The United Arab Emirates (UAE) is a thriving hub for businesses of all sizes. When it comes to ensuring compliance and financial transparency, Audit Services in Dubai play a pivotal role. With the dynamic business landscape of the United Arab Emirates, companies rely on these services to maintain integrity and trustworthiness in their operations.

With its strategic location and commitment to economic growth, the UAE offers a dynamic environment for entrepreneurs and established companies alike. However, to ensure long-term success, maintaining financial transparency and adhering to regulations is crucial.

An audit is an independent and systematic examination of a company's financial records. A qualified auditor assesses the accuracy and fairness of financial statements, providing an objective opinion on whether they represent a true and fair view of the company's financial health. Audit services ensure compliance with regulatory standard and enhance stakeholder confidence.

Audit services mainly include the assessment of a company's financial records, operations, and other internal controls to guarantee accuracy, regulatory compliance, and the integrity of financial reporting. These services help to identify potential risks, inefficiencies, and areas for improvement. This provides investors, regulators, and management a better confidence in the company’s financial health and transparency.

An internal audit serves to pinpoint any weaknesses in internal controls and assess operational efficiency and regulatory compliance. While internal audits can be conducted by individuals within the company, many opt to engage the expertise of companies providing internal audit services. This process ensures that the business remains on a trajectory aligned with its objectives.

Internal audits play a crucial role in monitoring company effectiveness, pinpointing areas for improvement, and ensuring adherence to government laws and regulations. This entails reviewing and validating financial information, evaluating risk management protocols, and scrutinizing operational procedures.

An external audit entails a methodical examination of a company's financial statements to assure stakeholders of their accuracy and the absence of significant errors. Throughout this process, external auditors meticulously scrutinize transactions and methodologies, sometimes seeking independent verification from entities such as banks, customers, and suppliers. A comprehensive audit report is then submitted upon conclusion, offering valuable insights into a company's financial well-being.

Companies registered in specified areas are obligated by Free Zone Authorities to furnish annual audit reports, a prerequisite for trade license renewal. Adherence to this reporting requirement is imperative, as failure to comply may result in financial penalties. It is thus advisable to have your company in free zones audited in accordance with the prescribed guidelines of the respective zone. Reyson Badger stands out as a premier provider of audits in free zones, boasting offices across all UAE-free zones.

Tax audits conducted by the Federal Tax Authority (FTA) in Dubai ensure timely settlement of outstanding debts and recovery of all due taxes for government coffers. Compliance with tax regulations, including issuance of proper Tax Invoices and receipt of eligible VAT credits, is meticulously verified. Businesses can seek assistance from registered tax agents to navigate pre- and post-audit processes, ensuring adherence to VAT compliance standards established by the FTA.

A Due Diligence Audit is performed as part of the process of evaluating a company's financial well-being and effectiveness. By doing so, the company is ensured that there are no hidden liabilities within the organization. A thorough due diligence process helps owners make informed decisions for the present and the future, thereby preventing them from incurring financial losses.

As leading Strata Auditors in Dubai, we ensure client compliance with Real Estate Regulation Authority (RERA) regulations and requirements. Our meticulous audits ensure that financial statements accurately reflect the company's financial position, assets, liabilities, and equity in accordance with UAE accounting principles.

Given the increasing prevalence of corporate fraud, forensic audits have gained prominence for investigating financial crimes and commercial conflicts. In Dubai, forensic auditors play a pivotal role in uncovering fraud, identifying the root causes of financial issues, and gathering evidence for potential legal action. From financial fraud to bankruptcy disputes, forensic audits offer comprehensive investigative services, leveraging evidence admissible in court proceedings.

A financial audit is the complete assessment of a company's financial statements for accuracy, completeness, and conformity to requirements of accounting. It includes transaction checking and analysis of financial data, in addition to reviewing internal controls.

Risk assessment & evaluation involves figuring out, examining, and evaluating capability dangers that would impact a company's operations, monetary overall performance, or reputation. It facilitates companies to prioritize risks and broaden powerful mitigation strategies.

An operational audit makes a speciality of evaluating the efficiency and effectiveness of a company's operations. It assesses techniques, process, and controls to identify opportunities for development and decrease in expenses.

