How to Develop a Budget That Actually Works for Your Business

Written By Akshaya Ashok, Reviewed By Nouphal P C

Published on 16/11/2024

Business Budget:

A business budget is a financial plan created on a monthly, quarterly, or annual basis to aid a business in monitoring financial results, distributing resources efficiently, predicting income, and making knowledgeable choices.

What are the Benefits of a well defined Business Budget?

- Stakeholder Confidence: A well-defined budget shows your business's financial responsibility and efficiency. This builds trust with lenders, investors, and potential partners who value a transparent picture of your financial health.

- Financial Control: Your budget is your financial roadmap, allowing you to track your income and expenses about your desired outcomes. This helps you identify areas where you are overspending and make thoughtful changes to maintain financial stability.

- Goal Setting and Planning: Budgets translate your business's goals into achievable financial targets. By allocating funds strategically, you can ensure sufficient cash to reach your objectives and prepare for future expansion projects.

- Cash Flow Management: Making a budget gives you a clear picture of your expected income and expenses. This enables active cash flow management techniques, helping you to maximize utilizing available resources and avoid unexpected problems.

- Cost Efficiency: Making a budget helps you examine spending patterns and identify areas for reducing expenses. Concentrating on essential expenses and eliminating unnecessary ones can increase business efficiency and profitability.

- Informed Decision-Making: Budgets offer a data-driven foundation for important business decisions. Understanding your financial situation will help you make informed choices regarding recruiting, marketing tactics, investments, and overall business objectives.

- Risk Management: Budget helps to identify potential financial risks, such as unexpected changes in the market. You can create backup plans to reduce these risks and maintain business continuity by identifying them.

- Performance Measurement: Budgets serve as a benchmark for evaluating the financial performance of your business. You can identify areas that are exceeding or falling short of expectations by keeping an eye on actual results in comparison to budgeted amounts. This makes your ability to make adjustments consistently to improve your financial state.

Types of Business Budget

| Business Budget Type |

About |

| Incremental Budgeting |

- Making small changes to the current budget to create a new one is known as incremental budgeting. The current budget will be adjusted to reflect newly allocated money by either increasing or decreasing the present totals. For many people, the incremental budgeting approach is a popular and successful tactic.

|

| Activity Based Budgeting (ABB) |

Activity-based budgeting (ABB) entails a thorough analysis of activities to calculate projected costs. When creating a budget, ABB does not take historical spending into account. The steps for ABB are:

- Determine the cost considerations related to various operations.

- Calculate how many units are required for each cost driver.

- Calculate the price of each activity unit connected to the cost driver.

|

| Value Proposition Budgeting |

- Value proposition budgeting directs resources toward goods and services that offer the most value to customers. In addition to focusing on high-value tasks and allocating resources as efficiently as possible, it guarantees that the budget is in line with business priorities. The approach is also referred to as priority-based budgeting.

|

| Zero Based Budgeting (ZBB) |

- Zero-based budgeting (ZBB) begins a new, requiring justification for each expenditure. No transfers from past budgets. Workers assist in pinpointing crucial expenses, eliminating wasteful expenditures, and enhancing internal solutions, ensuring that only valuable costs are approved

|

| Flexible Budgeting |

- A Flexible Budget adapts to variations in activity or production levels, maintaining precision and significance. In contrast to static budgets, it adjusts to changes in sales, production, or business activities, employing variable cost estimates to represent shifting situations.

