documents needed for filing will vary depending on your business structure and operations. However, the documents include:

UAE Corporate Tax is mandatory for all individuals within the Free Zones. The tax rate varies based on the type of income. For Free Zone entity, the applicable tax rate is either 0% or 9%. Here's a closer look at how these tax rates are determined for Free Zone individuals.

This is a Free Zone company that meets specific criteria set by the UAE authorities and enjoys a 0% corporate tax rate on its Qualifying Income.

According to Article 18 of the law, if the Juridical Person satisfies the following 6 conditions, he becomes a Qualifying Free Zone Person:

This refers to income earned by a QFZP (Qualifying Free Zone Person) from activities conducted entirely within the Free Zone which have a 0% Corporate Tax.

These are thresholds set to ensure QFZPs primarily operate within the Free Zone. There's a limit on non-qualifying income (usually the lower of 5% of total revenue or AED 5 million). If exceeded, the company loses its QFZP status and gets taxed at the standard 9% rate for a minimum of five years.

These are business activities allowed within Free Zones and that qualify for the 0% tax rate.

Certain activities like banking, insurance, and real estate may be restricted or not qualify for the 0% tax rate within Free Zones.

There were three announcements made regarding the UAE Free Zone Corporate Tax. The first one was on 2022 - Federal Decree-Law No 47 of 22 (Corporate Tax Law) followed by another one named Federal Decree-Law No.63 of 2023, and the recent update was published on May 2024. There were many documentations penned in the above-mentioned laws and one of the key elements was that every Free Zone individual must register for UAE Corporate Tax.

Non-qualifying income is income that does not qualify for the special 0% corporate tax rate provided under the Free Zone Persons. Based on the Ministry of Finance, revenues derived from transactions conducted outside the said free zones or derived from activities that do not classify as "Qualifying Activities" under the related ministerial decisions are classified as Non-Qualifying Income.

For Free Zone Persons, to retain eligibility for the 0% tax rate, there must be strict adherence to defined limits on Non-Qualifying Income. Notably, Non-Qualifying Income cannot exceed 5% of total revenue or AED 5 million, whichever is lower, in any accounting period. Where these thresholds are exceeded, may result in a loss of the preferential tax advantages and even imposition of the corporate standard tax rate.

The system of corporate tax in the UAE has several advantages for businesses, especially Free Zone businesses and small enterprises. Such benefits make it an attractive destination for companies both in the country and internationally.

The benefits of corporate tax in the UAE are aimed at promoting business growth, innovation, and a high level of competition. These facts are reasons why entrepreneurs and investors prefer to invest in this country.

A corporate tax audit is a thorough examination of a company's financial records and tax returns conducted by tax authorities to ensure precise calculations and adherence to tax laws. Corporate tax auditors precisely verify the accuracy of all reported income, expenses, and deductions. Throughout the audit, tax authorities diligently scrutinize various documents, such as income statements, expense reports, balance sheets, and tax returns. They may even conduct interviews with employees to gather further information. As a result of the audit, the outcome could range from no changes being necessary to additional taxes being owed, or even a potential refund if there has been an overpayment. By maintaining precise and reliable records while also thoroughly understanding tax laws, companies can significantly streamline the audit process and ensure its smoothness and efficiency.

Corporate Tax Audits and Regular Tax Audits are similar in principle, requiring a thorough inspection of financial data to ensure compliance. However, Corporate Tax Audits especially focus on validating deductions, expenses, applicable regulations, and the correctness of the taxable and non-taxable revenue declared by businesses.

Corporate Tax Audit is a necessary requirement in the process of filing Corporate Tax Returns. To ensure compliance, it is mandatory to have your financial statements audited by an approved auditor in Dubai. These audited statements must then be submitted to the Federal Tax Authority in order to complete your returns filing.

Corporate Tax Accounting is crucial for ensuring tax compliance and maintaining accurate financial records related to corporate tax. It involves calculating taxable income, assessing tax liabilities, and monitoring deductions and credits. Effective tax accounting not only helps minimize tax bills and avoid penalties, but also ensures accurate reporting to tax authorities. It is essential to have a deep understanding of tax legislation, stay updated on tax law changes, and maintain detailed records.

Timely accounting your financial statements can help you file your Corporate Tax Filing easy. Keep accurate record of your financial records with the best accounting services in Dubai.

Reyson Badger's Corporate Tax Service helps your business register for corporate tax, comply with tax regulations, file tax returns, conduct corporate tax audits and receive comprehensive tax support.

Corporate Tax is a direct tax on the net income or profit of corporations and other entities from their business activities. It is governed by Federal Decree-Law No. 60 of 2023, which amends parts of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses. All businesses with financial years starting on or after June 1, 2023, are now subject to UAE Corporate Tax. Ongoing compliance is required for all subsequent years.

The Corporate Tax aims to strengthen the UAE's position as a top worldwide business and investment destination. It aims to expedite the country's development and transformation in order to meet strategic objectives. Additionally, the UAE intends to reaffirm its commitment to international norms for tax transparency and the prevention of harmful tax practices.

