Why is your Cash Flow larger than Profit?

Written By Akshaya Ashok, Reviewed By Retheesh R S

Published on 12/11/2024

Many business owners are startled to realize that their cash flow crosses their profits. This may appear strange, but it shows a major difference between the two financial metrics. Understanding this is important for making wise financial decisions and ensuring your firm grows.

What is Profit?

This reflects how much money your business earns on paper. It's calculated by subtracting all expenses from your total revenue. A positive profit signifies your business generates income, but it doesn't necessarily translate to readily available cash.

What is Cash Flow?

Cash flow is the lifeline of your business. It represents the actual movement of money in and out - income from sales and expenses charged. There are two categories of Cash flows.

- Negative Cash flow: You could display a profit, but if clients delay their payments or you're making significant investments in equipment, you may experience negative cash flow. This indicates that you lack sufficient funds to meet your costs.

- Positive Cash Flow: In contrast, an early-stage business may have positive cash flow because it collects payments fast, even if they do not cover all of its initial costs (resulting in a negative profit).

Types of Cash Flows:

| Cash Flow |

Definition |

Formula |

| Free Cash Flow |

- Free Cash Flow (FCF) refers to the cash a business produces after setting its operational costs and capital investments. it's an essential measure that reflects a company's financial well-being and its capacity to invest, settle debts, or provide returns to shareholders.

|

- Net Income + Depreciation/Amortisation - Change in Working Capital - Capital Expenditure

|

| Operating Cash Flow |

- Operating Cash Flow (OCF) Signifies the cash produced from a company's Primary business activities. it represents the real cash a business produces from its daily operations, including the sale of goods or services and covering costs like salaries and inventory.

|

- Operating Income + Depreciation - Taxes + Change in Working Capital

|

| Cash Flow Forecast |

- A cash flow forecast is a financial estimate that predicts the upcoming receipts and expenditures of cash for a defined timeframe

|

- Beginning Cash + Projected Inflows - Projected Outflows = Ending Cash

|

How to Identify and Manage Cash Flows?

- Understand your growth factors: In times of cash barriers, it may appear effortless to reduce expenses; but, this could deny your company from crucial assets needed for progress. The first step is to fully understand your growth factors. For example, break down your marketing expenses and examine the ROI of every item to ensure that funds are allocated to profitable channels while saving money in areas that aren't producing results.

- Examine profit and loss statements: Enhancing the rates you set and negotiate through a thorough examination of the profit and loss statements and cash flow, which includes on- and off-invoice discounts and customer-specific service expenses. This ensures that you are properly compensated for the value you generate. It also reveals hidden costs, such as payment terms and discounts, which are typically not fully understood and can result in severe cash flow and profit issues.

- Raise product price: Initially, explore methods to speed up receivables. Charge in full in advance or charge half in advance. Next, review your pricing strategy. Identify the products or services you offer that are unique to your business, then increase their price to double. Certainly, you may lose some customers, but not every one of them. Finally, eliminate unprofitable (or barely profitable) products or services and fully commit to those that bring in the most revenue.

- Reduce unnecessary expenses: Depending on the company and context, some reductions may be the answer to achieving a positive cash flow again. Unnecessary costs, such as luxurious services, promotional activities, business lunches, and unnecessary office supplies, can be reduced. Business owners may contact suppliers to see if they are willing to negotiate longer payment dates.

- Focus on Profitable Sales: Smaller businesses often go through a repetitive sales process of selling, followed by execution. Refocusing on sales efforts, particularly profitable sales, can help solve a variety of cash flow issues.

- Collect customer feedback: Typically, cash flow issues come from visitor flow issues. If your sales are slow and you have a large number of visitors, whether in-person or online, you may have a design or product problem. This is less often, but if it happens, you should seek feedback from unhappy consumers who canceled with you. They usually give the most helpful comments.

- Review accounts payable: review accounts payable and cut overhead expenses. A longer-term solution requires a look into customer loss and a variety of products. Reduced sales are usually the root cause of cash flow challenges, reviewing the fit between product portfolio and consumer demands is a great way to determine the root cause connections.

- Turn to your Investors: Hopefully, you've been open and honest about the challenges the company is facing. To preserve their investment, allow the investor to double down and invest more money in the business. If it doesn't work out, look at a strategic lender to help bridge the cash flow gap. Surprisingly, there are still a lot of lenders out there.

- Accept Credit Cards: Accepting credit cards means quicker payments and fewer bad debts. It also increases the possibility of purchasing. According to a Square survey, 35% of customers would shop elsewhere if a store did not accept credit cards. However, credit card firms often charge a fee to retailers who utilise their services, so you must consider the expenses against the benefits of faster payments.

