Compliance & Anti-Money Laundering

Reyson Badger stands firmly against the Anti Money Laundering Practices in the UAE, and is willing to provide any AML Services in the UAE to fortify our nation from any unethical practices.

The UAE's AML legal framework is primarily governed by two key pieces of legislation: Federal Law No. (20) of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism, and Cabinet Decision No. (10) of 2019, which outlines the implementing regulations of Federal Law No. (20). These laws establish the responsibilities and obligations of various entities in preventing and combating money laundering activities within the country. Obligated entities under the UAE's AML regulations include financial institutions such as banks and insurance companies, as well as designated non-financial businesses and professions (DNFBPs) like lawyers, accountants, and real estate agents. Additionally, other entities specified by the UAE's Financial Intelligence Unit (FIU) are also required to comply. These entities must implement robust AML measures to ensure compliance with the regulations.

Obliged entities need to stay updated with the latest developments and guidelines in AML regulations, as these are subject to change. Continuous monitoring and adaptation to new AML requirements are essential for ensuring ongoing compliance and effectively combating money laundering and terrorist financing activities in the UAE.

AML Services - Reyson Badger

Reyson Badger offers a range of AML (Anti-Money Laundering) Services to help businesses comply with regulatory requirements and mitigate the risk of money laundering and terrorist financing. Some of the AML Services offered by Reyson Badger include:

- AML Registration Services

- AML Documentation

- AML Health Check

- AML Software Services

- AML Notification Services

- AML Filing Services

- AML Due Diligence Services

- AML KYC Support

- AML Inspection Support

- AML Risk Assessment

- AML Regulation Services

- AML Compliance Support

- AML Setup Services

- AML Policy Services

- AML Certification Services

- AML Reporting

AML Registration Services

Anti-Money Laundering (AML) registration is important for businesses operating in the UAE to comply with regulatory requirements. The UAE government has implemented strict AML regulations to prevent financial crimes, and businesses must register with the relevant authorities to show their commitment to AML compliance.

- Assistance with registering the company with the relevant AML authorities, including the UAE Financial Intelligence Unit (FIU) and the Dubai Financial Services Authority (DFSA)

- Preparation and submission of registration applications and documents, including the AML registration form, business license, and identity documents

- Liaison with authorities to ensure successful registration and resolution of any queries or issues

- Obtaining the AML registration certificate and supporting businesses with ongoing compliance requirements

With Reyson Badger's AML registration services, businesses can ensure a smooth and efficient registration process, avoiding potential penalties and reputational damage associated with non-compliance.

AML Documentation

We assist obliged entities in preparing and maintaining necessary AML documentation, including:

AML Policy Development

- Creation of a tailored AML policy that meets regulatory requirements

- Definition of AML roles and responsibilities within the organization

- Establishment of procedures for reporting suspicious transactions

Customer Due Diligence (CDD) Documentation

- Development of CDD forms and templates for customer onboarding and ongoing monitoring

- Creation of risk assessments and scoring matrices for customer categorization

- Implementation of ongoing CDD review and update processes

AML Risk Assessment and Management

- Identification and assessment of AML risks specific to the business

- Development of risk mitigation strategies and controls

- Ongoing monitoring and review of AML risks and updates to the risk assessment

AML Transaction Reporting

- Creation of procedures for reporting suspicious transactions to the UAE FIU

- Development of templates for submitting Suspicious Transaction Reports (STRs)

- Ongoing support for submitting STRs and maintaining related records

AML Record Keeping

- Establishment of a system for maintaining AML-related records, including customer documents and transaction data

- Development of procedures for storing, retrieving, and deleting AML records

- Ongoing support for maintaining accurate and up-to-date AML records

Our team ensures that all AML documentation is accurate, complete, and up-to-date, helping obliged entities demonstrate compliance with UAE regulations.

AML Health Check

An AML Health Check is a comprehensive review of a company's Anti-Money Laundering (AML) framework to ensure it is effective and compliant with regulatory requirements. The health check assesses the company's AML policies, procedures, and controls to identify areas of strength and weakness, providing recommendations for improvement. This proactive approach helps businesses prevent financial crimes, avoid regulatory penalties, and maintain a strong AML compliance culture.

