Corporate Tax in UAE requires companies to register and submit their corporate tax returns. Once registered for corporate tax, the company will be required to file within 9 months of the end of their financial period. For example, if a company's financial year was closing on 31 December 2023, then the corporate tax return should be filed within 30 September 2024. Filing within the right time is important because failure can lead to penalties, fines, interest payments due, and even potential audits. The corporate tax return form needs to be filed with all the necessary details that need to be perfectly accurate, including the company information of the business, financial statements, tax calculations, taxable income, and deductions.

This guide will lead you through the corporate tax return filing form process, including all the essential requirements, and procedures, give you the complete details for filling out the form, and some hints on how to fill it out accurately.

Filing corporate tax returns is important for the following reasons:

1. Corporate Tax Return Period

2. Due Dates

Business has to meet these deadlines so that there are no fines related to late submissions regarding UAE corporate tax regulation.

1. Business Structure

2. Emirates ID

3. Shareholder Information

A. Statement of Profit or Loss

a. Salaries

b. Depreciation

c. Interest

3. Net Profit or Loss

B. Statement of Other Comprehensive Income

1. Foreign Exchange Gains/Losses

2. Income/Losses That May Be Reclassified

C. Statement of Financial Position

1. Assets

2. Liabilities

3. Shareholder Equity

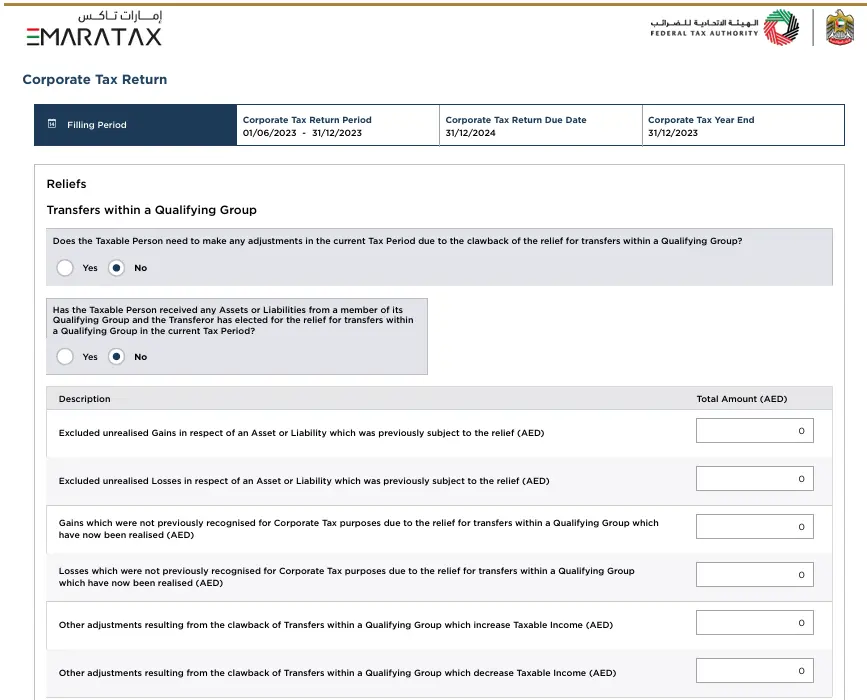

A. Transfers within a Qualifying Group

1. Adjustment due to clawback of relief

2. Receipt of Assets or Liabilities

3. Total Amount Adjustments

a. Excluded unrealized Gains

b. Excluded unrealized Losses

c. Gains not previously recognized

d. Losses not previously recognized

e. Other adjustments increasing Taxable Income

f. Other adjustments decreasing Taxable Income

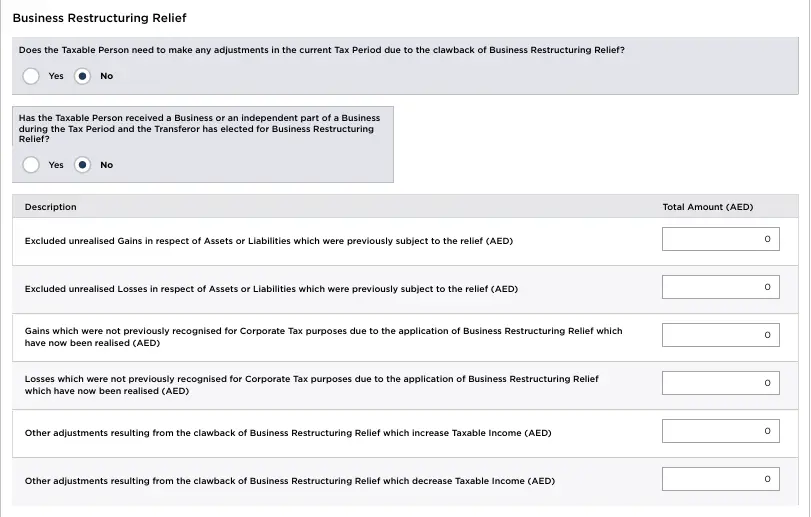

B. Business Restructuring Relief

1. Adjustment due to clawback of relief

2. Receipt of Business or independent part of Business

3. Total Amount Adjustments

a. Excluded unrealized Gains

b. Excluded unrealized Losses

c. Gains not previously recognized

d. Losses not previously recognized

e. Other adjustments increasing Taxable Income

f. Other adjustments decreasing Taxable Income

Transfers within a Qualifying Group

1. Does the Taxable Person need to make any adjustments in the current Tax Period due to the clawback of the relief for transfers within a Qualifying Group?