Corporate Tax will be imposed on businesses' taxable income at these rates:

In the UAE, the advanced systems of business taxation contain legal provisions and reliefs based on specific areas of investment designed to provide support to corporations to increase investment and growth.

These provisions do not only contribute to the general easing of the tax burden placed on business entities, but they also maintain the UAE's competitiveness in the global economy thereby making it attractive for more business to set up their operations in the country.

Corporate Tax (CT) will applicable to:

The legal requirements governing corporate tax in the UAE are a set of coordinated relations between major government bodies and components, which effectively regulate the implementation, management, and compliance with the tax legislation. These entities include:

Under this law, taxable income is taxed as follows:

The law is administered through the Federal Tax Authority (FTA) which supervises tax registration, submission as well as collection. Companies have to adhere to legal requirements; make their accounts balanced, and submit their accounts and taxes on an annual basis. Amendments, such as Decree Law 60, made in the year 2023, are often meant to elaborate on the earlier provisions to facilitate better compliance or to bring them by the international tax rules.

The regulatory framework of corporate tax in the UAE should weigh up on transparency, competitiveness, and ease of doing business for any corporation to grow economically while meeting international tax standards such as the Base Erosion and Profit Shifting (BEPS) framework

Companies registered in the UAE should therefore ensure that their corporate tax regulations are aligned to avoid penalties, remain in good standing, and benefit from any tax relief or incentives. The following are the specifics regarding compliance and procedural requirements:

The UAE Corporate Tax system separates income and entities into two groups - that are exempt from taxation and those that are subject to Corporate Tax. This separation helps businesses in the UAE follow tax rules correctly.

Certain income categories and specific entities are exempt from UAE Corporate Tax. This exemption simplifies the tax filing process for these entities and supports specific economic activities within the UAE.

Income categories not subjected to UAE Corporate Tax

Examples:

Entities not required to pay UAE Corporate Tax

Examples:

All other business income and most business entities operating in the UAE fall under the taxable category. Knowing what counts as taxable income and which entities must pay corporate tax is important for businesses to correctly figure out how much tax they need to pay.

Taxable Income

Income subject to UAE Corporate Tax after accounting for allowable deductions

Entities required to pay corporate tax on their taxable income.

According to Article 40 of the Corporate Tax Law, a Tax Group consists of two or more taxable persons who are classified as a single taxable person in the UAE. Corporate Tax Group is different from VAT Tax Group.

UAE group entities can form a tax group if certain conditions are met.

Corporate Tax Transfer Pricing is the process of setting prices for transactions between related entities within a multinational corporation. This practice ensures that goods, services, and intellectual property are exchanged at market rates, adhering to the arm's length principle. Proper transfer pricing is essential for accurately allocating profits across different tax jurisdictions, preventing tax evasion, and ensuring fair taxation. Regulations and documentation requirements help maintain transparency and compliance with both international and local tax laws.

Expenses that are entirely and solely incurred for business purposes in the UAE and are not capital in nature are usually tax deductible. UAE Corporate Tax limits the deductibility of specific expenses. The intention is to guarantee that the relief can exclusively be claimed for expenses related to the generation of taxable income and to counteract potential instances of misuse or exaggerated deductions.