AML Framework Review

- Assessment of AML policies, procedures, and guidelines

- Review of AML risk assessments and risk management strategies

- Evaluation of AML training programs and awareness initiatives

Compliance Review

- Review of customer due diligence (CDD) processes and procedures

- Assessment of ongoing CDD and transaction monitoring practices

- Evaluation of sanctions screening and Politically Exposed Persons (PEPs) management

Risk Assessment and Management

- Identification and assessment of AML risks specific to the business

- Evaluation of risk mitigation strategies and controls

- Recommendations for enhancing risk management practices

Transaction Monitoring and Reporting

- Review of transaction monitoring systems and processes

- Assessment of Suspicious Transaction Report (STR) submission practices

- Evaluation of AML transaction reporting and record-keeping practices

AML Control Testing

- Testing of AML controls and procedures to ensure effectiveness

- Identification of control gaps and weaknesses

- Recommendations for strengthening AML controls

Report and Recommendations

- A comprehensive report highlighting AML health check findings

- Practical recommendations for improving AML compliance and controls

- Action plan for implementing recommendations and enhancing AML framework

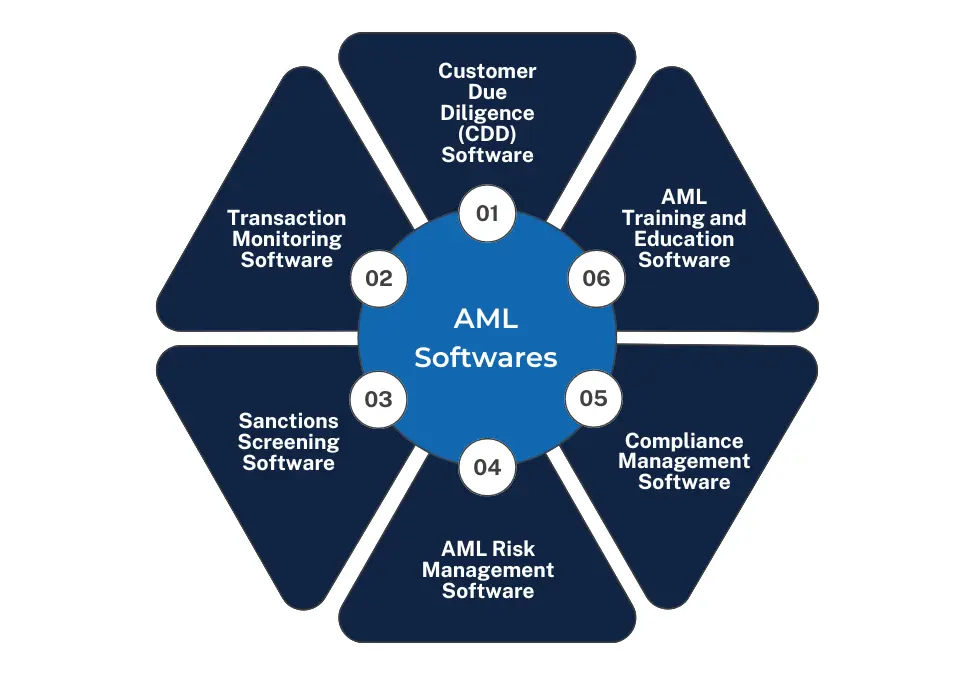

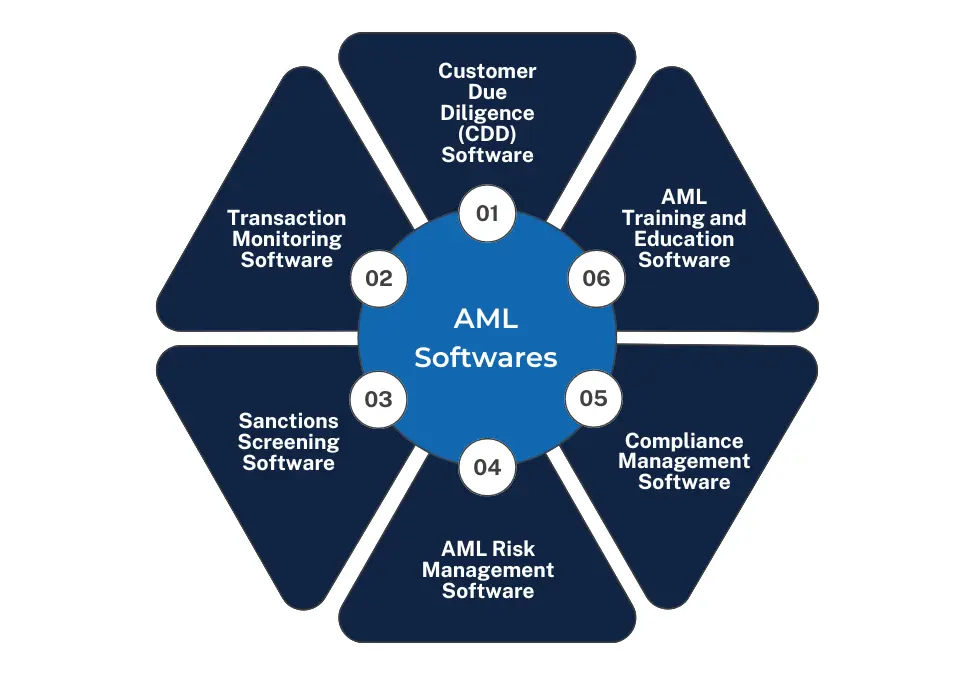

AML Software Services

Customer Due Diligence (CDD) Software

- Automates CDD processes for efficiency.

- Provides real-time customer risk assessment.

- Offers ongoing monitoring and updates for customer information.

Transaction Monitoring Software

- Screens transactions in real-time to identify suspicious activity.

- Uses advanced risk scoring to prioritize alerts.

- Automates Suspicious Transaction Report (STR) filing.

Sanctions Screening Software

- Screens customers and transactions against global sanction lists in real time.

- Generates automated alerts and notifications for potential matches.

- Ensures ongoing updates and maintenance of sanction lists.

AML Risk Management Software

- Assesses and scores potential money laundering risks within your business.

- Enables a risk-based approach to CDD and ongoing monitoring.

- Automates risk reporting and provides data analytics.

Compliance Management Software

Creates a central hub for managing all AML compliance activities.

Automates compliance tasks and generates reminders.

Provides real-time reporting and analytics on your compliance status.

AML Training and Education Software

- Delivers interactive training modules for your staff on AML best practices.

- Tracks and records employee training completion.

- Offers automated updates and notifications on new regulations or training materials.

