The pillar in Islam is zakat, which limits the charity to those who have reached the financial capability of donating it. The Arabic term 'zakat' translates to "increase" or "growth" in a literal sense. It also implies"cleansing" and "enhancement." At the beginning of its 23-year period of gradual disclosure, the Quran, the holy book of Islam, established the Arabic term ‘zakat’ as the designated form of almsgiving in Islam. It purifies money, enhances faith, encourages benevolence, and benefits the needy and the poor, in addition to reducing poverty and inequality in Muslim society. It entails giving 2.5 percent of your total savings and property. The Zakat collected is then divided among specific needy categories, such as the poor, the needy, and those who have no one to support them.

Zakat – one of the components of the so-called five pillars of Islam – means much more than simply devout fulfillment of a religious duty. This is an efficacious weapon for spiritual and moral improvement, social progress, and economic equilibrium. Here's why:

Spiritual Benefits

Social and Economic Benefits

Zakat in Saudi Arabia is comprehensively taken to play the role of a social and economic organizer. Modern Saudi Arabia has made it easier to organize Zakat by establishing a Zakat Fund to disburse and collect Zakat money. This must be done to make sure that the funds get to the neediest and within the Kingdom of Saudi Arabia as well as in other parts of the world. Through Zakat, Muslims provide solutions to the problems that affect society by coming up with positive changes and improvements ensuring people show a level of generosity and managing wealth to impact society positively.

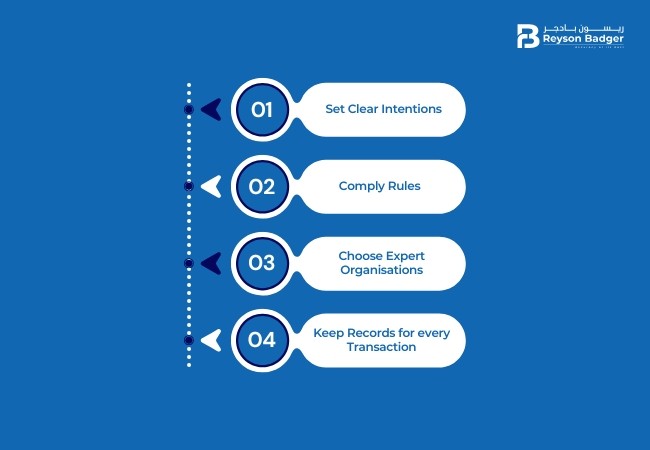

Setting Clear Intentions

Zakat as among the foremost religious obligations of Muslims implies a rather significant cost for enterprises in Saudi Arabia. To ensure proper compliance with the laws and legal requirements of Zakat, business people need to understand the rules to perform their religious duties.

Business owners are required to pay zakat on all trading stock, which includes:

Other than business owners there are people who need to pay Zakat in KSA who possess a certain minimum amount of wealth known as Nisab (minimum amount of wealth). This amount varies on the type of wealth (gold, silver, cash, livestock) and also it is crucial to know the deadline to pay Zakat in KSA. Unlike other Islamic pillars, there is no specific period when Zakat payment is due in KSA. It is paid after one lunar year from the time a person gains more than Nisab value and becomes eligible for it. Nevertheless, it is preferable to pay it before the beginning of a new Islamic lunar year.

Picking Organisations to Work with

Keeping Records

Understanding Zakat Calculation in KSA is an important step in giving Zakat. For business owners, it is computed based on their tangible and intangible assets less certain current fixed assets such as buildings, or machinery.

Zakat is not simply a vital charitable act in Islam; it is a social and economic redevelopment act that also leads to individual reformation. Concisely; if being self-employed in Saudi Arabia the principles and calculations of Zakat will help owners to serve the religion and society’s needy deserving people appropriately.

Are you a businessperson in Saudi Arabia having issues concerning Zakat or taxation? Your solution is Reyson Badger. Our experienced consultants are here to ensure you overcome the various legalities related to zakat and get the correct figures. Please get in touch with us right away to find out how we can help you complete your Zakat responsibly and with confidence.

What types of wealth are subject to Zakat?

How to determine the amount for Zakat?

Zakat calculation begins with the assessment of the total value of the wealth or total value of your assets minus your total debts. If the value is over the Nisab (currently 85 grams of gold), then its amount should multiplied by 2.5%. This is the Zakat you owe.

Can I give Zakat directly to needy individuals or should I consult an organization for donating Zakat?

Of course, you may pay your Zakat to anyone you owe, but normally, it should be given to those categorized by Islamic law as deserving recipients of Zakat. But the use of those organizations guarantees proper distribution of the food items as well as observing the rights stipulated in the Islamic laws. When it comes to Zakat and tax advice in Saudi Arabia, there is a recommendable firm known as Reyson Badger.

Should Zakat be paid only during Ramadan?

No, Zakat does not only have to be paid during the month of Ramadan. It’s a calendar yearly requirement that is paid after one lunar year of owning wealth equal to or over the Nisab amount. Many even prefer to pay their Zakat during Ramadan, however, ranging does not confine itself to the period in between.