Related Party Loans

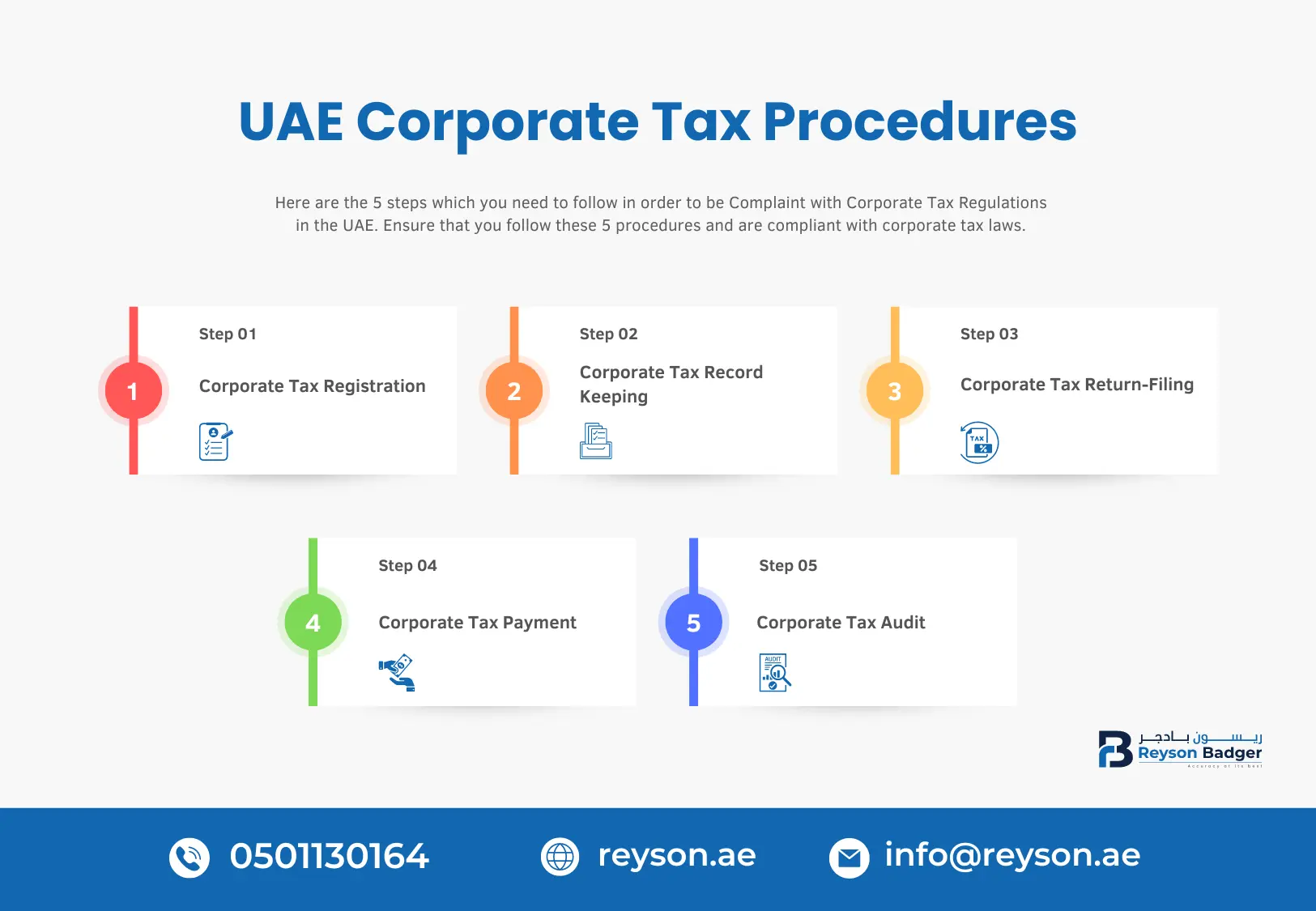

Several procedures must be followed for businesses to comply with the UAE Corporate Tax regime. Here's a breakdown of the key steps.

Return Filing

Any corporate tax payable based on the filed return must be settled within the prescribed time frame (usually within the same timeframe as return filing).

A tax loss occurs when a business's expenses or allowable deductions surpass its revenue in a given tax year, leading to a net loss as per the Corporate Tax Law. This loss can be used to offset future taxable income, referred to as carry-forward tax losses.

Calculating corporate tax in the UAE involves several key steps and considerations. Here’s an overview of the process:

Start by calculating the company's taxable income for the financial year. This involves subtracting allowable deductions and expenses from the total revenue earned during the period.

The UAE corporate tax system allows for various deductions that can reduce your taxable income. These include

The UAE applies a tiered corporate tax rate structure:

Multiply the applicable tax rate by the taxable income to determine the corporate tax liability.

Taxable Income (above AED 375,000) x 9% = Corporate Tax

Evaluate any available tax credits or incentives that may reduce the overall tax liability. These could include incentives for specific industries or activities.

Complete corporate tax returns accurately and on time, detailing the calculated tax liability. Submit these returns through the EmaraTax platform or as per regulatory requirements.

Ensure timely payment of the calculated tax liability to the Federal Tax Authority (FTA) within the stipulated deadlines to avoid penalties and interest charges.

Maintain compliance with UAE tax laws and regulations, including record-keeping requirements and responding to any tax audits or inquiries from the FTA.

Reyson Badger offers expert corporate tax services with a team of highly qualified professionals. Our team is well-versed in UAE tax laws, ensuring compliance and providing effective corporate tax solutions. We have a strong track record of successfully handling complex tax issues, earning the trust of our clients. Our personalized consultations and tailored tax advice cater to each client's specific needs and business goals. Additionally, our multilingual support helps clients from diverse backgrounds understand and manage their tax obligations.

We stay updated on tax regulations to advise clients on compliance and tax incentives. Our client-focused approach prioritizes smooth and hassle-free tax services. We provide expert advice and personalized solutions for businesses to achieve the best tax outcomes and free them to focus on growth.

At Reyson Badger, we recognize that every business has unique tax challenges and operational goals. That’s why our corporate tax advisory services are customized to meet the specific needs of each client, ensuring compliance with UAE tax regulations while optimizing tax efficiency. For more details, visit our blog on corporate tax advisory services.

Our experienced corporate tax consultants in UAE assist clients with key services, including Corporate Tax Registration, Filing Tax Returns, and providing up-to-date guidance on the latest regulations from the Federal Tax Authority (FTA). We help businesses navigate the complexities of the tax landscape and avoid potential fines and penalties.

With a reputation for delivering exceptional service and strategic tax solutions, Reyson Badger is the preferred choice for Corporate Tax Services in the UAE. Contact us today for expert advice or visit our office for comprehensive support.