AML Notification Services

Anti-Money Laundering (AML) notification services are very important for keeping businesses safe from money laundering. These services send real-time alerts to help businesses spot and reduce possible AML risks. With AML notifications, businesses can quickly learn about changes in customer risk, sanctions, and negative news. This helps them act fast to stay compliant and lower risks. Using AML notification services helps businesses improve their AML programs, reduce risk, and protect themselves against money laundering and terrorist financing.

We provide timely and accurate AML notification services to help you stay compliant with regulatory requirements. Our services include:

Sanctions Alerts:

- Real-time notifications of sanctions list updates

- Automated screening against sanctions lists

AML Regulatory Updates:

- Notifications of changes to AML regulations and guidelines

- Analysis and interpretation of regulatory updates

Suspicious Transaction Reports (STRs)

- Automated generation and submission of STRs

- Notifications to relevant authorities and stakeholders

Customer Risk Rating Updates

- Ongoing monitoring and updates of customer risk ratings

- Notifications of changes to customer risk profiles

AML Compliance Reminders

- Automated reminders for AML compliance tasks and deadlines

- Notifications of upcoming compliance requirements

Transaction Monitoring Alerts

- Real-time alerts for high-risk transactions

- Automated transaction monitoring and reporting

AML Filing Services

Anti-Money Laundering (AML) filing services involve sending necessary reports to regulatory authorities like the Financial Intelligence Unit (FIU) to follow AML rules. AML filing is very important for a good AML compliance program. It helps find and report suspicious transactions, activities, and transactions that go over certain amounts. Accurate and timely AML filing helps stop money laundering, terrorist financing, and other financial crimes. By outsourcing AML filing services to Reyson Badger, businesses can make sure they follow the rules, reduce risk, and keep a strong AML compliance program.

Reyson Badger's AML Filing Services help businesses comply with regulatory requirements by filing necessary reports, including:

- Suspicious Transaction Reports (STRs)

- Suspicious Activity Reports (SARs)

- Currency Transaction Reports (CTRs)

- Large Cash Transaction Reports (LCTRs)

AML Due Diligence Services

Customer Due Diligence (CDD)

- Verifies customer identity and credentials through documentation and data checks.

- Assesses customer risk profile based on business activities, ownership structure, and geographic location.

- Provides ongoing monitoring and updates to keep customer information current.