|

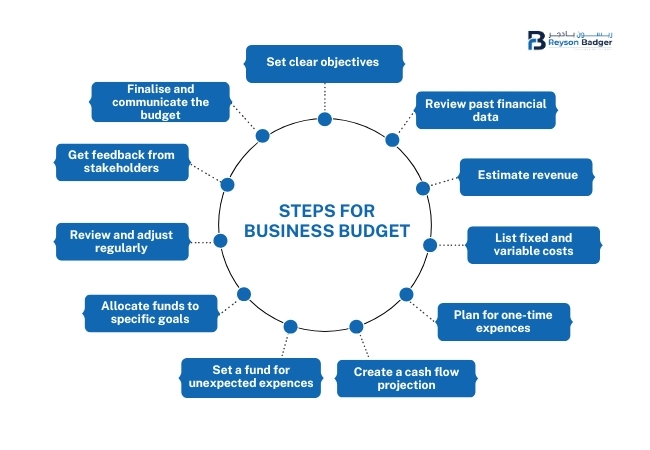

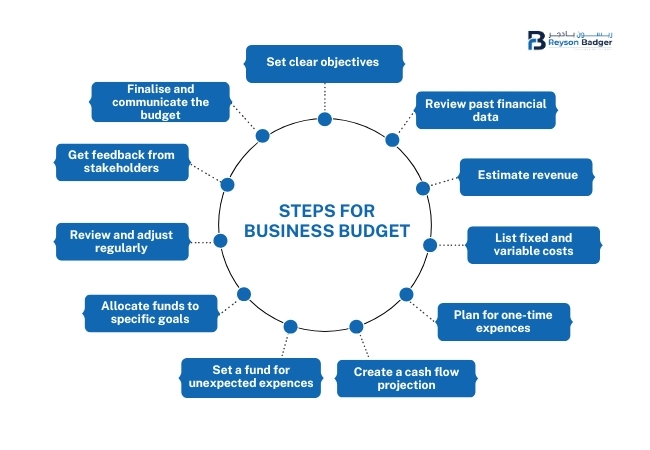

What are the steps for budget making?

Set Clear Objective

- Review Historical Data: Review historical financial documents to recognize trends and patterns.

- Identify Strengths and Weaknesses: Review historical financial documents to recognize trends and patterns.

- Search for Accounting Services: A financial expert can assist you in analyzing financial information and offer important perspectives.

Estimate Revenue

- Estimate Income: Forecast your anticipated income from different avenues, including sales, services, and investments.

- Consider Market Trends: Consider industry trends, economic factors, and the competitive environment of your business.

- Seek Expert Advice: A financial professional can help enhance your revenue predictions utilizing industry insights and economic analyses.

List Fixed and Variable Costs

- Fixed Costs: Identify regular costs such as rent, employee salaries, and insurance payments.

- Variable Costs: Assess variable expenditures like utilities, materials, and promotional costs.

- One-Time Expenses: Consider one-time expenses such as the acquisition of equipment or significant renovations.

Plan for One-time Expenses

- Identify Non-Recurring Costs: Consider significant expenditures that happen rarely, like the acquisition of equipment, software licenses, or upgrades to buildings.

- Allocate Funds: Allocate dedicated funds for these one-time costs, making sure they don't interfere with your normal budget.

Create a Cash Flow Projection

- Map Inflows and Outflows: Project your cash inflows and outflows for a designated timeframe.

- Identify Potential Shortfalls: Identify possible cash deficits and strategize accordingly.

- Search for Accounting Services: An accountant can assist you in evaluating your cash flow forecasts and suggest methods to enhance cash flow management.

Set up a fund for Unexpected Expenses

- Allocate Funds for Unexpected Costs: Reserve a segment of your budget to manage unexpected costs.

- Protect Against Risks: This fund can assist in alleviating the effects of unforeseen difficulties.

Allocate Funds Strategically

- Prioritise Goals: Allocate resources to various departments or initiatives according to their significance and how well they align with your overall goals.

- Optimise Resource Allocation: Ensure that money is allocated effectively to optimize profits.

Review and Adjust Regularly

- Track Performance: Regularly assess how your budget is performing for your financial objectives.

- Make Adjustments as Needed: Be ready to adjust your budget as situations evolve.

Get Feedback from Stakeholders

- Seek Input: Engage with team members and other stakeholders to collect insights and feedback.

- Foster Collaboration: Encourage open communication and collaboration to win commitment and support.

Finalize and Communicate the Budget

- Document the Budget: Develop a straightforward budget report.

- Communicate Effectively: Distribute the budget among all pertinent stakeholders, making sure everyone comprehends their duties and responsibilities.

- Search for Accounting Services: A financial expert can examine your budget for precision and thoroughness, offering professional advice

By following these steps and recognizing the importance of accounting services, you can develop a thorough and efficient budget that aligns with your business objectives. Reyson Badger's team of skilled accountants can support you at all steps of the budgeting process, from predicting revenue to monitoring expenses. Utilizing their expertise allows you to make educated financial choices, enhance resource distribution, and attain enduring business success. Avoid allowing budgeting to turn into a difficult chore. Collaborate with Reyson Badger to optimize your financial operations and realize your business's complete potential.

Written By

Akshaya Ashok

Akshaya Ashok is a content writer specializing in creating content focused on accounting and auditing. With over two years of experience, she has developed expertise in crafting professional content for the financial sector.