| Company Formation in Saudi Arabia within 15 Days! |

The Saudi Arabian government has made a significant commitment to developing the country's infrastructure and facilitating business activities. Saudi Arabia offers numerous advantages to businesses, including a large market, a skilled workforce, and favorable business regulations. Furthermore, the Saudi Arabian government strives to increase opportunities for women in the workplace and encourage their entrepreneurial pursuits. Saudi Arabia's efforts are making it an increasingly attractive destination for companies seeking to expand their Middle Eastern operations.

Several laws and regulations have also been reformed, making it easier for businesses to operate in the country. The Saudi Arabian government holds 20% of the world's proven petroleum reserves. The country is OPEC's top oil exporter and one of its most influential members. During the past seven years, the Saudi economy has grown by an average of 4% annually, primarily due to a pro-business environment in which investors are positioned close to the Arabic market. As a result of these reforms, visible results have already been achieved. Recently, Saudi Arabia has attracted several high-profile corporations, including Google and Uber. Companies like these are investing in the country and creating jobs for Saudi citizens.

The majority of investors consider the process of Company Formation in Saudi Arabia to be a tedious one, which is where Reyson Badger steps in. The company formation process can be broken down into nuances and we help you get a license within 15 days.

Company formation in Saudi Arabia refers to the process of setting up a new business entity in Saudi Arabia. The Kingdom of Saudi Arabia offers various types of business structures, including:

1. Limited Liability Company (LLC): A popular choice for foreign investors, LLCs offer limited liability protection and flexible ownership structures.

2. Joint Stock Company (JSC): A JSC is a publicly traded company with a minimum capital requirement of SAR 500,000.

3. Branch Office: A branch office is an extension of a foreign company, allowing it to operate in KSA without establishing a separate entity.

4. Representative Office: A representative office is a liaison office that promotes the interests of a foreign company in KSA.

5. Sole Proprietorship: A business that is owned and run by just one person is known as a single proprietorship.

Firstly, you must select the legal structure that best meets the requirements and objectives of your company. A brief overview of the most common options is provided below:

Based on the business activity and the legal form of the company, the shareholding structure and paid-up capital requirements will differ.

Rate: 20% on net adjusted profits.

Taxable Entities: All firms operating in Saudi Arabia, including foreign companies.

Tax Year: Typically a calendar year, but can be adjusted based on the company's financial year.

Tax Return Filing: Annual tax returns must be filed within 120 days of the fiscal year-end.

Find more about our corporate tax services.

Rate: Varies from 5% to 20% depending on the type of income and recipient.

Applicable To: Payments made to non-resident individuals and entities for services rendered or goods supplied.

Find more details on withholding tax in Saudi Arabia.

Requirement: Companies are required to have a certain percentage of Saudi nationals in their workforce.

Nitaqat Program: A government initiative to promote Saudization and monitor compliance.

Standard Rate: 15%

Zero-Rated Supplies: Certain goods and services, such as basic food items and healthcare, are zero-rated.

Exempt Supplies: Some goods and services, such as residential rents, are exempt from VAT.

VAT Registration: Businesses with annual turnover exceeding SAR 500,000 are required to register for VAT.

VAT Return Filing: VAT returns must be filed monthly or quarterly, depending on the business's turnover.

Know more about our VAT services.

Religious Tax: A religious obligation for Muslim individuals and businesses.

Calculation: Based on the net worth of the business.

Payment: Zakat is typically paid directly to religious institutions or charities.

Find out the details of all our zakat services.