Enhanced Due Diligence (EDD)

- Conducts in-depth analysis for high-risk customers or transactions.

- Investigate sources of funds and wealth to identify potential money laundering risks.

- Assesses political exposure (PEP status) and reputational risks associated with the customer.

Vendor Due Diligence

- Evaluates the risk profile of potential or existing vendors.

- Verifies vendor credentials and reputation through background checks and reference inquiries.

- Implements ongoing monitoring to identify any changes in vendor risk.

Partner Due Diligence

- Assesses the risk profile of potential or existing business partners.

- Verifies partner credentials and reputation through document checks and reference checks.

- Maintains ongoing monitoring to stay updated on any changes in partner risk.

AML Screening

- Screens customers, vendors, and partners against global sanctions lists and AML watchlists.

- Conducts ongoing monitoring for any additions or changes to these lists that may impact your business relationships.

Risk Assessment

- Identifies and evaluates potential Anti-Money Laundering (AML) risks specific to your business.

- Develops risk mitigation strategies to address identified vulnerabilities and ensure compliance.

AML KYC Support

AML KYC (Know Your Customer) Support helps businesses follow Anti-Money Laundering (AML) rules by checking and keeping track of their customers' identities and activities. This support makes sure businesses understand their customers' risk levels, helping them avoid AML risks. By using Reyson Badger's AML KYC Support, businesses can do accurate and efficient customer checks, reduce AML risks, and keep a strong compliance program.

Reyson Badger's AML KYC Support provides businesses with expert assistance in

- Customer Identification and Verification

- Risk Assessment and Categorization

- Ongoing Monitoring and Updates

- Document Collection and Validation

- PEP and Sanctions Screening

KYC is very important for AML compliance. Good KYC procedures help stop money laundering, terrorist financing, and other financial crimes. Reyson Badger's AML KYC Support helps businesses build strong relationships with their customers while making sure they follow the rules.

AML Inspection Support

AML Inspection is a process that helps identify vulnerabilities and weaknesses in a company's Anti-Money Laundering (AML) compliance program. The inspection process includes:

- Review of AML policies and procedures

- Assessment of Customer Due Diligence (CDD) practices

- Evaluation of transaction monitoring and reporting systems

- Review of Sanctions and Watchlist screening processes

- Assessment of AML training programs for employees

- Review of record-keeping and documentation practices

- Evaluation of risk assessment and management practices

- Review of compliance with regulatory requirements and guidelines

The goals of an AML inspection include:

- Identifying areas for improvement in the AML compliance program

- Ensuring compliance with regulatory requirements and guidelines

- Detecting and combating money laundering and terrorist financing.

- Protecting the company from reputational risk and financial losses

- Ensuring effective implementation of AML controls and procedures

AML inspections can be conducted by:

- Internal audit teams

- External auditors and consultants

- Regulatory authorities and supervisory bodies

By conducting regular AML inspections, companies can strengthen their AML compliance programs, reduce risk, and demonstrate their commitment to preventing money laundering and terrorist financing.

AML Risk Assessment

AML (Anti-Money Laundering) Risk Assessment is a systematic process to identify, assess, and prioritize risks related to money laundering and terrorist financing. It involves evaluating the likelihood and potential impact of AML risks and implementing controls to mitigate them.

Key steps in AML Risk Assessment:

- Identify Risks: Consider factors like customer types, geographic locations, products/services, transactions, and industry sectors.

- Assess Risks: Evaluate the likelihood and potential impact of identified risks using a risk matrix or scoring system.

- Categorize Risks: Group risks into high, medium, or low categories based on their assessed level of risk.

- Implement Controls: Develop and implement AML controls and procedures to mitigate identified risks.

- Monitor and Review: Continuously monitor and review the risk assessment and update controls as needed.

AML Risk Assessment considers various factors, including:

- Customer Risk: PEPs, high-risk industries, adverse media

- Geographic Risk: High-risk countries, sanctions, and embargoes

- Product/Service Risk: Cash-intensive businesses, high-risk transactions

- Transaction Risk: Large or unusual transactions, cash transactions

- Industry Sector Risk: High-risk industries like gambling, cryptocurrency

By conducting regular AML Risk Assessments, businesses can:

- Identify and mitigate AML risks

- Comply with regulatory requirements

- Protect their reputation and assets

- Enhance their AML compliance program

Reyson Badger's AML Risk Assessment services can help businesses effectively identify and manage their AML risks.