An investigation audit is a totally technical form of audit related to the examination of a difficulty or allegation about a few wrongdoing through fraud, theft, or misconduct. An investigation audit entails gathering and analyzing proof in pursuit of establishing records.

An information system audit assesses an enterprise's statistics structures safety, reliability, and effectiveness. It evaluates controls, identifies vulnerabilities, and recommends measures to protect sensitive records.

A stock audit verifies the accuracy and completeness of a company's stock facts. It includes physically counting inventory items as part of it., comparing them to recors, and identifying discrepancies.

A real estate audit completely assesses a corporation's financial facts, belongings valuations, lease agreements, and compliance with applicable legal guidelines and laws. It aids to assure that the organization's real estate assets are managed successfully and that its financial reporting is correct.

Engaging a reputable audit firm in the UAE offers several advantages:

Compliance with Local Laws

Compliance with Local laws is necessary for firms operating in Dubai to follow the financial regulations and legislation set by the UAE government and local authorities. Audit Services in UAE guarantees that a company's financial statements accurately reflect its financial status in line with applicable legislation. This covers accounting standards, tax legislation, reporting requirements, and other financial restrictions unique to Dubai and the larger UAE region.

Audits serve to ensure that a company's financial operations comply with these requirements, lowering the risk of noncompliance and related penalties, and assisting organizations function legally and ethically in Dubai.

"Fraud Prevention" refers to the detection and mitigation of fraudulent actions within a company's financial processes. Auditors have an important role in discovering anomalies, abnormalities, and suspicious transactions that could suggest fraudulent activities.

To detect potential fraud, auditors use a variety of procedures, including scrutinizing financial records, evaluating transactional data, conducting interviews, and doing internal control assessments. Auditors can detect red flags and areas of vulnerability to fraudulent activity by reviewing financial accounts and operational processes.

The objective of fraud prevention through auditing is: to prevent people from committing fraud by building effective internal controls and to detect and eliminate fraudulent behavior as soon as it occurs. Businesses that detect fraud early can reduce financial losses, protect assets, and maintain their brand and integrity in the marketplace. Finally, strong fraud prevention procedures help to retain stakeholders' trust and confidence in the company's financial integrity and reliability.

Credibility refers to the integrity and accuracy of a company's financial records and declarations. An audit performed by an independent and certified auditor gives an objective assessment of the company's financial health and the reliability of its financial records.

Audits improve the dependability of a company's financial information by checking its precision and conformity with applicable laws, regulations, and accounting standards. Audited financial statements help stakeholders, such as creditors, investors, regulatory authorities, and the general public, make educated decisions regarding the company.

Audit Services use insights gathered from the audit to improve the efficiency and effectiveness of an organization's operations. Auditors look at not only financial records but also operational procedures and internal controls in order to find areas for improvement.

The goal of operational improvement through auditing is to help firms run more effectively and efficiently, maximize value for stakeholders, and achieve long-term success.

Financial health signifies a company's general well-being and financial stability. Financial health assessment involves examining several aspects of the financial health of a business, including liquidity, solvency, and profitability.

A company's long-term existence and sustainability rely heavily on maintaining excellent financial health. Audits are critical in guaranteeing the quality and reliability of financial information, which is required for making informed business decisions, recruiting investors, obtaining funding, and establishing confidence with stakeholders.

Finally, by fostering openness, accountability, and effective fiscal practices, audits help to improve the financial health and stability of organizations.

Risk management is the identification, assessment, and mitigation of risks that may influence the financial health of a business, operations, or reputation. Auditors help firms assess and manage a wide range of risks, including financial, operational, regulatory, and reputational hazards.

Auditors assist businesses in reducing the chance of undesirable outcomes such as monetary losses, regulatory penalties, legal liabilities, or reputational damage by proactively identifying and managing risks. They help execute risk mitigation techniques and controls that protect assets, improve operational efficiency, and assure regulatory compliance.

Risk management through auditing adds to a company's overall stability, sustainability, and success by limiting risks while maximizing chances for growth and value generation.

Auditors use quality assurance measures to ensure that financial statements are prepared in accordance with applicable accounting standards, laws, and regulations.