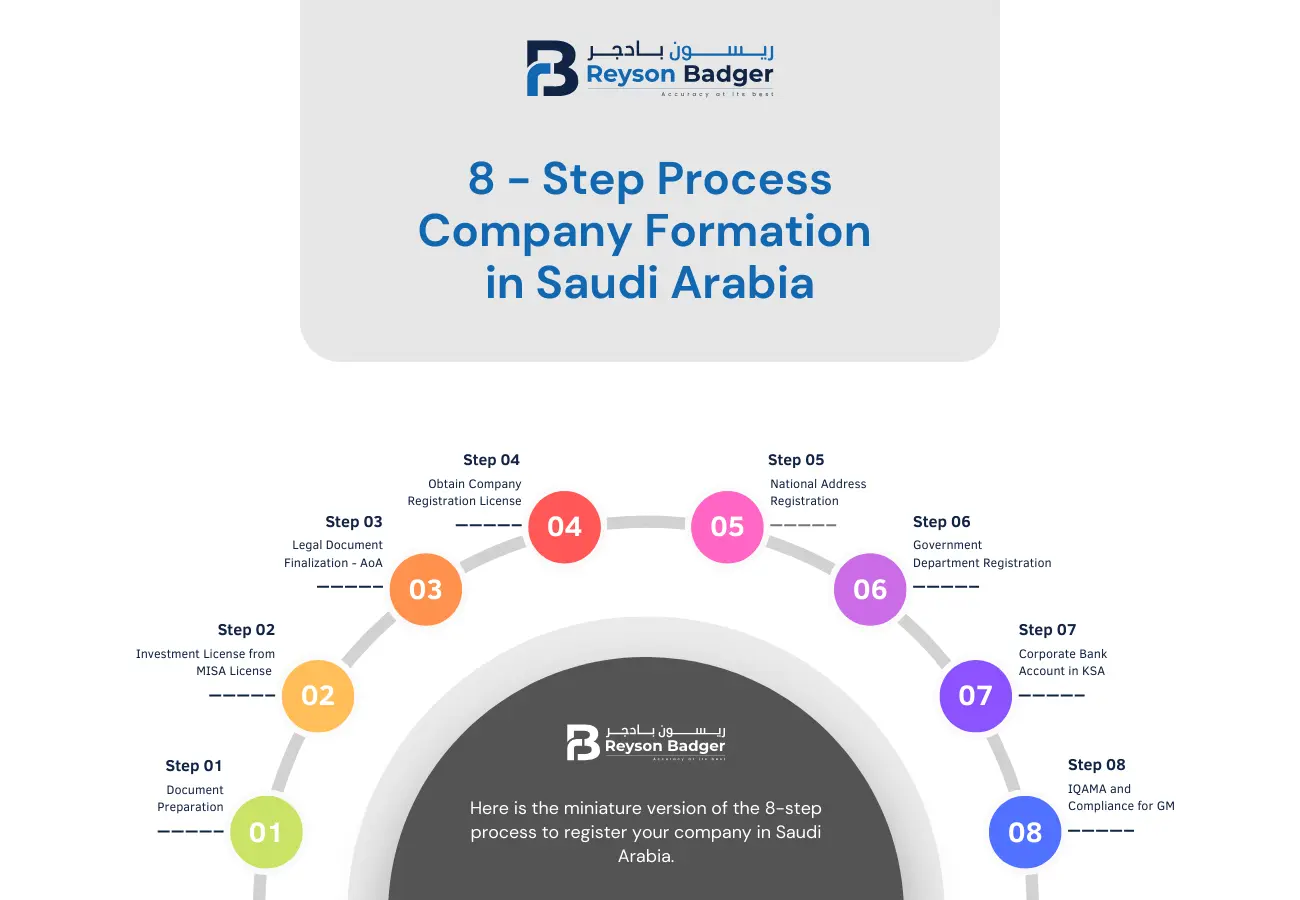

In order for a company to be incorporated in Saudi Arabia, adequate conceptualization is required, as well as the fulfillment of certain regulatory requirements. In this upward economic environment, it is recommended that you take a step-by-step approach to the process of company incorporation. For more information, please refer to the steps listed below.

Step 1: Prepare the documents required for the Company Formation

Step 2: Get an Investment License from the Ministry of Investment Saudi Arabia (MISA)

Step 3: Articles of Association - Finalize the Legal Documentation for the Company

Step 4: Obtain your Company's Commercial Registration License

Step 5: Choose your Business Location and Register the national address of your company.

Step 6: Register with the Government departments responsible for taxation, insurance, and employment.

Step 7: Apply for your Corporate Bank Account in KSA

Step 8: Ask the General Manager to visit KSA to get a Residency (IQAMA)

Step 9: Ensure the General Manager is listed on the company's books and with the government.

