The Corporate Tax Filing Deadline in the UAE is nine months following the end of the financial year. The deadline is usually determined by the financial year of each business. Corporate Tax Deadlines vary depending on each business's financial year. As per the new notification of The Federal Tax Authority (FTA) urges businesses subject to Corporate Tax to file their returns and pay dues within the stipulated legal timeframes. The FTA extended the deadline to December 31, 2024, for tax periods ending on or before February 29, 2024, as per Decision (7) of 2024 issued last September. A detailed overview on the each business's corporate tax filing deadline is mentioned below.

Every tax period, a company must prepare and file its UAE Corporate Tax return, as well as any additional schedules that may be required. Regardless of a company's income or operational status, all UAE taxpayers must submit a corporate tax return. Noncompliance with these tax filing rules could lead to penalties and fines.

Additionally, businesses must meet the following requirements:

Businesses in the UAE are required to file corporate tax returns once every tax period. Businesses have nine months from the end of their tax deadline to file their company tax return and pay the required amount to the Federal Tax Authority (FTA)

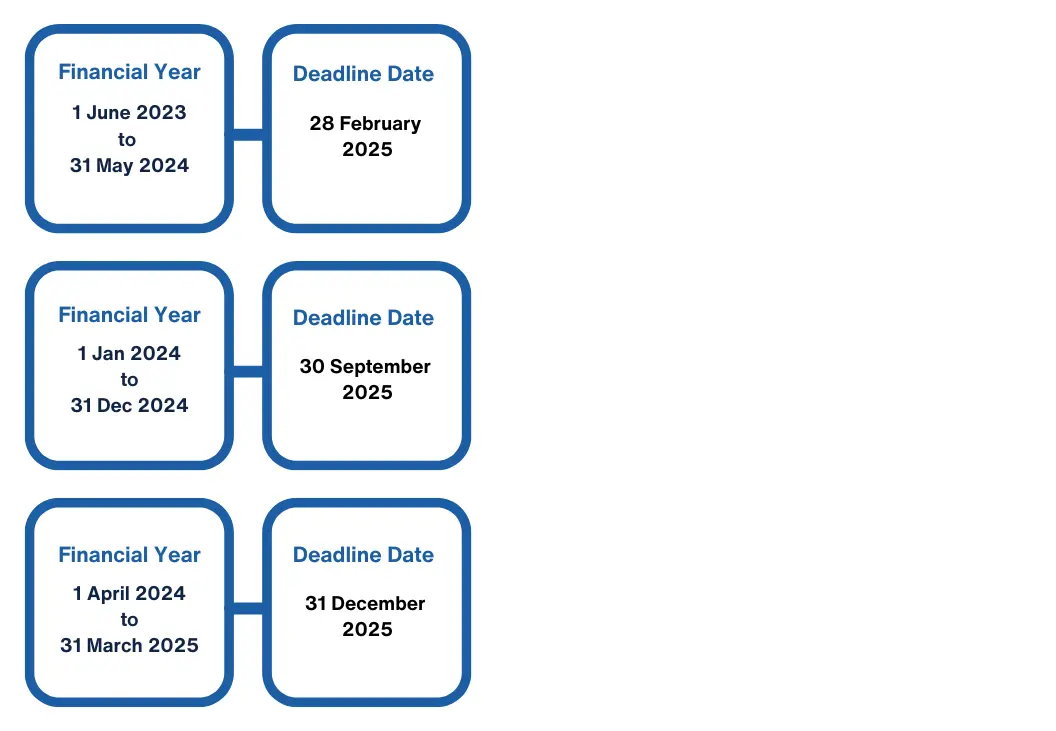

| Sl.No. | Financial Year of the Business | Corporate Tax Return Filing Timeline |

| 1 | 1 June 2023 - 31 May 2024 | 1 June 2024 - 28 February 2025 |

| 2 | 1 January 2024 - 31 December 2024 | 1 January 2025 - 30 September 2025 |

| 3 | 1 April 2024 - 31 March 2025 | 1 April 2025 - 31 December 2025 |

The tax year for these businesses' would run from 1 January 2024 to 31 December 2024. The equivalent Corporate Tax return filing period lasts nine months, beginning 1 January 2025 and concluding on 30 September 2025. Businesses have until the deadline to file their tax returns and other necessary documents in order to meet Corporate Tax regulatory requirements.

These businesses' financial year spans from 1 April 2024 to 31 March 2025. The tax filing deadline will be available for nine months, from 1 April 2025 to 31 December 2025. Businesses can ensure compliance with all applicable requirements by submitting their tax returns and associated documents before the deadline.

Failure to file tax returns on time may result in fines or penalties, which vary depending on the length of the delay and the amount owed. Here is an overview of some of the most prevalent fines for UAE Corporate Tax for missing deadlines.

| SL.No. | Violation | Penalties |

| 1 | Failure of the Legal Representative to file a Tax Return within the specified timeframes. | 500 monthly for the first 12 months; 1,000 monthly thereafter. |

| 2 | Failure of the Registrant to submit a Tax Return within the specified timeframe. | 500 monthly for the first 12 months; 1,000 monthly thereafter. |

| 3 | Late submission or failure to submit a Declaration to the Authority. | 500 monthly for the first 12 months; 1,000 monthly thereafter. |

Choosing Reyson Badger for corporate tax filing in the UAE guarantees that deadlines are fulfilled, filings are accurate, and tax-related burdens are eliminated. With our experienced staff handling your tax issues, you can be confident that you will fulfill all filing deadlines, avoid penalties, and concentrate your efforts on achieving your company objectives. Trust us to make the Corporate Tax compliance easy and stress-free.