- Accept Online Payments: An online payment option, such as credit cards, makes buying easier for your customers, as does an e-commerce store in general. It can also help you shift inventory more effectively

- Use a Monthly Business Budget: If your firm is seasonal or your cash flow is predictable, an annual budget and an accurate cash flow statement will help you determine how much money you'll need each month to cover recurrent bills. You'll need to set aside money from high-revenue months to pay overhead during low-revenue periods. A monthly cash flow estimate can identify potential deficits and give you time to seek more funds if necessary.

- Search for Accounting Services: you can hire an accounting firm, which helps to get an efficient plan for Cash flow management and other Accounting services. It helps you to focus more on your business without cash flow issues.

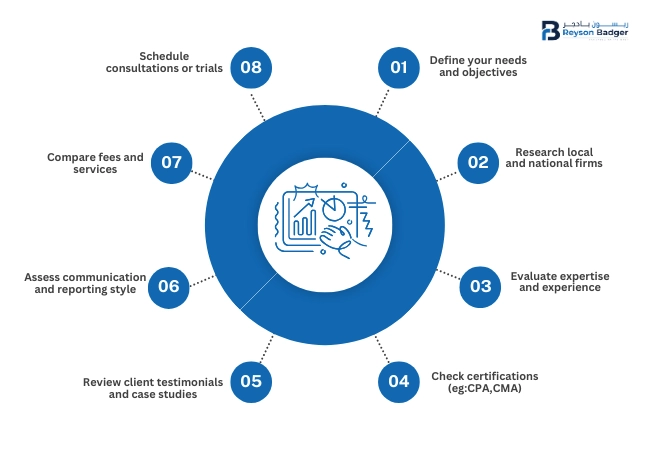

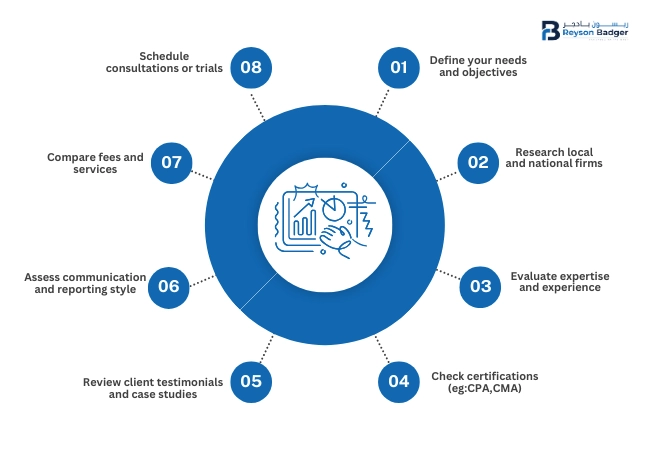

By following these simple steps, we can get the best accounting services that can manage Cash flows:

Reyson Badger: Your Partner in Cash Flow Management

At Reyson Badger, we understand the importance of maintaining healthy cash flow for business success. We offer a comprehensive range of Accounting services designed to help you:

- Cash flow forecasting and budgeting: predicts future cash inflows and outflows to create a financial plan, helping businesses manage their finances effectively.

- Accounts receivable and payable management: focuses on managing outstanding invoices and payments to ensure timely cash flow and avoid financial risks.

- Inventory management: helps businesses optimize their inventory levels to minimize costs and maximize profits by efficiently managing stock.

- Short-term and long-term cash flow planning: involves creating strategies for managing cash flow in the immediate and long term, ensuring financial stability and growth.

- Financial statement analysis: analyses financial statements to assess a company's financial health, identify trends, and make informed decisions.

- Accounts payable and receivable optimization: aims to improve the efficiency of accounts payable and receivable processes to minimize costs and maximize cash flow.

- Cash flow monitoring and reporting: tracking cash inflows and outflows, generating reports, and analyzing financial performance to identify potential issues and opportunities.

- Funding and financing options advisory: guides various funding and financing options, helping businesses secure the necessary capital to achieve their goals.

- Risk management and mitigation strategies: identify potential financial risks and develop strategies to minimize their impact on the business.

- Financial performance improvement recommendations: Provide expert advice on improving financial performance, such as cost reduction, revenue growth, and operational efficiency.

Conclusion

Partnering with Reyson Badger provides you with important insights and professional advice to enhance your cash flow and reach your financial objectives. Avoid allowing an unexpected cash flow issue to disrupt your business. Gain control and secure your financial health by applying efficient cash flow management techniques.

Written By

Akshaya Ashok

Akshaya Ashok is a content writer specializing in creating content focused on accounting and auditing. With over two years of experience, she has developed expertise in crafting professional content for the financial sector.