For Company Registration in Saudi Arabia, the following documents may be required:

While setting up a business in Saudi can be a lucrative venture, there are several challenges that entrepreneurs and businesses may face:

Professional Company Formation Consultants play a crucial role in helping businesses establish a presence in the Kingdom of Saudi Arabia. Their services include:

1. Assistance with legal documentation and registration: Preparing and submitting necessary documents to register the company with the relevant authorities.

2. Advisory on tax compliance and operational setup: Guiding tax laws, regulations, and operational requirements to ensure compliance and smooth operations.

3. Streamlining the entire process for smooth execution: Coordinating with relevant authorities, preparing necessary documents, and ensuring timely completion of the company formation process.

Several advantages can be gained by setting up a business in Saudi Arabia:

If you are considering starting a business in Saudi Arabia, you may be wondering whether you will need a company formation service. You should consider what type of business you are starting, as well as your goals when starting a business. Starting a small business or one that does not require a significant amount of infrastructure or personnel may not necessitate the use of a business setup service.

On the other hand, if you are starting a larger business or one that will require substantial investment in terms of both time and money, a business setup service may be of great assistance to you. In addition to assisting with all of the necessary paperwork and approvals, a good business setup service can also advise you on how to set up the business in compliance with Saudi Arabian laws and regulations.

If you are considering Company Formation in KSA, seeking professional assistance can help ensure a smooth and compliant setup process

You will want to take into account a few factors when choosing the best Company Formation Consultant in KSA.

We have an experienced and knowledgeable team that can assist you with the Company Formation in Saudi. With our assistance, you will be guided through every step of the process, from choosing the right company name to incorporating your company and obtaining all the necessary licenses and permits.

Our services are offered at competitive rates. Starting a new business can be financially challenging, so our prices are reasonable.

Reyson Badger has a great reputation in Saudi Arabia particularly in facilitating smooth Company Formation in Saudi. The majority of our clients have been satisfied with our services and have recommended them to others. The fact that we have been able to accomplish this is a testament to the fact that we are a reliable and trustworthy company that can assist you with the setup of your new business in Saudi Arabia.

Company formation in Saudi Arabia is a rewarding experience that can lead to success in this dynamic market. Follow the steps outlined above meticulously, seek expert advice, and embrace the cultural differences of the Kingdom and you will be well on your way to achieving your entrepreneurial dreams.

FAQs on Company Formation in Saudi Arabia

1. Can a foreigner start a company in Saudi Arabia?

A: Yes, a foreigner can start a business in Saudi Arabia. To do so, they must obtain an investment license from the Saudi Arabia General Investment Authority (SAGIA). Additionally, foreign investors can select from various business structures suited to their needs.

2. How to form a company in Saudi Arabia?

A: The process of Company Formation in Saudi Arabia involves these steps:

3. What is the difference between establishment and Company in Saudi Arabia?

A: In Saudi Arabia, an establishment is typically a sole proprietorship or small business owned by one person, while a company is a legal entity involving multiple shareholders and has a more complex structure. Companies, such as LLCs, offer limited liability protection, whereas establishments do not.

4. How much does it cost to set up a Company in Saudi Arabia?

A: The cost of Company Formation in Saudi Arabia typically ranges between SAR 15,000 and SAR 30,000, depending on factors such as the type of business, legal structure, and additional licensing fees.

5. Can you own 100% of a company in Saudi Arabia?

A: Yes, foreign investors can own 100% of a company in Saudi Arabia, provided they comply with local regulations, including obtaining a SAGIA investment license. This policy supports foreign investment and offers more control to international business owners.

6. How long does it take to set up a company in Saudi Arabia?

A: The time frame for Company Formation in Saudi Arabia varies depending on the type of business and documentation. Generally, it can take 2 to 4 weeks if all requirements are met and documents are submitted correctly.

7. Do I require a local sponsor to Company Formation in Saudi?

A: For some business activities and forms, like foreign company branches, you will need a local Saudi sponsor. The sponsor serves as your official representative and helps with communication with the local government.

8. What are the advantages of Company Formation in Saudi Arabia?

A: Saudi Arabia has a number of advantages, such as exposure to a large market, an educated labor force, good business laws, and government incentives for foreign investors. Moreover, the strategic positioning allows for exposure to the wider Middle East market.