AML Regulation Services

AML (Anti-Money Laundering) regulations are laws and guidelines designed to prevent money laundering and terrorist financing. Key aspects of AML regulations include:

- Customer Due Diligence (CDD): Verifying customer identity and assessing risk.

- Ongoing Monitoring: Regularly reviewing customer transactions and activity.

- Reporting Suspicious Transactions: Submitting SARs (Suspicious Activity Reports) to regulatory authorities.

- Record Keeping: Maintaining accurate and up-to-date records.

- Compliance Programs: Establishing and maintaining effective AML programs.

- Training and Education: Educating employees on AML regulations and requirements.

- Risk Assessment: Identifying and assessing AML risks.

- Transaction Screening: Screening transactions against sanctions and watchlists.

AML regulations are enforced by the Central Bank of the UAE (CBUAE) in the UAE.

Businesses subject to AML regulations include:

- Banks and financial institutions

- Money service businesses (MSBs)

- Securities and insurance companies

- Casinos and gaming establishments

- Real estate and luxury goods dealers

- Cryptocurrency and virtual asset service providers

AML Compliance Support

AML (Anti-Money Laundering) compliance refers to the processes and procedures implemented by businesses to prevent, detect, and report money laundering and terrorist financing activities. AML compliance involves:

- Customer Due Diligence (CDD): Verifying customer identity and assessing risk.

- Ongoing Monitoring: Regularly reviewing customer transactions and activity.

- Transaction Reporting: Submitting SARs (Suspicious Activity Reports) and other required reports.

- Risk Assessment: Identifying and assessing AML risks.

- Compliance Programs: Establishing and maintaining effective AML programs.

- Training and Education: Educating employees on AML regulations and requirements.

- Record Keeping: Maintaining accurate and up-to-date records.

- Audit and Testing: Regularly reviewing and testing AML controls.

AML compliance is crucial for businesses to:

- Prevent money laundering and terrorist financing.

- Meet legal and regulatory requirements.

- Protect their reputation and assets.

- Avoid fines and penalties for non-compliance.

- Ensure a safe and secure financial system.

AML Setup Services

AML Setup refers to the process of establishing and configuring an Anti-Money Laundering (AML) system or program for a business or organization. This includes:

- Identifying and assessing AML risks.

- Policy Development: Creating AML policies and procedures.

- Setting up CDD processes and procedures.

- Configuring transaction monitoring and reporting tools.

- Setting up sanctions screening and watchlist filtering.

- Configuring reporting tools for SARs (Suspicious Activity Reports) and other required reports.

- Providing AML training for employees.

- Establishing an AML compliance program.

- Integrating AML systems with existing infrastructure.

- Testing and validating AML setup to ensure effectiveness.

AML Policy Services

An AML (Anti-Money Laundering) policy is a document outlining a company's procedures and guidelines for preventing, detecting, and reporting money laundering and terrorist financing activities. An AML policy should include:

- Purpose and Scope

- Risk Assessment and Management

- Customer Due Diligence (CDD) and Know-Your-Customer (KYC) procedures

- Transaction Monitoring and Reporting

- Sanctions and Watchlist Screening

- Suspicious Activity Reporting (SAR)

- Record Keeping and Documentation

- Training and Education

- Compliance and Audit Procedures

- Review and Update Procedures

The AML policy should be:

- Written and readily available

- Approved by senior management

- Communicated to all employees

- Reviewed and updated regularly

- Consistent with regulatory requirements

AML Certification Services

In the United Arab Emirates (UAE), AML (Anti-Money Laundering) certification is a professional credential that demonstrates an individual's expertise and knowledge in AML compliance, prevention, and detection.

AML Certification Programs in the UAE:

- Association of Certified Anti-Money Laundering Specialists (ACAMS) - offered in the UAE

- Certified Anti-Money Laundering Professional (CAMP)

- Certified Money Laundering Prevention Officer (CMPO)

- Certified AML Specialist (CAMS) - offered by the UAE's Central Bank and the Emirates Institute for Banking and Financial Studies (EIBFS)

AML Certification Benefits:

- Demonstrated expertise in AML compliance

- Enhanced career opportunities in the UAE's financial sector

- Improved skills and knowledge in AML prevention and detection

- Recognition by employers and regulators in the UAE

- Staying up-to-date with UAE's AML regulations and guidelines

To obtain AML Certification, individuals typically need to:

- Meet eligibility requirements (e.g., education, experience)

- Complete training and education programs (e.g., CAMS, ACAMS)

- Pass a certification exam (e.g., CAMS, ACAMS)

- Maintain certification through ongoing education and professional development

Additional Requirements in the UAE:

- Compliance with UAE's AML regulations and guidelines

- Knowledge of UAE's AML laws and regulations

- Familiarity with the UAE's Financial Intelligence Unit (FIU) and its reporting requirements

By obtaining AML certification, professionals in the UAE can demonstrate their expertise and commitment to preventing money laundering and terrorist financing, and enhance their careers in the financial sector.