Quality assurance in auditing protects the integrity of financial information, builds trust in the company's financial reporting, and enables stakeholders to make educated decisions. It also strengthens the integrity and dependability of the organization's financial operations, generating conviction in your business.

Investor confidence relates to investors' trust and confidence in a company's financial performance, management, and long-term prospects. Auditing strengthens investor confidence by independently verifying and validating an organization's financial statements and reporting methods.

The confidence of investors is increased when auditors discover and address any anomalies, abnormalities, or areas of concern in the financial reports. Auditors help to reduce uncertainty and reassure investors about the company's financial credibility and stability by flagging potential risks and making guidelines for improvement.

Regulatory compliance makes sure a company's financial statements and reporting methods are in accordance with applicable legal and regulatory standards.

Failure to comply with regulatory demands can lead to legal implications, monetary fines, reputational harm, and a loss of trust among stakeholders. Audits can identify and resolve noncompliance issues in order to avoid potential penalties.

Auditors play an important role in determining whether a firm complies with numerous legal frameworks, such as local legislation, accounting standards, and industry-specific rules. They analyze financial records, transactions, and reporting methods to ensure that the company's activities comply with applicable regulatory standards.

Market Reputation connects to a company's view and reverence inside its industry and among its stakeholders, which include consumers, investors, partners, and competitors. The company's commitment to transparency, ethics, and strong financial management has an impact on its market reputation.

A favorable market reputation is founded on trust and reliability, which are maintained by audits that validate regulatory compliance, accounting standard adherence, and successful internal control execution. Companies that continuously demonstrate transparency and accountability in their financial reporting tend to have a positive reputation in the market.

In contrast, a lack of transparency or occurrences of financial irregularities can harm a company's market reputation and undermine stakeholder trust. Negative opinions of a company's financial integrity can discourage investors, reduce customer loyalty, and jeopardize commercial alliances.

Companies could use audit findings and insights to guide and reinforce a company's strategic decision-making processes.

Strategic Planning helps ensure that a company's resources are aligned with its overall vision and goals, increasing the possibility of attaining long-term growth and competitive advantage. It lets management successfully respond to changing market conditions, predict future obstacles, and capitalize on new possibilities.

Resource allocation ensures that these assets are used efficiently and effectively to meet the organization's goals while reducing loss and increasing value.

Effective resource allocation, aided by auditing, enables businesses to make the most of their existing resources, increase productivity, and attain strategic goals more efficiently. It also helps to reduce the risks associated with resource misuse and promotes an accountability and transparency culture inside the firm.

Auditors review internal controls by testing procedures, analyzing documentation, and interviewing staff to ensure that controls are effective and consistent. They detect flaws or inadequacies in internal controls and make recommendations for improvements to reduce risks and strengthen control mechanisms.

Proper internal controls contribute to the quality and dependability of financial information, prevent unauthorized activities, and protect the assets of the company from misuse or theft. They also improve operational efficiency by streamlining operations and lowering the risk of errors or inefficiencies.

Tax Compliance

Tax compliance signifies guaranteeing that a corporation correctly calculates, reports, and remits taxes in conformity with applicable tax rules and regulations.

Audits assist businesses in proactively identifying and addressing tax compliance concerns, lowering the risk of penalties, and ensuring that tax obligations are met on time and accurately. Audits help to protect a company's reputation and integrity in the business community by encouraging transparency and accountability in the filing of taxes.

Business valuation involves determining the value of a company's assets, liabilities, and overall operations using various valuation methodologies and criteria.

Business valuation backed up by auditing enables stakeholders to make informed decisions about purchasing, selling, or investing in a company. It guarantees that deals are completed at an appropriate price and that stakeholders understand the company's financial situation and potential outcomes in the future.

Auditing provides legal protection by shielding a corporation from possible lawsuits, fines, penalties, or other legal consequences caused by mistakes or shortcomings in financial reporting. Auditors help to reduce legal risks by guaranteeing the quality and reliability of financial information and encouraging transparency and responsibility in the company's operations.

In Dubai, where government oversight and legal standards are strict, auditing provides legal protection that is critical for companies to maintain compliance and mitigate legal risks.