2. Has the Taxable Person received any Assets or Liabilities from a member of its Qualifying Group and the Transferor has elected for the relief for transfers within a Qualifying Group in the current Tax Period?

|

Description |

Total Amount (AED) |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

2. Has the Taxable Person received a Business or an independent part of a Business during the Tax Period and the Transferor has elected for Business Restructuring Relief?

|

Description |

Total Amount (AED) |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

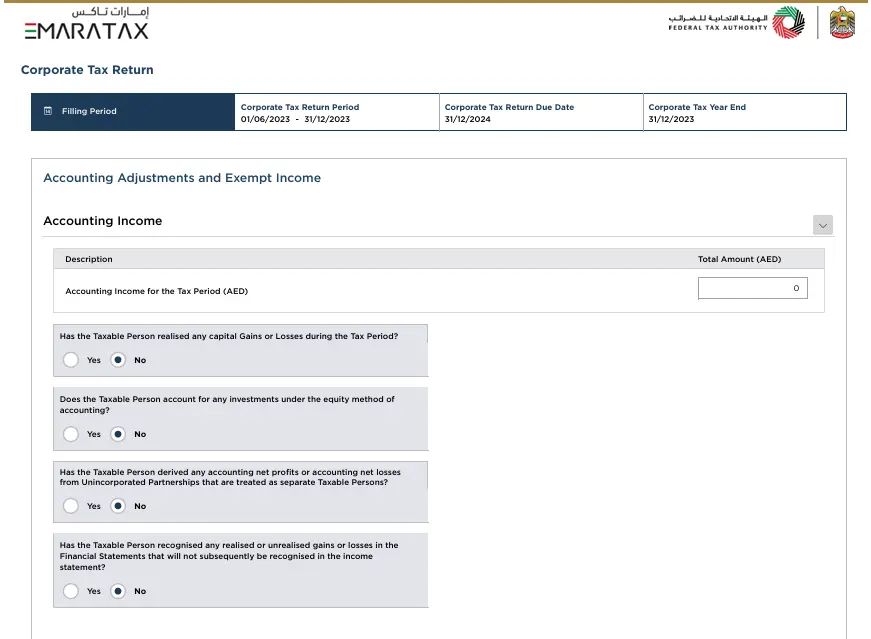

|

Description |

Total Amount (AED) |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

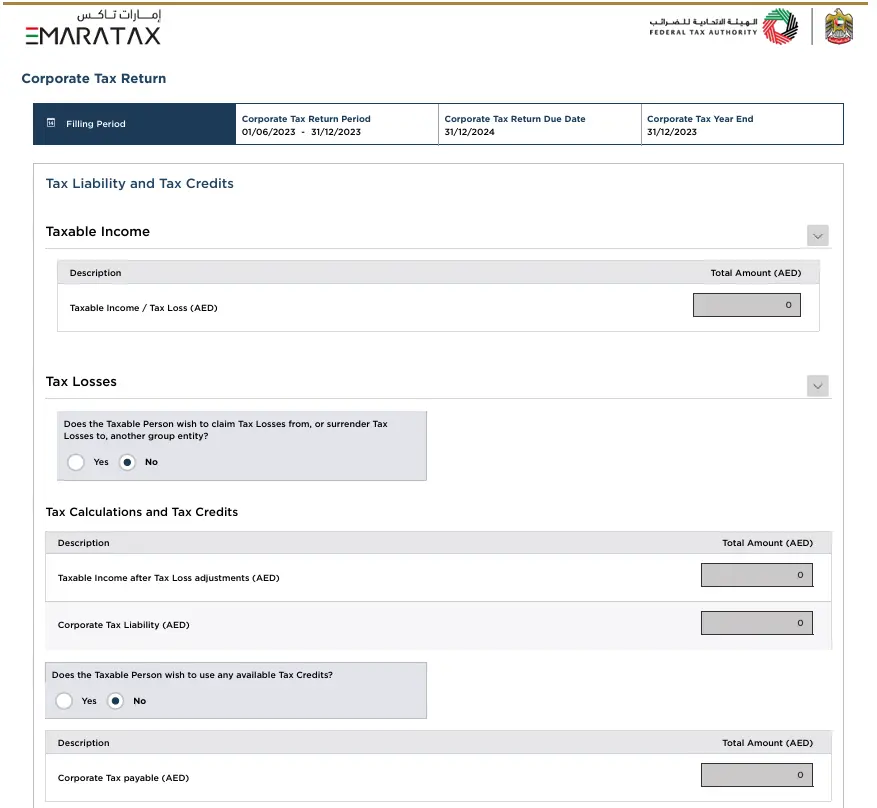

Taxable Income

Tax Calculations and Tax Credits

|

Description |

Amount (AED) |

|

|

|

|

|

|

Adjustments for Non-Deductible Expenditure

Taxable Income

Tax Calculation and Tax Credits

Submission and Filing

Additional Attachments

Filing your Corporate Tax Return is a critical process in maintaining tax compliance at the local level and ensures that your business runs successfully under legal compliance. An accurate review of all the reliefs, adjustments, and taxable income, helps in reducing one's tax liability while being compliant with them.

To assist you in preparing and filing your Corporate Tax Return, Reyson Badger is here to provide you with the most meticulous assistance. This tax consultancy firm is an expert in accomplishing the entire process of corporate tax filing. It is a firm specializing in doing corporate tax filing, tax planning, and ensuring compliance with tax laws. Providing a fiscal filing with the support of professionals and knowledge would undoubtedly be correct and accordingly according to the timely conditions to avoid penalties and maximize reliefs available. Let Reyson Badger take care of the corporate tax so you can focus on building your business.