AML Reporting

AML reporting in the UAE is a critical requirement for financial institutions and other organizations to prevent money laundering and terrorist financing. The UAE's Financial Intelligence Unit (FIU) receives and analyzes AML reports to identify suspicious transactions and prevent criminal activity.

Reports:

- Suspicious Transaction Report (STR)

- Currency Transaction Report (CTR)

Reporting Requirements:

- Identify and report suspicious transactions exceeding AED 55,000 (approximately USD 15,000)

- Submit reports to the UAE's FIU within 14 days of identifying a suspicious transaction

- Maintain accurate and complete records

- Ensure confidentiality and security of reported information

Additional Requirements:

- Ongoing monitoring of customer transactions

- Updating reporting as necessary

- Complying with UAE AML regulations and guidelines

Regulatory Authorities:

- Financial Intelligence Unit (FIU)

- Central Bank of the UAE

- Dubai Financial Services Authority (DFSA)

- Abu Dhabi Global Market (ADGM)

Industry Specific Requirements:

- Banks and financial institutions

- Insurance companies

- Money exchange and remittance businesses

- Auditing and accounting firms

- Legal firms

- Real estate agents

Consequences of Non-Compliance:

- Penalties and fines

- Criminal prosecution

- Reputation damage

- Loss of license or authorization

By understanding and complying with AML reporting requirements in the UAE, organizations can help prevent money laundering and terrorist financing, and maintain the integrity of the financial system.

AML Challenges in UAE

The UAE faces unique AML challenges, including:

- High-Risk Transactions: Large cash transactions and wire transfers.

- Real Estate Sector Vulnerabilities: Money laundering risks in property transactions.

- Free Zone Challenges: Lack of transparency and oversight in free zone transactions.

- Hawala and Informal Money Transfer Systems: Difficult to trace and monitor.

- Cash-Intensive Businesses: High-risk sectors like gold and jewelry trading.

- Limited AML Resources: Insufficient expertise and resources for effective enforcement.

- Language Barriers: Arabic and English language differences can hinder AML efforts.

- Cultural and Religious Sensitivities: Balancing AML measures with cultural and religious practices.

- Data Privacy Concerns: Ensuring AML measures comply with UAE data protection regulations.

- Sanctions Compliance: Adhering to international sanctions lists and regulations.

- Cryptocurrency Risks: Addressing AML risks associated with virtual assets.

- Coordination between Emirates: Ensuring consistent AML efforts across all seven Emirates.

Importance of AML Services in UAE

AML services are crucial to:

- AML services help detect and prevent money laundering, terrorist financing, and other financial crimes.

- Effective AML measures to safeguard the reputation of financial institutions, businesses, and individuals from reputational damage.

- AML services ensure compliance with UAE's AML regulations and guidelines, avoiding legal and financial penalties.

- AML services identify and mitigate risks associated with money laundering and terrorist financing.

- AML services help maintain the integrity of the financial system, ensuring the stability and trustworthiness of the UAE's economy.

- AML services facilitate thorough customer due diligence, ensuring that businesses deal with legitimate and trustworthy customers.

- AML services help expand financial inclusion by reducing the risk of financial crimes, making financial services more accessible to a wider audience.

- AML services facilitate collaboration between countries to combat global financial crimes.

In the UAE, AML services are essential for financial institutions, businesses, and individuals to prevent financial crimes, maintain their reputation, and comply with regulations.

How can Reyson Badger Help

AML (Anti-Money Laundering) services are very important for businesses and banks in the UAE to stop money laundering and terrorist financing. Reyson Badger AML services give complete support to help follow UAE rules and laws, reduce AML risks, and protect reputation and assets. With Reyson Badger businesses can make sure they follow AML rules, manage risks, and report to regulators correctly. This helps keep the UAE's financial system strong.