Transparency and accountability are highly valued in Dubai, therefore for enterprises to gain the trust of stakeholders and adhere to regulatory requirements, operational transparency validated by audits is crucial.

A company's financial stability, operational effectiveness, and competitive positioning can all be evaluated through performance assessment through auditing. In order to improve overall performance and accomplish strategic objectives, it assists management in identifying areas for optimization, allocating resources efficiently, and making well-informed decisions.

Through performance assessment, businesses may capitalize on strengths, fix weaknesses, and adjust to shifting market conditions—all of which ultimately contribute to sustained profitability and sustainability.

Auditing allows for continuous improvement by applying corrective measures, process innovations, and organizational changes to solve flaws and optimize performance. It demands a proactive attitude to monitoring and analyzing the effectiveness of existing modifications, as well as making additional adjustments as needed.

Due diligence assisted by auditing assists prospective purchasers, investors, or lenders in making informed judgments by offering a thorough picture of the target company's financial condition, performance, and risks. It reduces the risk of unexpected liabilities, fraud, or misrepresentations and makes transactions run more smoothly by identifying potential impediments or issues early on.

Due Diligence Audits allow stakeholders to examine the viability and possible returns of a transaction or investment possibilities, allowing them to make intelligent choices that are consistent with their business goals and risk tolerance.

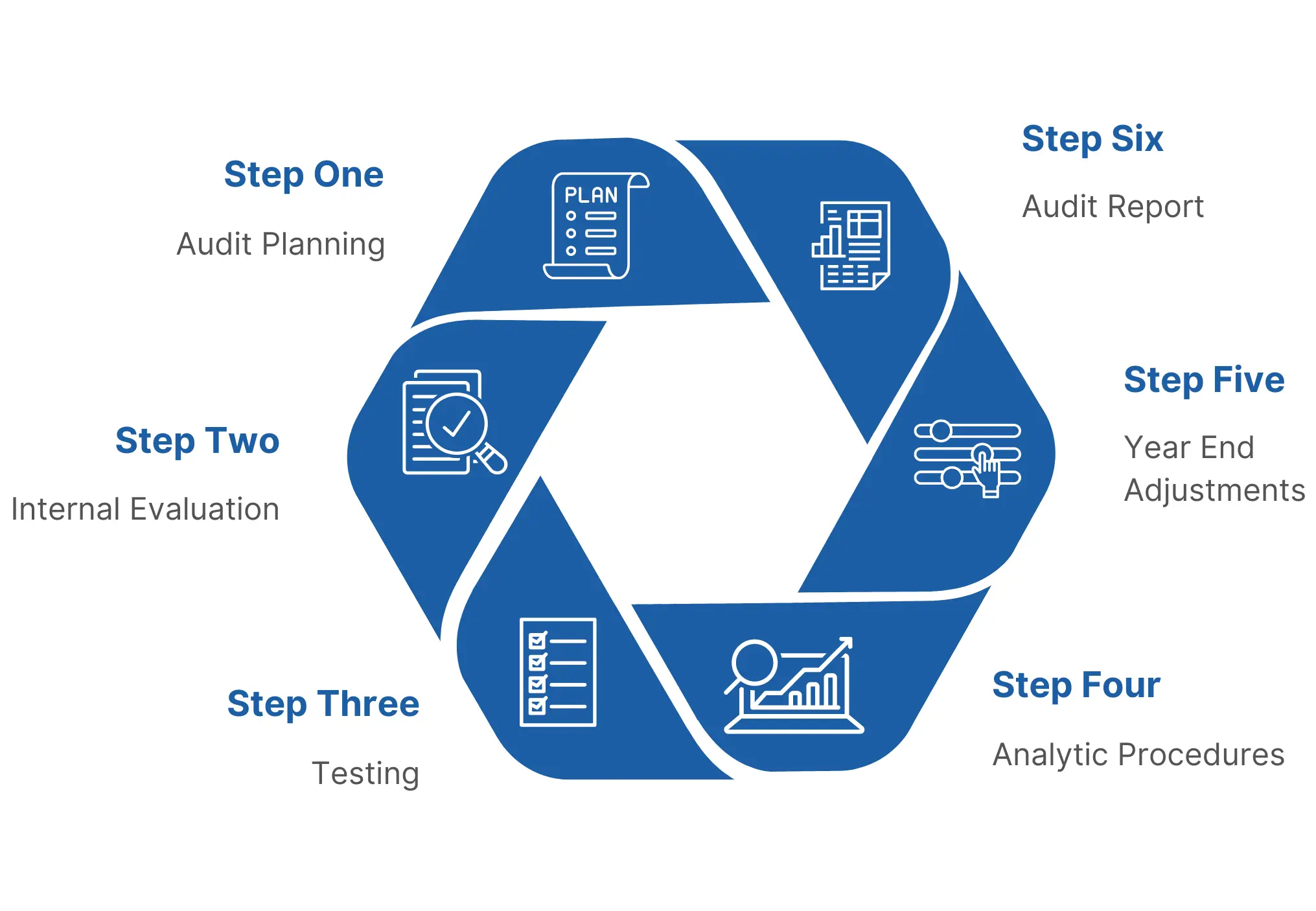

The typical audit process in the UAE follows a structured approach

Advantages of conducting an Audit in Dubai

To guarantee the accuracy and transparency of the business's finances, Reyson Badger provides the best financial audit services in Dubai. A company's financial statement is evaluated during a financial audit in the United Arab Emirates. The outcome of the financial audit is an audit report that has been attested by the auditor, proving that the business submitted a true, impartial, and fair financial statement.

The primary objective of a financial audit is to ensure the credibility and transparency of a company's financial position. By reviewing financial statements, auditors can identify issues in internal management and uncover insights that help businesses address both current and future challenges. A financial statement audit ensures that financial statements comply with IFRS standards. Our financial auditors will carefully and thoroughly review the finances in order to produce a true and accurate financial statement audit report.

Types of Financial Statements

Various types of financial statements, including:

An investor or shareholder's confidence must be maintained by a high-quality and accurate financial statement audit. Here are key reasons why these services are essential:

In general, the offer of financial audit services is critical to maintaining the values of Dubai's business community, encouraging transparency, and creating a reliable business environment.

The audit period in the UAE typically corresponds to a company's financial year. However, auditors may adjust the period based on specific circumstances or regulatory requirements. You can refer our article for more details on the measures companies must take before reaching the audit period in the UAE.

Always note your documents properly after each transaction, which would reduce the complexities for auditors to perform the audit. This article on proper document management heps to get the maximum result out of your audit process.

Emerging technology is revolutionizing the auditing panorama, enhancing accuracy and efficiency. Innovations like records analytics, AI, and blockchain are remodeling audits, supplying better chance management and transparency. Cloud-based solutions and cybersecurity audits in addition make certain secure and dependable financial reporting in today’s digital international.

Audit services benefit numerous groups by ensuring financial accuracy and compliance. Corporate audits aid large businesses, while startup audits lay a robust monetary foundation. Healthcare audits make certain regulatory compliance inside the medical subject, and economic consultants rely on audits for higher monetary insights. Business risk specialists use audits to become aware of dangers, and small agencies benefit transparency and belief through frequent audits.

This guide on customized audit solutions will help to further understand more about the benefits of audit services for different business types.

Auditing services are important throughout diverse industries to make sure financial accuracy, compliance, and operational efficiency. From building to technology and healthcare, industry-specified audits help corporations manage risks, improve processes, and maintain stakeholder agreement. Customized auditing answers provide precious insights and make sure that corporations meet regulatory necessities while promoting sustainable development.

Auditing Services for businesses in free zones are essential for making sure compliance with local policies and keeping transparency. These audits assist free zone corporations streamline their financial reporting, manage risks, and meet the unique necessities of free zone government. By presenting tailor-made answers, auditing services increase, improve operational performance, and make sure that organizations in free zones maintain credibility with stakeholders and regulators.

At Reyson Badger, we are a leading provider of Audit Services in Dubai, dedicated to providing comprehensive and reliable audit services. Our team of qualified and experienced auditors can help you navigate the complexities of the UAE's financial landscape. We offer:

By partnering with Reyson Badger, you gain a trusted advisor who can ensure the accuracy of your financial statements, foster business growth, and empower you to make informed decisions for a successful future.